Key Takeaways

- Strong momentum from BRIUMVI's growth, lifecycle innovations, and new indications is expected to drive ongoing revenue acceleration and expand the company's addressable markets.

- Pipeline investments and operational scalability, paired with strategic commercialization, position the company for transformative upside and enhanced market share across expanding therapeutic areas.

- Heavy dependence on a single drug, pricing pressures, regulatory risks, and R&D uncertainty threaten long-term revenue stability and profitability.

Catalysts

About TG Therapeutics- A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

- The rapid adoption and strong year-over-year revenue growth of BRIUMVI, with U.S. net sales reaching almost $120 million in just the first quarter of 2025 and persistence trends exceeding expectations, point to substantial unmet need and confirm a robust demand curve expected to drive revenue growth well beyond current projections.

- Lifecycle innovations such as the streamlined single-dose IV infusion and the upcoming self-administered subcutaneous BRIUMVI are expected to increase patient convenience, adherence, and market penetration. The successful launch of these new formulations, plus expanding indications like myasthenia gravis, will open up new patient pools and support sustained top-line revenue acceleration.

- Real-world safety, efficacy, and tolerability data, combined with positive physician and patient feedback, are cementing BRIUMVI’s profile as a differentiated therapy in a growing multiple sclerosis market. This positions the company to capture dynamic market share, expand addressable markets, and further raise net margins as repeat prescriptions surpass new starts and switching trends continue.

- Substantial investments in clinical pipeline expansion, including allogeneic CD19 CAR-T therapy for progressive forms of MS and other autoimmune diseases, offer transformative upside if clinical milestones are hit. These pipeline assets, set against aging population trends and growing global healthcare spending, could drive future revenue streams and long-term earnings leverage beyond the current MS franchise.

- Strategic execution on commercialization, with focus on direct-to-patient outreach, efficient manufacturing, and possible additional regulatory approvals, is expected to boost operational scalability and upwardly impact margins by leveraging fixed SG&A across a broader base, particularly as the company penetrates new geographies and larger patient groups.

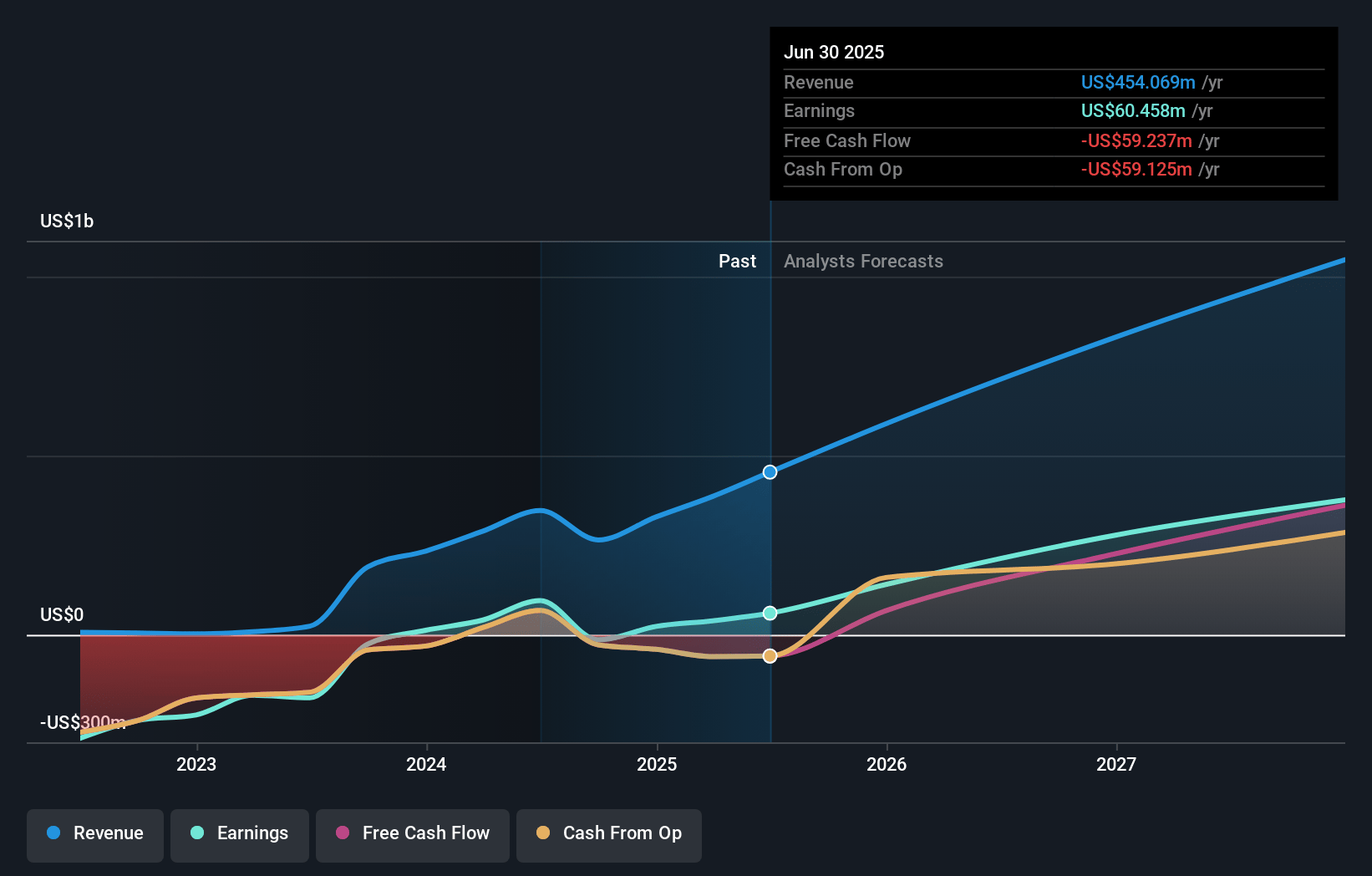

TG Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TG Therapeutics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TG Therapeutics's revenue will grow by 51.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.1% today to 42.6% in 3 years time.

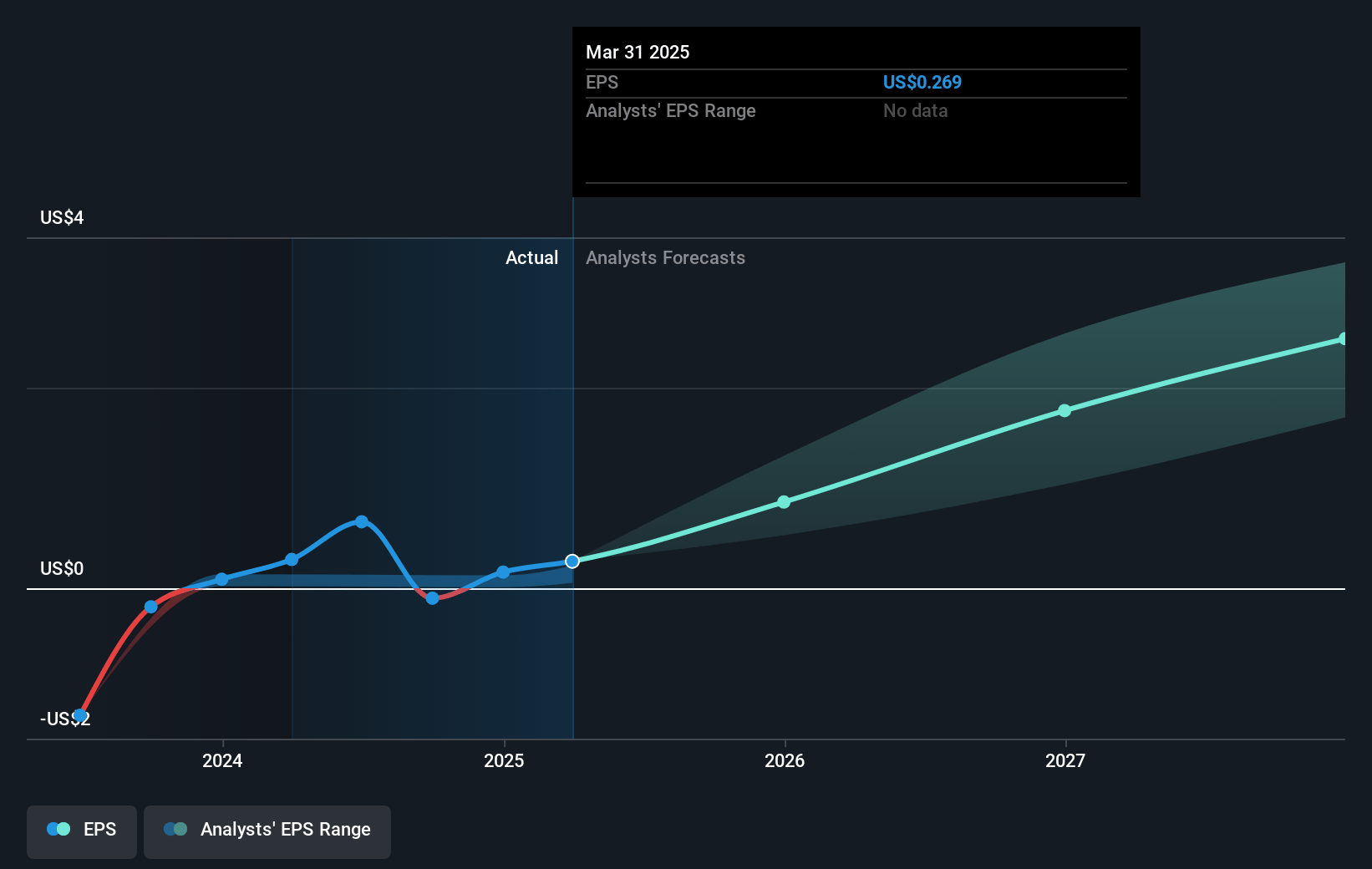

- The bullish analysts expect earnings to reach $577.1 million (and earnings per share of $3.45) by about July 2028, up from $39.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, down from 139.2x today. This future PE is greater than the current PE for the US Biotechs industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

TG Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's significant reliance on BRIUMVI as the main revenue driver creates earnings volatility risk if safety, efficacy, or competitive profile concerns emerge, which could cause a sudden decline in revenue and net income.

- Persistent industry pricing pressures from government and commercial payers, as well as the growing leverage of consolidated pharmacy benefit managers, may erode TG Therapeutics’ pricing power, squeezing both revenue growth and long-term net margins.

- The potential for major healthcare reimbursement reforms and stricter drug pricing controls in the US would structurally reduce profitability for specialty pharma companies like TG Therapeutics, ultimately impacting future net income.

- As BRIUMVI matures, patent expiry and the eventual entrance of biosimilars or generics pose a structural threat to revenue and profit margins, especially given the product’s centrality to TG Therapeutics’ financial performance.

- Risks in pipeline development remain high due to a mixed historical track record in clinical and regulatory outcomes, and with pipeline expansion requiring sustained R&D investment amidst volatile capital markets, future earnings and revenue diversification may be challenged.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TG Therapeutics is $53.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of TG Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $577.1 million, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $37.37, the bullish analyst price target of $53.0 is 29.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.