Key Takeaways

- Heavy dependence on a single drug and mounting payer and regulatory pressures could sharply limit long-term pricing power and future revenue growth.

- Potential biosimilar threats, patent expiries, and intensifying competition raise significant risks to sustained market access and profitability.

- Robust demand for BRIUMVI, product innovation, diversification into new indications, and favorable market trends position the company for sustained revenue growth and financial health.

Catalysts

About TG Therapeutics- A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

- Despite current robust sales of BRIUMVI and optimistic guidance increases, the company faces escalating payer scrutiny and mounting pressure from U.S. and global healthcare systems to control specialty drug costs, which could severely cap BRIUMVI's long-term pricing power and limit net revenue growth as payers impose stricter reimbursement and mandatory discounts.

- While TG Therapeutics is investing heavily in life-cycle management strategies such as subcutaneous formulations and new indications, any future healthcare reforms that increasingly focus on cost-effectiveness and clinical superiority may result in slower-than-expected uptake and make it difficult for premium-priced or marginally differentiated products to achieve broad market access, thereby threatening future sales velocity and sustainable earnings.

- The company’s commercial success hinges on a narrow portfolio, with BRIUMVI for multiple sclerosis contributing the vast majority of revenue, making TG Therapeutics highly vulnerable to looming biosimilar competition, patent expiries later this decade, or unforeseen clinical setbacks, each of which could trigger rapid revenue decline and margin erosion after current exclusivity periods lapse.

- Amplifying competition from entrenched large pharmaceutical companies and new biotech entrants in the immunology and neurology markets increases the risk of aggressive pricing, higher commercialization costs, and loss of market share, likely compressing both revenue and net margins over the medium

- to long-term.

- Increasing regulatory scrutiny and tougher clinical trial standards—especially for safety in autoimmune and oncology therapies—may substantially extend development timelines and inflate research and development expenses, raising the risk of approval delays or outright failures in the pipeline, ultimately dampening long-term earnings and growth prospects.

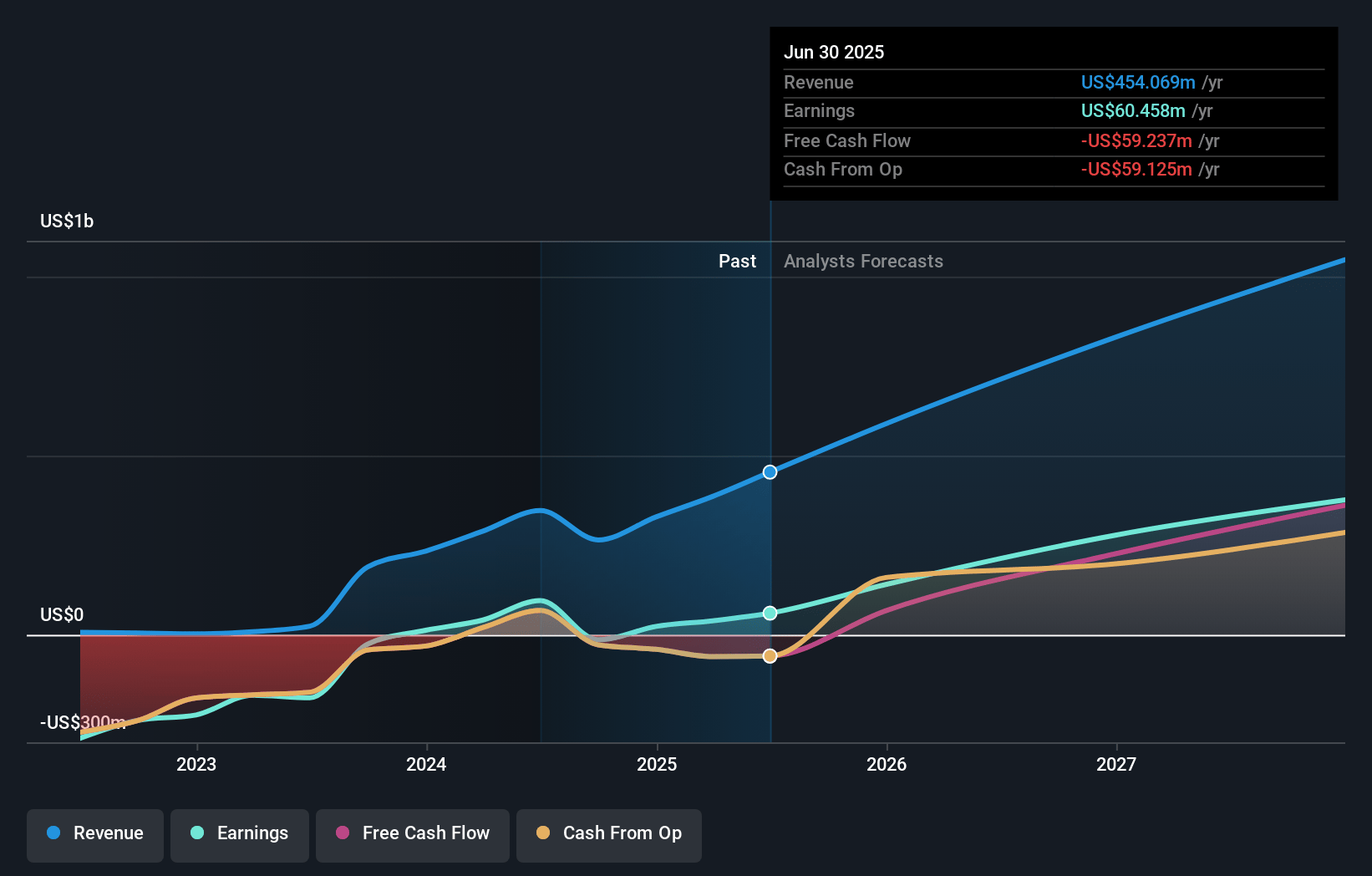

TG Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on TG Therapeutics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming TG Therapeutics's revenue will grow by 37.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.1% today to 32.9% in 3 years time.

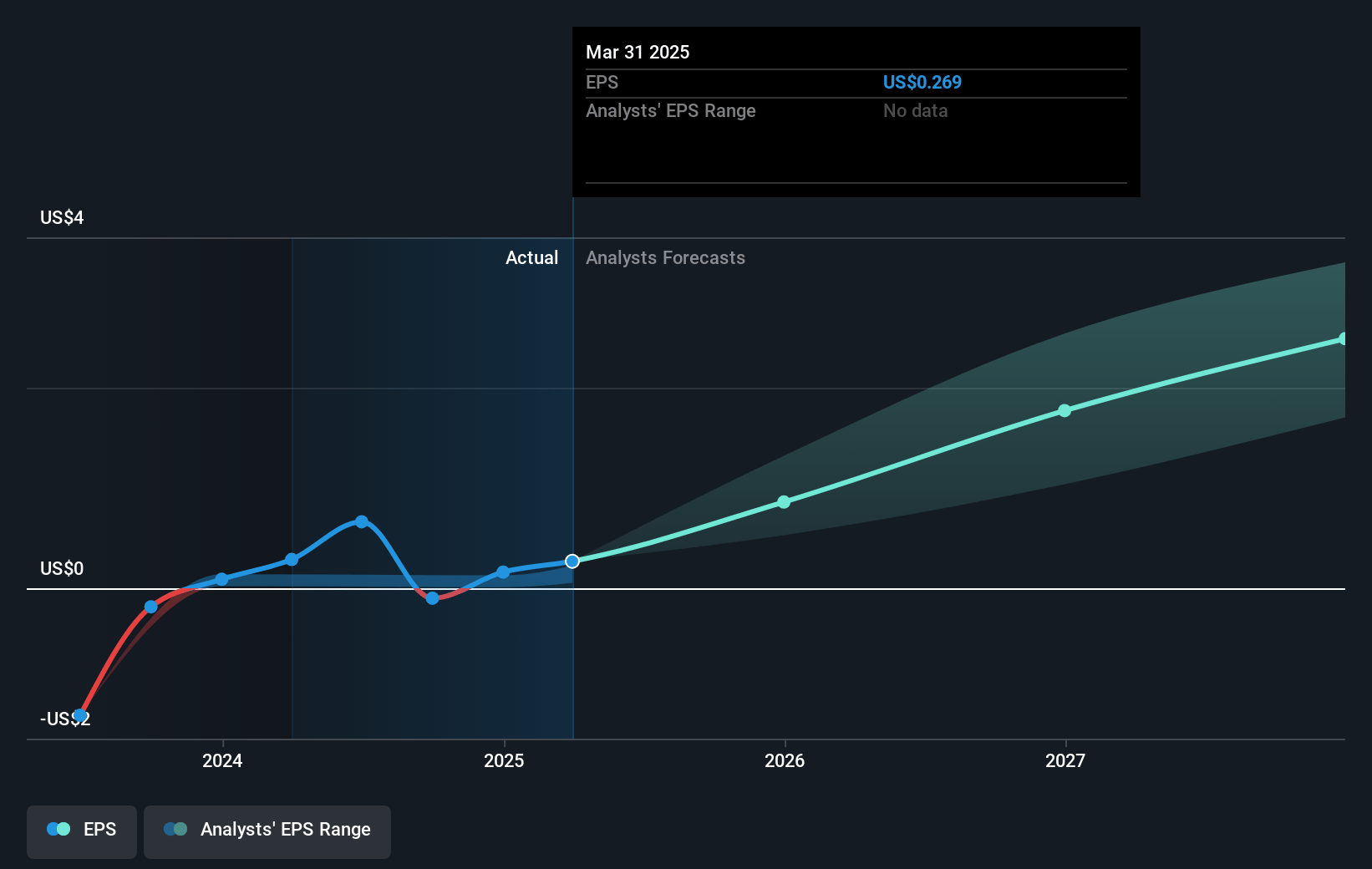

- The bearish analysts expect earnings to reach $329.1 million (and earnings per share of $2.03) by about July 2028, up from $39.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.9x on those 2028 earnings, down from 140.0x today. This future PE is lower than the current PE for the US Biotechs industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

TG Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong and accelerating revenue growth for BRIUMVI, with Q1 2025 net sales of nearly $120 million representing 137% year-over-year growth and robust repeat prescriptions, indicates persistent demand and market penetration, which can drive consistent topline revenue expansion.

- Continued product innovation, including development of a subcutaneous BRIUMVI formulation and new streamlined IV dosing regimens, could expand the addressable patient base and differentiate BRIUMVI in a competitive market, supporting long-term revenue and margin growth.

- The company is pursuing additional indications such as myasthenia gravis and has a pipeline program for allogeneic CD19 CAR T cell therapy, offering diversification of revenue streams and reducing dependence on a single product, which can enhance earnings stability over time.

- TG Therapeutics demonstrated operational discipline with confidence in meeting its operating expense guidance while delivering GAAP net income and maintaining a strong cash position, signaling financial health and the potential to sustain profitability as revenues scale.

- Favorable secular trends—including an aging population with higher rates of autoimmune diseases, expanding healthcare spending, and streamlined regulatory pathways—support ongoing market growth and adoption of novel therapies, which can translate into sustained increases in revenues and net margins for TG Therapeutics in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for TG Therapeutics is $12.34, which represents two standard deviations below the consensus price target of $40.5. This valuation is based on what can be assumed as the expectations of TG Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $329.1 million, and it would be trading on a PE ratio of 6.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $37.6, the bearish analyst price target of $12.34 is 204.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.