Key Takeaways

- Exposure to policy uncertainty, tariffs, and shifting industry budgets threatens revenue growth, profit margins, and long-term earnings stability.

- Reliance on acquisitions and mounting competition risks margin compression, higher costs, and volatility in core business performance.

- Differentiated products, operational efficiency, and strategic global investments position Bio-Techne for sustained growth, high margins, and resilience against industry and geopolitical challenges.

Catalysts

About Bio-Techne- Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

- Bio-Techne faces mounting uncertainty around government healthcare policies and research funding, particularly the risk of substantial NIH budget cuts proposed in the U.S., which could significantly constrain academic and government customer spending, pressuring both revenue growth and margin sustainability for years to come.

- The escalation of global tariffs and increasing geopolitical tensions threaten to disrupt Bio-Techne's international operations, increase cost structures due to supply chain fragmentation, and erode access to key end markets, undermining top-line growth and putting downward pressure on net margins over the long term.

- The company's continued reliance on acquisition-driven growth, when combined with persistent M&A integration risks, raises the likelihood of lower-than-expected cost synergies, higher operating costs, and greater earnings volatility as the life sciences sector consolidates and competition intensifies.

- Intensifying competition from both established biotechnology giants and emerging nimble startups could accelerate commoditization of core reagents and analytical tools, resulting in persistent pricing pressure and stagnant revenue growth, while potentially erasing the historical margin advantages that have supported Bio-Techne's premium valuation.

- Shifts in industry spend, with biopharma and academia under increased pressure to maximize efficiency and reallocate budgets away from traditional research consumables and tools, could lead to a structural slowdown in Bio-Techne's core business, impairing its ability to deliver on long-term earnings and cash flow expectations.

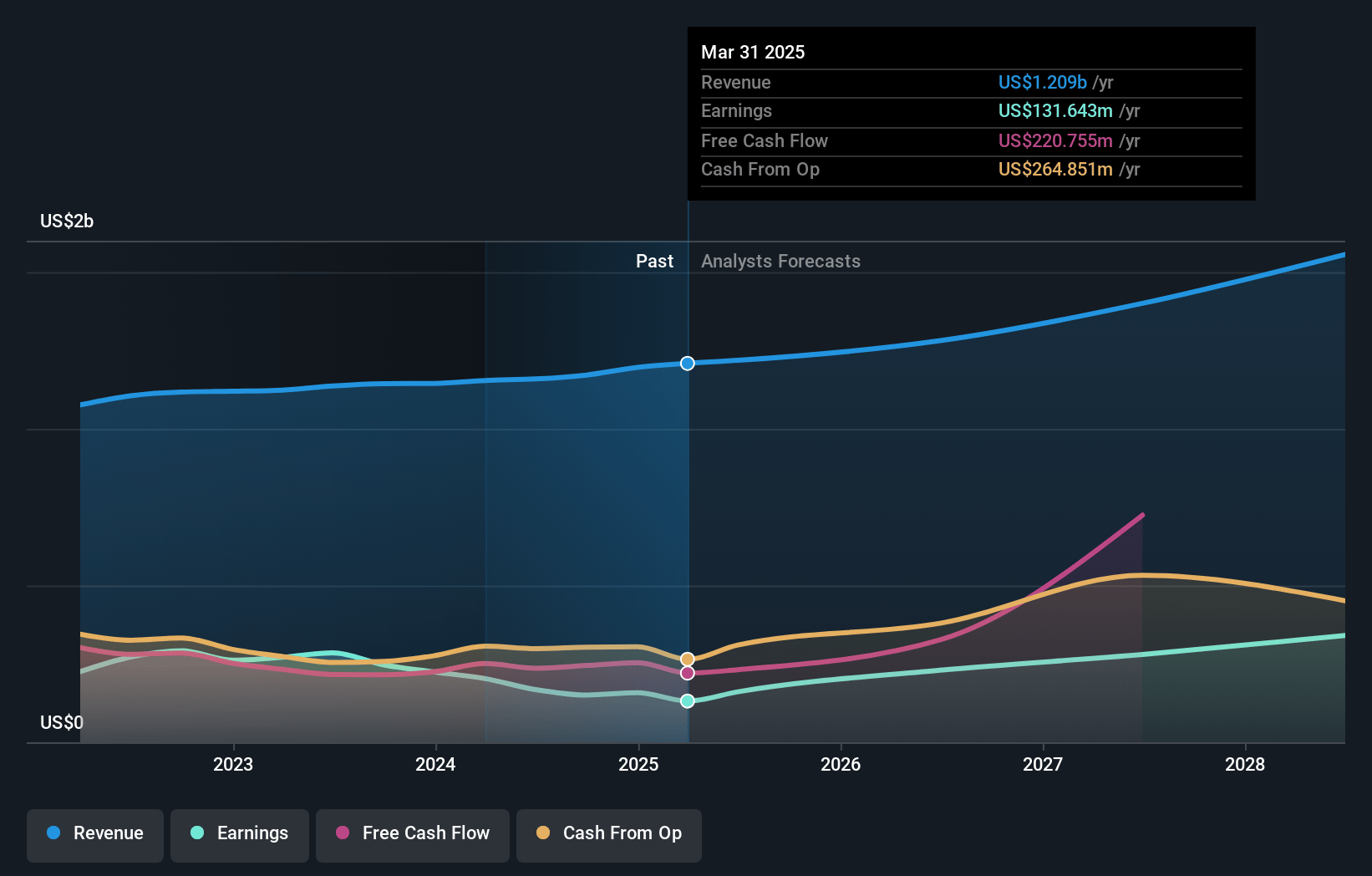

Bio-Techne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bio-Techne compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bio-Techne's revenue will grow by 6.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.9% today to 24.0% in 3 years time.

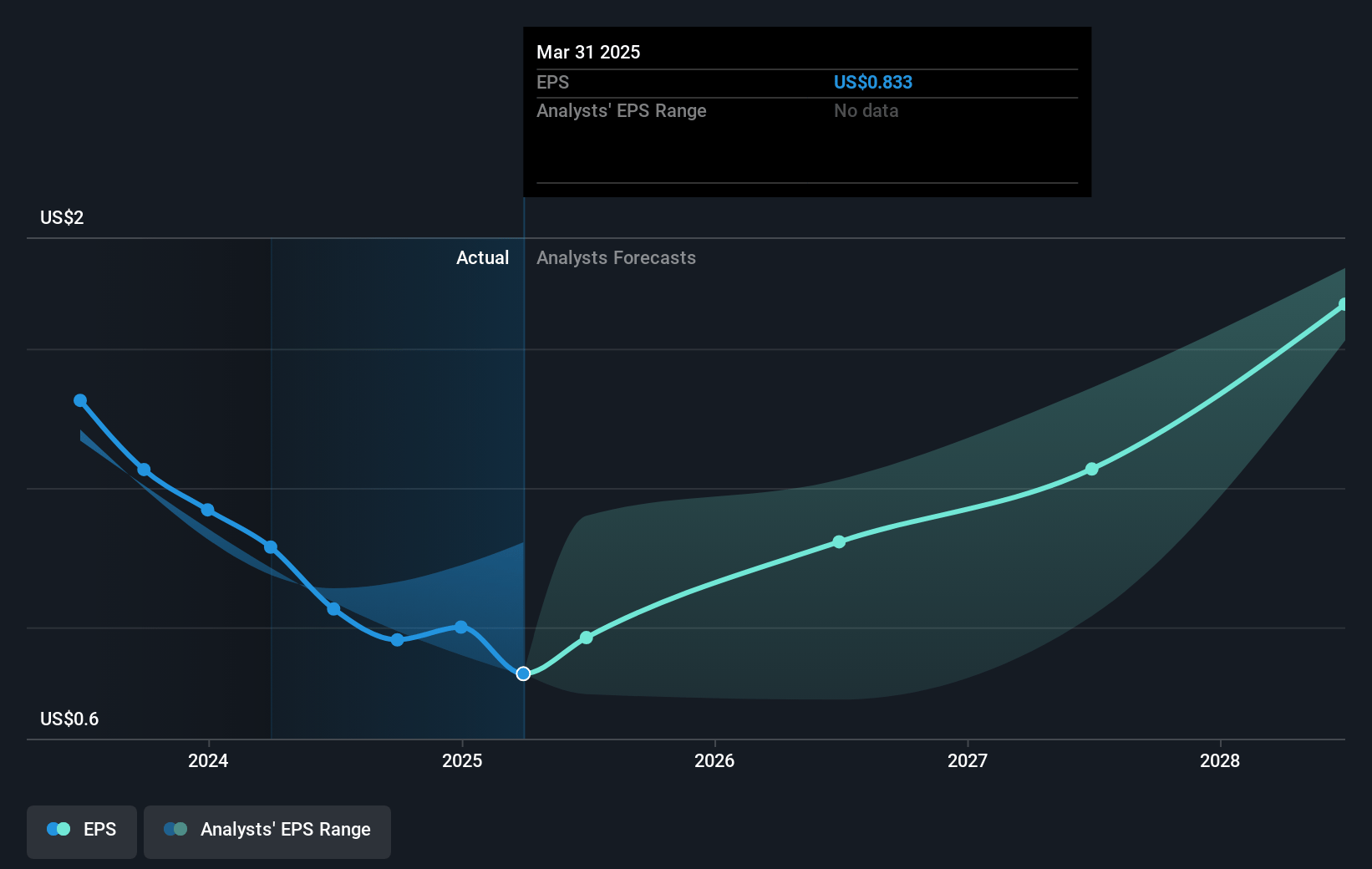

- The bearish analysts expect earnings to reach $352.0 million (and earnings per share of $1.28) by about June 2028, up from $131.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.7x on those 2028 earnings, down from 59.4x today. This future PE is lower than the current PE for the US Life Sciences industry at 35.3x.

- Analysts expect the number of shares outstanding to decline by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Bio-Techne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating adoption of precision medicine, growth in cell and gene therapy, and ongoing increases in global biopharma R&D spending are creating robust secular demand for Bio-Techne's core reagents, protein analysis tools, and workflow solutions, supporting long-term revenue growth despite near-term headwinds.

- The company's large, diversified, and recurring consumables product portfolio, including over 6,000 proteins and 400,000 antibodies with strong pull-through, enhances revenue visibility and maintains high gross margins over time.

- Bio-Techne's track record of operational efficiency and cost discipline, alongside ongoing investments in digitalization and automation, positions the company to further increase operating leverage and net margins as top-line growth resumes.

- Rapid innovation and unique product launches, such as organoid solutions, automation-ready instruments, and proprietary spatial biology platforms with multiomic capabilities, differentiate Bio-Techne from competitors and open new avenues for top-line and margin expansion.

- Strategic investments in global manufacturing and supply chain flexibility, including regional production and local China facilities, enable the company to proactively and rapidly mitigate tariff and geopolitical risks, thereby minimizing long-term impacts on earnings and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bio-Techne is $51.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bio-Techne's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $352.0 million, and it would be trading on a PE ratio of 26.7x, assuming you use a discount rate of 6.9%.

- Given the current share price of $49.89, the bearish analyst price target of $51.0 is 2.2% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.