Key Takeaways

- Structural revenue growth and margin expansion are likely, driven by unique licensing, product differentiation, and rapid adaptation to regulatory and market disruptions.

- Leadership in emerging scientific fields and strategic global expansion positions Bio-Techne to outperform peers and achieve resilient, long-term earnings growth.

- Bio-Techne faces margin and revenue risks from funding uncertainties, global trade tensions, increased competition, customer volatility, and disruptive technology developments requiring sustained R&D investment.

Catalysts

About Bio-Techne- Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

- Analyst consensus broadly expects robust growth in core reagents and automated analytical solutions, but the extraordinary scale of Bio-Techne's product catalog, unique licensing model, and acceleration from FDA shifts to human-relevant testing could drive a structural and sustained increase in revenue growth and outsized expansion in high-margin product lines over the next several years, materially beating current estimates.

- While consensus expects operating efficiencies and cost control to support high margins, Bio-Techne's proven ability to quickly implement global supply chain and regional manufacturing optimizations gives it the potential not only to fully offset tariffs, but to expand net and operating margins above historic levels as global disruptions push competitors out of key markets.

- The global rise in chronic diseases combined with refocused NIH and international funding toward non-infectious diseases is likely to disproportionately accelerate demand for Bio-Techne's solutions in cancer, neurology, and diabetes research, creating outsized, sustained revenue and earnings growth overlooked by the market.

- First-mover advantage in spatial biology and multiomic automation, including differentiated COMET platform capabilities and proprietary consumables pull-through, positions Bio-Techne to dominate next-generation research workflows and capture premium pricing, rapidly scaling revenues and delivering long-term operating leverage.

- Bio-Techne's strategic expansion in high-growth regions, especially the Asia-Pacific market-with a flexible local manufacturing presence and robust commercial partnerships-poises the company to outgrow industry peers globally and diversify revenue streams, creating long-term resilience and incremental upside to overall earnings power.

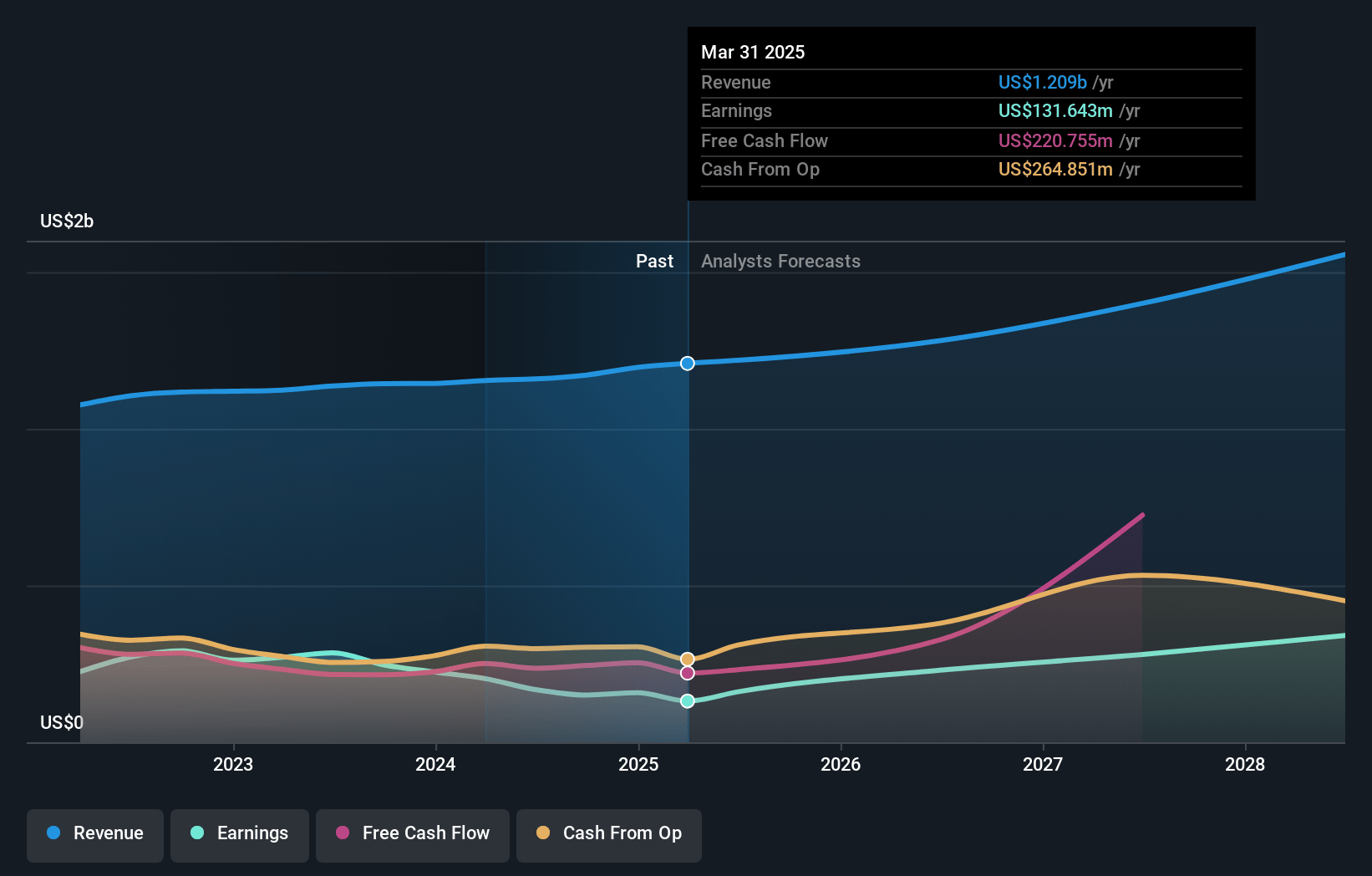

Bio-Techne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bio-Techne compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bio-Techne's revenue will grow by 9.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.9% today to 22.5% in 3 years time.

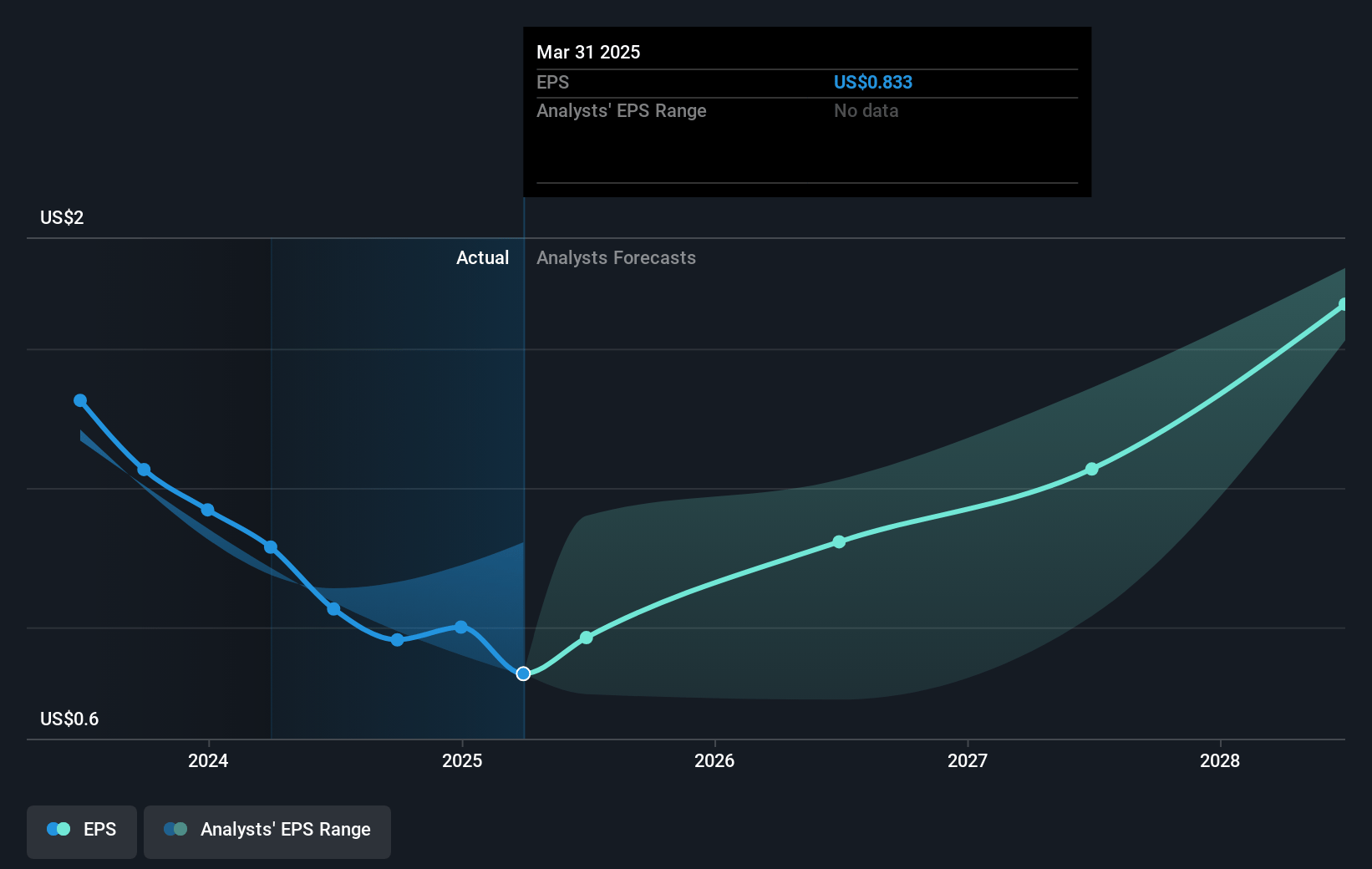

- The bullish analysts expect earnings to reach $356.6 million (and earnings per share of $2.3) by about July 2028, up from $131.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 41.4x on those 2028 earnings, down from 63.3x today. This future PE is greater than the current PE for the US Life Sciences industry at 36.0x.

- Analysts expect the number of shares outstanding to decline by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.88%, as per the Simply Wall St company report.

Bio-Techne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Uncertainty and potential long-term reduction in U.S. NIH and academic funding could dampen demand for Bio-Techne's reagents and instrumentation, presenting a risk of lower revenue and pressured topline growth, especially if macroeconomic headwinds turn structural.

- Ongoing tariff escalation and global trade tensions, despite management's mitigation efforts, introduce persistent risk to international operations and supply chains, which could lead to sustained increases in cost of goods sold, compressing operating margins and net earnings.

- Increased commoditization and competition in core reagents and analytical instruments may require price reductions, putting sustained downward pressure on Bio-Techne's gross margins and eroding long-term profitability.

- Reliance on large pharma and biopharma customers, coupled with observed volatility in biotech and China markets, exposes Bio-Techne to fluctuating R&D spending; cyclical or structural downturns in these sectors could impact both revenue stability and earnings visibility.

- Rapid advances in technologies such as omics and AI-driven platforms, alongside emerging entrants in decentralized diagnostics and personalized medicine, could render Bio-Techne's current product lines less competitive and require ongoing high R&D investment, potentially diluting both future earnings growth and return on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bio-Techne is $80.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bio-Techne's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $356.6 million, and it would be trading on a PE ratio of 41.4x, assuming you use a discount rate of 6.9%.

- Given the current share price of $53.12, the bullish analyst price target of $80.0 is 33.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.