Key Takeaways

- Accelerating adoption and strong recurring treatment rates suggest potential for revenue and cash flow to consistently surpass current expectations.

- Expansion into new indications and global markets positions the company for multiple revenue streams, reduced risk, and greater operational leverage.

- Heavy dependence on XDEMVY, pipeline uncertainties, pricing pressures, rising competition, and regulatory complexity threaten sustainable growth and margin expansion.

Catalysts

About Tarsus Pharmaceuticals- A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

- Analyst consensus recognizes strong DTC and physician adoption, but they may be underestimating the total addressable market's conversion rate; rapid unaided awareness gains and accelerating weekly prescriber adoption point to potential for top-line revenue to surpass even the most bullish projections as XDEMVY approaches household name status and routine use by a majority of U.S. eyecare providers.

- While analysts broadly agree that demographic tailwinds and chronic disease prevalence will expand the market, the depth of cross-specialty adoption-driven by embedded routines (e.g., screening every patient for DB)-suggests a far steeper and more prolonged growth curve as screening for Demodex blepharitis becomes a standard part of eye exams, turbocharging both initial and recurring prescription revenue.

- Recurring treatment rates are trending significantly above early external script estimates, implying a higher steady-state annual retreatment rate; if refill and retreatment rates stabilize well above the anticipated 20 percent, recurring revenue and patient lifetime value could be materially higher, supporting sustained outperformance in both top-line growth and long-term cash flows.

- Clinical category creation in ocular rosacea and other neglected diseases is moving swiftly, with Tarsus leveraging FDA buy-in and first-mover status; rapid advancement across new indications could create multiple concurrent blockbuster revenue streams while reducing pipeline risk and accelerating multi-year earnings growth.

- Global expansion is likely to deliver above-consensus operational leverage: as underdiagnosis of Demodex blepharitis and related conditions unwinds, and international regulatory wins stack, the company stands to achieve greater margin expansion and market share capture in Europe and Asia than currently modeled, driving stronger international net income contribution.

Tarsus Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tarsus Pharmaceuticals compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Tarsus Pharmaceuticals's revenue will grow by 50.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -31.1% today to 49.9% in 3 years time.

- The bullish analysts expect earnings to reach $500.8 million (and earnings per share of $9.92) by about September 2028, up from $-92.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from -25.9x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

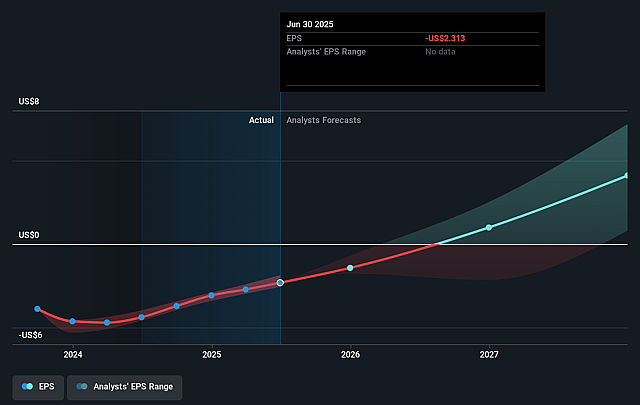

Tarsus Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on XDEMVY as its primary revenue driver presents outsized risk in the event of clinical, regulatory, or commercial setbacks, which could materially reduce revenue and near-term earnings.

- The recent and planned increases in R&D expenses to advance pipeline candidates such as TP-04 for ocular rosacea may not generate proportional increases in future revenue if those candidates fail or face regulatory delays, pressuring net margins over time.

- Accelerating drug price reform and payer demands for cost containment could maintain high gross-to-net discounts in the low forties, limiting Tarsus' ability to increase realized revenue and compressing long-term net income growth.

- The growing threat of competition from generics, biosimilars, or alternative device-based or digital therapies for eye conditions could erode XDEMVY's market share and reduce both future revenue and margin potential.

- Increasing regulatory complexity and scrutiny, especially related to international expansion and label extensions, may slow new approvals or market entries, delaying anticipated revenue streams and increasing long-term development costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tarsus Pharmaceuticals is $92.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tarsus Pharmaceuticals's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $500.8 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 6.8%.

- Given the current share price of $56.49, the bullish analyst price target of $92.0 is 38.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.