Key Takeaways

- Heavy reliance on a single product exposes Tarsus to revenue risk amid regulatory pressures, evolving payer dynamics, and uncertain adoption rates.

- Escalating spending and rising competition could threaten profitability, especially if new pipeline launches or revenue growth do not materialize as planned.

- Deepening XDEMVY adoption, broad payer coverage, and pipeline expansion position Tarsus for sustainable growth while reducing reliance on a single product and supporting financial stability.

Catalysts

About Tarsus Pharmaceuticals- A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

- Regulatory headwinds loom as ongoing global drug pricing reforms and heightened scrutiny threaten to erode XDEMVY's pricing power; any inability to sustain high net prices or cope with deeper future discounts will compress net margins and could sharply reduce overall profitability.

- Tarsus's dependence on a single commercial product leaves it exposed if the adoption tempo for XDEMVY among prescribers and patients slows or flattens, a real risk as most of the initial TAM conversion is NRx-driven and retreatment rates remain lower than anticipated, putting sustained revenue and long-term earnings at risk.

- Escalating commercial and R&D expenses, especially persistent high direct-to-consumer advertising outlays and increased development costs for new indications like ocular rosacea, could drive operating losses if future bottle growth or successful pipeline launches fail to offset spend, straining cash flow and diminishing bottom-line growth.

- Payer leverage is set to intensify as insurance coverage becomes more restrictive and large pharmacy benefit managers consolidate, which may result in tougher reimbursement negotiations and higher gross-to-net discounts, reducing net realizable revenue despite headline sales growth.

- Rising competition in eye care and potential new entrants employing novel modalities, such as biologics or gene therapies, could threaten the long-term relevance of Tarsus's small-molecule platform, risking eventual market share losses and potential product obsolescence that undermine forward-looking revenue streams.

Tarsus Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tarsus Pharmaceuticals compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

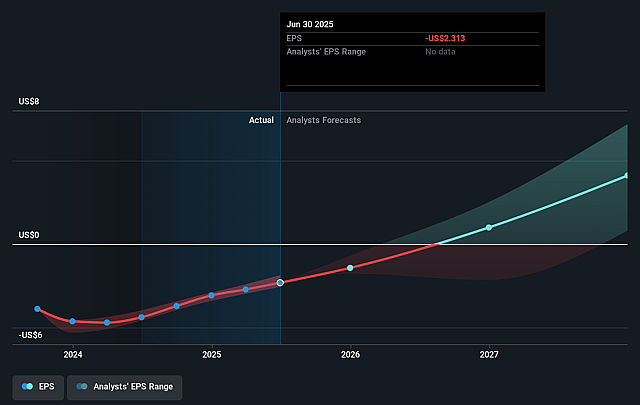

- The bearish analysts are assuming Tarsus Pharmaceuticals's revenue will grow by 41.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -31.1% today to 6.9% in 3 years time.

- The bearish analysts expect earnings to reach $57.4 million (and earnings per share of $1.1) by about September 2028, up from $-92.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 53.6x on those 2028 earnings, up from -26.4x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Tarsus Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The expanding addressable market fueled by an estimated 25 million people in the US with Demodex blepharitis, combined with currently low market penetration (having treated only around 350,000 patients so far), provides a substantial opportunity for sustained long-term revenue growth as XDEMVY adoption deepens.

- XDEMVY's prescription momentum is underpinned by both a rapid expansion in new prescribers-including over 20,000 eye care professionals, with increasing weekly and daily prescribing-and a successful direct-to-consumer campaign, indicating durable and growing demand that can further boost net sales and support earnings acceleration.

- Payer coverage for XDEMVY now exceeds 90% across commercial, Medicare, and Medicaid lives, reducing access barriers and supporting robust volume growth, which directly contributes to recurring revenue and gross margin stability.

- The company is leveraging a scalable launch blueprint for pipeline expansion, with new indications-such as ocular rosacea-set to enter clinical trials and offering the potential for additional diversified revenue streams, which can drive future top-line growth and mitigate the risk of reliance on a single product.

- Tarsus maintains industry-leading gross margins around 93% and possesses a strong cash position of $381 million, which enables continued investment in commercialization and R&D while supporting future net income growth and overall financial resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tarsus Pharmaceuticals is $49.58, which represents two standard deviations below the consensus price target of $76.0. This valuation is based on what can be assumed as the expectations of Tarsus Pharmaceuticals's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $832.2 million, earnings will come to $57.4 million, and it would be trading on a PE ratio of 53.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $57.43, the bearish analyst price target of $49.58 is 15.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.