Key Takeaways

- Innovative drug combinations and targeted therapies position Puma for significant market expansion and revenue growth in hard-to-treat cancer indications.

- Strategic international launches and advanced commercialization efforts are set to drive durable, long-term growth and improved financial performance.

- Puma's overreliance on Nerlynx, eroding market share, regulatory pressures, R&D setbacks, and liquidity challenges threaten its revenue stability and long-term growth prospects.

Catalysts

About Puma Biotechnology- A biopharmaceutical company, focuses on the development and commercialization of products to enhance cancer care in the United States and internationally.

- Analyst consensus sees opportunity from combination data in metastatic tumors, but the compelling early efficacy in historically treatment-resistant cancers like pancreatic suggests the neratinib/Enhertu combination could become a new standard in multiple HER2-altered cancers, dramatically expanding market size and driving revenue and earnings upward substantially beyond current forecasts.

- Analyst consensus acknowledges upcoming readouts from the alisertib program, but the accelerated enrollment pace, planned biomarker targeting, and favorable early biomarker-driven signals in hard-to-treat cancer subsets position alisertib for rapid label expansion and premium pricing, with potential for step-change growth in revenue and margin profile if approved in these new high-value indications.

- Demographic trends-such as the globally aging population and rising incidence of HER2-positive and hormone receptor-positive cancers-underscore a large, steadily expanding addressable market for both NERLYNX and pipeline assets, setting the stage for durable, multi-year top line growth.

- Emerging markets are seeing rapid growth in healthcare access and insurance coverage, and Puma's new international launches and recent distribution deals in regions such as the Middle East, North Africa, Eastern Europe, and Central Asia could unlock outsized revenue acceleration as these markets mature, supporting higher long-term earnings and cash flow visibility.

- Puma's increased deployment of data analytics and predictive technologies in sales and marketing, coupled with a focus on physician education and patient persistence initiatives, could yield significant improvements in net revenue per patient and operating leverage through higher treatment adherence, longer patient duration, and more efficient commercial execution.

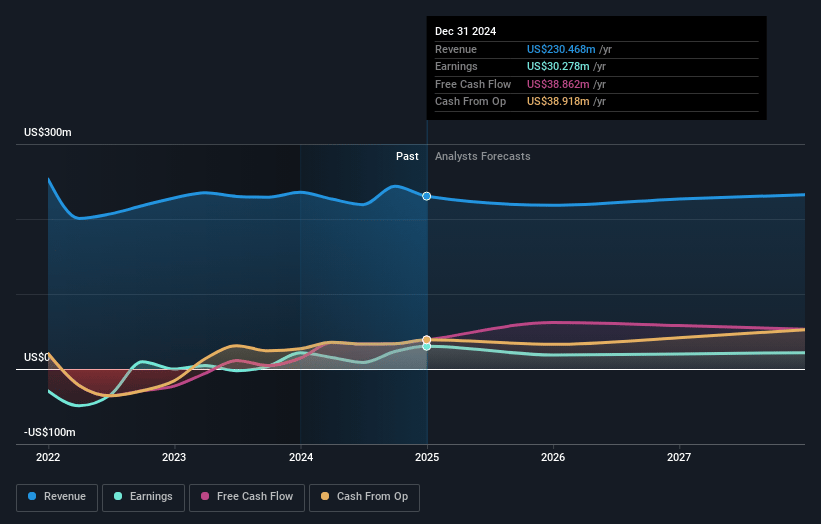

Puma Biotechnology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Puma Biotechnology compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Puma Biotechnology's revenue will decrease by 2.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 16.4% today to 3.3% in 3 years time.

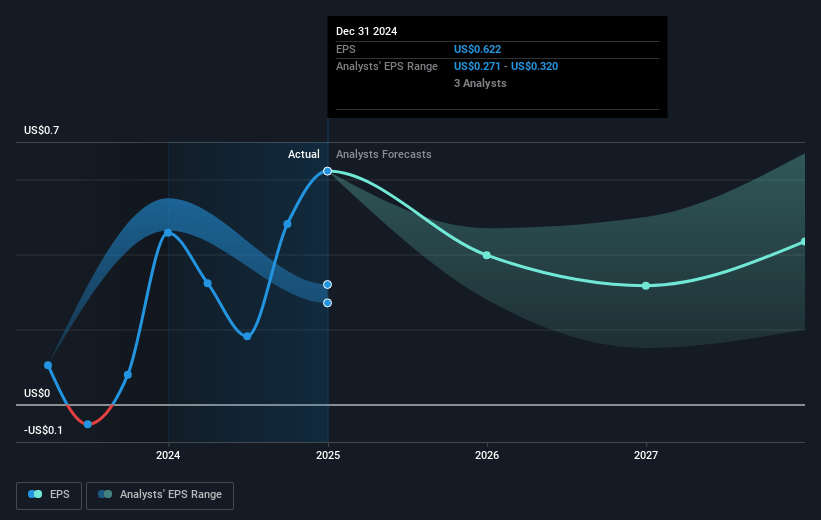

- The bullish analysts expect earnings to reach $7.0 million (and earnings per share of $0.13) by about July 2028, down from $38.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 35.6x on those 2028 earnings, up from 4.5x today. This future PE is greater than the current PE for the US Biotechs industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Puma Biotechnology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Puma Biotechnology faces mounting pricing pressures and regulatory scrutiny globally, as evidenced by gross to net adjustments rising to over 20 percent and explicit mention of anticipated reimbursement changes under measures like the IRA, which could compress net margins and limit the company's future earnings growth.

- The company remains heavily reliant on Nerlynx as its sole marketed product, with Q1 2025 product revenue net consisting entirely of Nerlynx sales and royalties, exposing Puma to significant revenue concentration risk as new competing therapies, generics, or biosimilars become available and as clinical guidelines evolve.

- Nerlynx's year-over-year and quarter-over-quarter declines in bottle sales, prescriptions, and total demand suggest eroding market share and potential inability to offset revenue losses if secular trends favor newer and more personalized cancer therapies or if current commercial initiatives fail to reverse prescription declines, hampering both future revenue and earnings.

- Ongoing R&D productivity risks are highlighted by still-early-stage data for pipeline candidates like alisertib, trial amendments due to pharmacokinetic concerns, and dependence on successful biomarker-based patient selection, all of which may delay or even prevent meaningful revenue diversification and sustained top-line growth in the long run.

- Industry consolidation and capital market caution continue to threaten Puma's ability to secure competitive partnerships and affordable financing, and with cash burn of nearly 8 million dollars and a 56 million dollar debt balance as of Q1 2025, the company could face tightening liquidity, making it harder to support R&D, market expansion, and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Puma Biotechnology is $4.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Puma Biotechnology's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $214.1 million, earnings will come to $7.0 million, and it would be trading on a PE ratio of 35.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $3.47, the bullish analyst price target of $4.0 is 13.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.