Last Update01 May 25Fair value Decreased 4.00%

AnalystConsensusTarget has decreased revenue growth from 11.0% to 9.2%, decreased profit margin from 6.4% to 4.3% and increased future PE multiple from 20.6x to 29.7x.

Read more...Key Takeaways

- Delay in LCDs implementation offers a chance to capitalize on demand, boosting near-term revenue and market share for key products.

- Investments in clinical data and policy shifts could enhance reimbursement, access, and margins, driving sustained revenue growth and expansion in new markets.

- Regulatory changes and competitive dynamics create market uncertainty, potentially impacting revenue, market share, and earnings, while increased R&D expenses may compress net margins.

Catalysts

About Organogenesis Holdings- A regenerative medicine company, develops, manufactures, and commercializes products for the advanced wound care, and surgical and sports medicine markets in the United States.

- The delay in the implementation of the LCDs to April 13, 2025, provides an opportunity for Organogenesis to capitalize on the continued strong customer demand without significant disruption, potentially boosting revenue in the near term.

- The finalization of the LCDs, which will limit coverage to 18 products, including Organogenesis' key offerings while excluding over 200 others, presents a significant opportunity for the company to increase its market share and drive long-term revenue growth.

- The push for CMS to transition to a value-based payment methodology for skin substitutes could reduce Medicare Part B expenditures and improve patient access, potentially increasing revenue as the company gains favor with policy adjustments.

- The advancement of the ReNu program, particularly with the BLA submission targeted for the end of 2025, could open up a significant new revenue stream in the large and growing market for knee osteoarthritis treatment if approved.

- The strategic focus on investing in clinical data for existing and pipeline products is expected to improve reimbursement dynamics and enhance physician and payer engagement, which could positively impact both net margins and revenue growth.

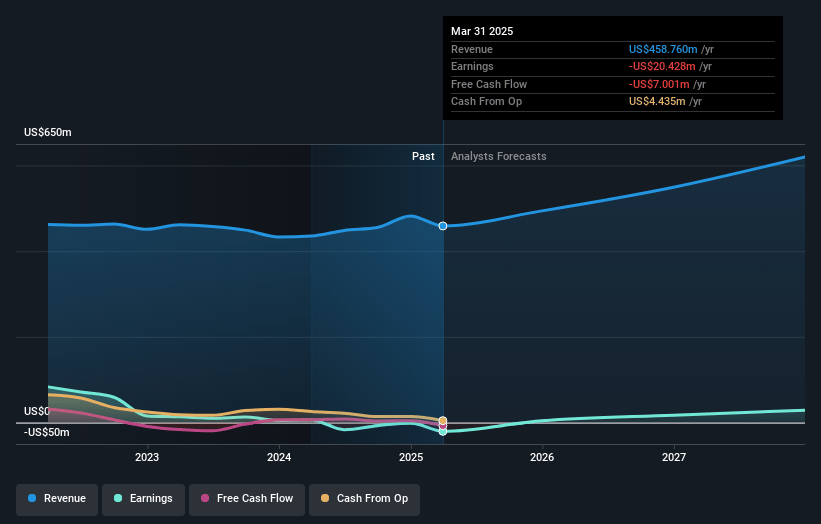

Organogenesis Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Organogenesis Holdings's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.2% today to 4.3% in 3 years time.

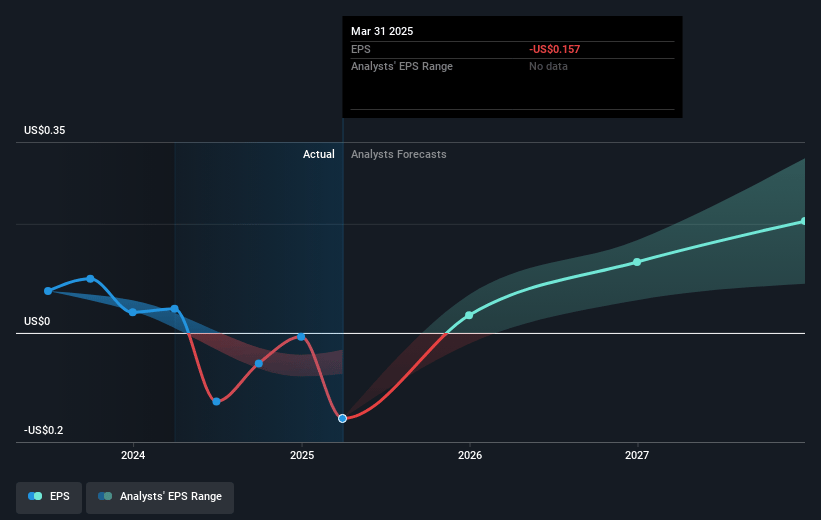

- Analysts expect earnings to reach $27.1 million (and earnings per share of $0.18) by about May 2028, up from $-937.0 thousand today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $39 million in earnings, and the most bearish expecting $15.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.7x on those 2028 earnings, up from -660.5x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to decline by 4.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Organogenesis Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shifting implementation dates for LCDs and regulatory changes create market uncertainty and could disrupt demand and utilization trends, impacting net revenue in the short term.

- There is a risk of delayed conversion and slower uptake of products not on the covered list, like PuraPly, potentially affecting revenue and market share.

- The emphasis on clinical and real-world data requirements for product coverage means higher R&D spending and operational costs, which could compress net margins.

- Competitive dynamics post-LCD introduction may affect how quickly Organogenesis can capitalize on available market share, potentially impacting revenue and earnings.

- Engagement with CMS for payment methodology reform represents a long-term opportunity, but the absence of immediate changes could strain financial performance, affecting future net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.0 for Organogenesis Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $626.9 million, earnings will come to $27.1 million, and it would be trading on a PE ratio of 29.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $4.88, the analyst price target of $6.0 is 18.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.