Key Takeaways

- Expansion into first-line maintenance for Zepzelca and EU approval for zanidatamab enhance revenue potential through larger patient populations and new market opportunities.

- Acquisitions and pipeline expansion in oncology, along with Epidiolex market growth, strengthen long-term earnings and competitive positioning.

- Revenue risks stem from market changes, competition, regulatory updates, and potential tariffs, while navigating new drug commercialization challenges.

Catalysts

About Jazz Pharmaceuticals- Jazz Pharmaceuticals plc identifies, develops, and commercializes pharmaceutical products in the United States, Europe, and internationally.

- The submission of a supplemental New Drug Application (sNDA) to expand Zepzelca into first-line maintenance in extensive-stage small cell lung cancer could significantly increase revenue potential due to a larger patient population and longer treatment duration.

- The positive CHMP opinion recommending the marketing authorization for zanidatamab in advanced HER2-positive biliary tract cancer (BTC) in the EU provides a new market opportunity in Europe, potentially enhancing revenue.

- The acquisition of Chimerix and integration of dordaviprone into the pipeline strengthens Jazz's presence in rare oncology, offering a durable revenue stream and expanding earnings due to its patent protection into 2037 and possible extensions.

- The expansion of the Epidiolex market through growth in the adult and long-term care setting, coupled with robust demand and favorable U.S. payer mix, positions it for blockbuster status, thereby increasing revenue and boosting overall earnings.

- The ongoing efforts in Phase III trials and expected data readouts for drugs such as zanidatamab and dordaviprone could lead to future regulatory approvals, positively impacting net margins through differentiation and competitive advantage in niche markets.

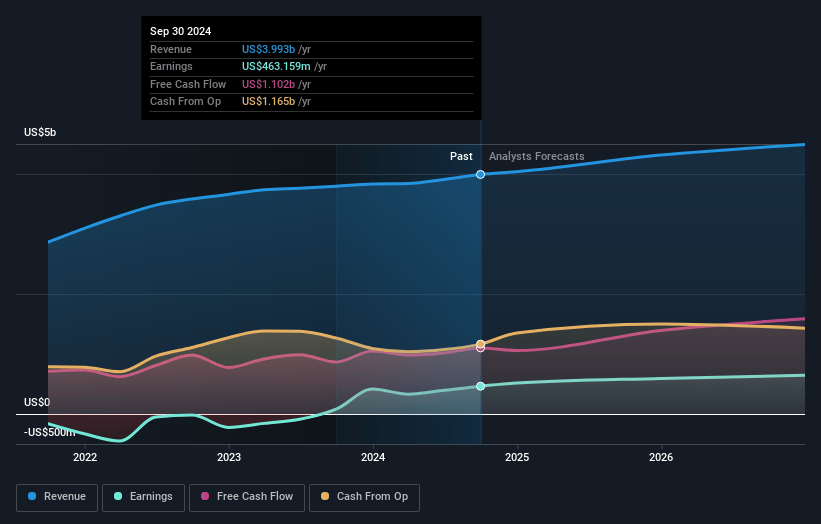

Jazz Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jazz Pharmaceuticals's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.9% today to 16.9% in 3 years time.

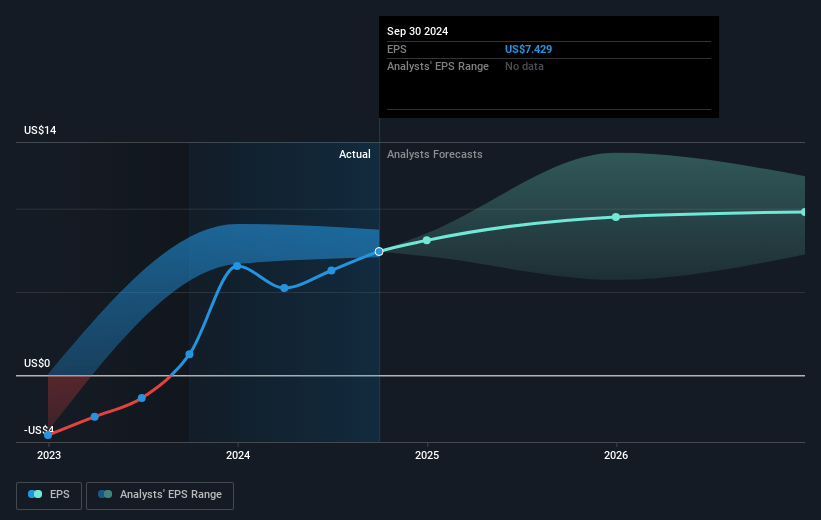

- Analysts expect earnings to reach $812.5 million (and earnings per share of $8.26) by about July 2028, up from $482.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.0 billion in earnings, and the most bearish expecting $514 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, up from 14.1x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 17.6x.

- Analysts expect the number of shares outstanding to decline by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Jazz Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jazz Pharmaceuticals experienced a decline in oncology product sales year-over-year, which was partially attributed to having one fewer shipping week in Q1 2025 compared to Q1 2024, impacting revenue streams.

- The U.S. market for Rylaze has been affected by the update to pediatric treatment protocols for acute lymphoblastic leukemia, causing temporary revenue fluctuations and highlighting reliance on external guidelines that could impact revenue stability.

- Zepzelca experienced a 16% decline in revenue due to increased competition in the second-line setting and the adoption of new immunotherapy regimens, leading to potential risks to future revenue growth from market share loss.

- Potential tariffs on pharmaceutical products and raw materials could pose an indirect financial challenge in the future, affecting costs and impacting net margins unless mitigated by inventory strategies or manufacturing shifts.

- The pediatric diffuse glioma market, targeted by Jazz's new acquisition dordaviprone, is characterized by a high-risk patient population with currently no approved therapies, which could present regulatory and commercialization risks impacting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $185.734 for Jazz Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $147.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $812.5 million, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of $112.3, the analyst price target of $185.73 is 39.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.