Last Update07 May 25Fair value Decreased 17%

Key Takeaways

- Exposure to drug pricing scrutiny, regulation, and looming generic competition poses risks to revenue and margin stability despite ongoing product growth and portfolio diversification.

- High leverage from acquisitions limits investment flexibility and may constrain profitability even as new product launches offer potential growth opportunities.

- Overdependence on a limited product range and external pressures on pricing, regulation, and manufacturing threaten revenue stability and long-term profitability despite portfolio diversification efforts.

Catalysts

About Jazz Pharmaceuticals- Jazz Pharmaceuticals plc identifies, develops, and commercializes pharmaceutical products in the United States, Europe, and internationally.

- While Jazz has demonstrated robust year-over-year growth in key neurology products like Xywav and Epidiolex, the company remains exposed to global healthcare cost containment and increasing scrutiny on specialty drug pricing, which could limit revenue upside and compress net margins over time.

- Although the acquisition of Chimerix and pipeline progress in oncology signal successful portfolio diversification and future earnings potential, reliance on premium pricing for orphan and rare disease drugs faces mounting risk from payer and policy focus on cost-effectiveness, which could pressure long-term revenue stability.

- While the aging global population and enhanced focus on rare neurological disorders support sustainable demand for Jazz’s core therapies, the looming threat of faster generic migration and expiring exclusivity on flagship products increases vulnerability of earnings and could erode top-line growth.

- Despite strategic operational flexibility in supply chain and manufacturing that helps manage near-term risks, intensifying regulation—especially around opioids and CNS drugs—may present persistent headwinds, increasing R&D costs and regulatory hurdles, thereby impacting future profitability.

- While early launches and regulatory milestones for new products like zanidatamab and dordaviprone could add growth drivers and reduce concentration risk, the company’s high leverage from past acquisitions increases interest expense and restricts investment flexibility, potentially offsetting gains to net margins and constraining future earnings growth.

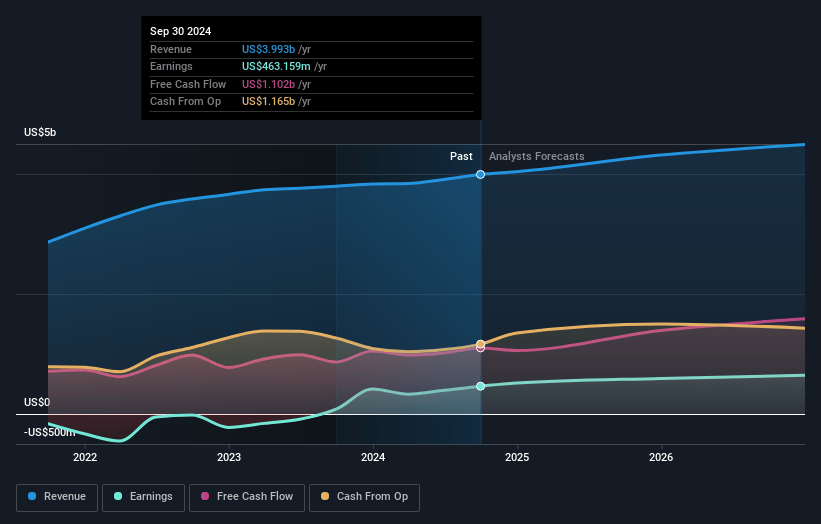

Jazz Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Jazz Pharmaceuticals compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Jazz Pharmaceuticals's revenue will decrease by 0.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 13.8% today to 6.7% in 3 years time.

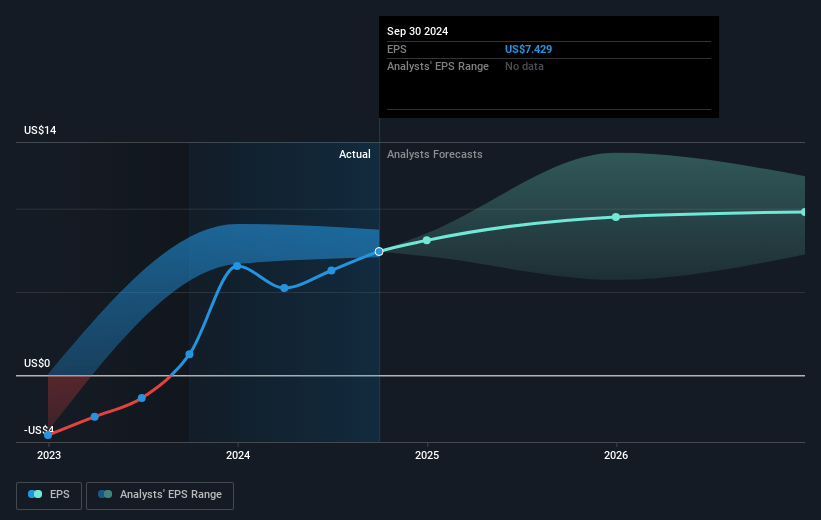

- The bearish analysts expect earnings to reach $276.0 million (and earnings per share of $10.61) by about May 2028, down from $560.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 32.8x on those 2028 earnings, up from 12.1x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 16.8x.

- Analysts expect the number of shares outstanding to decline by 3.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.06%, as per the Simply Wall St company report.

Jazz Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jazz continues to face heavy dependence on a small set of core products, especially Xywav and Epidiolex, meaning future revenues remain vulnerable to generic competition, lost exclusivity, and concentration risk.

- The oncology franchise experienced year-over-year declines, with key products like Zepzelca and Rylaze facing increased competition and changing treatment protocols, which threaten revenue durability and long-term earnings from this segment.

- While Jazz is diversifying its portfolio through acquisitions like Chimerix and pipeline investments, high R&D expenses and potential late-stage clinical trial risks could lead to disappointing product launches, negatively impacting net margins and future earnings growth.

- The company has a significant manufacturing footprint in Europe and the UK, making it exposed to long-term industry risks such as evolving global trade policy, tariffs, and supply chain disruptions, which could increase costs and compress operating margins.

- Deteriorating payer and regulatory environments, including growing pressure on pricing of specialty and orphan drugs, as well as ongoing antitrust litigation expenses, could limit future revenue growth and reduce net income over the long haul.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Jazz Pharmaceuticals is $136.69, which represents two standard deviations below the consensus price target of $190.28. This valuation is based on what can be assumed as the expectations of Jazz Pharmaceuticals's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $125.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $276.0 million, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of $111.17, the bearish analyst price target of $136.69 is 18.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.