Catalysts

About Insight Molecular Diagnostics

Insight Molecular Diagnostics develops and commercializes highly precise, kit-based molecular assays that enable transplant centers to perform in-house donor derived cell free DNA monitoring and related testing.

What are the underlying business or industry changes driving this perspective?

- Imminent FDA submission and anticipated mid 2026 clearance of GraftAssureDx positions the company to shift from a development only model to a high margin commercial kit business. This supports a rapid inflection in revenue and operating leverage as kit volumes scale.

- Growing global demand for in-house transplant monitoring, supported by simplified one step PCR workflows and strong head to head performance versus centralized lab assays, should accelerate adoption at a concentrated base of roughly 100 major transplant centers. This may drive recurring kit sales and improve earnings visibility.

- Expansion from kidney into heart and lung assays, with streamlined regulatory paths that leverage existing analytical work, creates a multi organ franchise that can increase annual testing per patient and total addressable market. This can boost top line growth and long term earnings power.

- Favorable reimbursement dynamics, including Medicare payment of over $2,700 per laboratory result and potential positive billing impact from the proprietary combination model score, support premium pricing on kits and structurally high gross margins. These factors can translate into industry leading operating margins.

- Macro growth in organ transplantation, longer graft survival and therapies that require more frequent molecular monitoring, combined with reference lab adoption and evolving guideline support for dd cfDNA testing, are set to increase testing intensity per patient and expand TAM well beyond $1 billion. This may drive sustained revenue growth and margin expansion over time.

Assumptions

This narrative explores a more optimistic perspective on Insight Molecular Diagnostics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

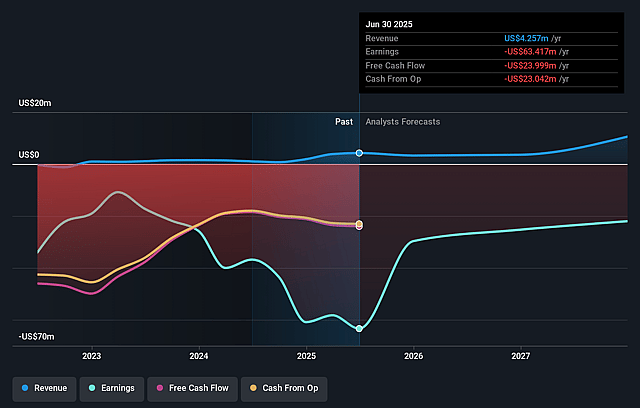

- The bullish analysts are assuming Insight Molecular Diagnostics's revenue will grow by 51.1% annually over the next 3 years.

- The bullish analysts are not forecasting that Insight Molecular Diagnostics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Insight Molecular Diagnostics's profit margin will increase from -1380.7% to the average US Biotechs industry of 16.0% in 3 years.

- If Insight Molecular Diagnostics's profit margin were to converge on the industry average, you could expect earnings to reach $2.4 million (and earnings per share of $0.08) by about December 2028, up from $-60.8 million today.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 131.0x on those 2028 earnings, up from -2.5x today. This future PE is greater than the current PE for the US Biotechs industry at 19.0x.

- The bullish analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Extended regulatory uncertainty at the FDA, including delays from government shutdowns, review backlogs or unforeseen data requests, could push GraftAssureDx authorization beyond mid 2026. This would slow the transition from low volume lab services to higher margin kit sales and defer meaningful revenue growth and operating leverage, which would weigh on earnings and net margins over the long term.

- Clinicians and transplant centers may be slower than expected to convert from entrenched centralized lab providers to in-house testing, even with head-to-head data and registry exposure. This could lead to a shallower adoption curve than management's internal launch framework implies, which would limit kit volumes, compress anticipated gross margin expansion and reduce long run revenue relative to the bullish expectations.

- Reimbursement and policy developments such as restrictive MolDX LCD testing limits or slower than expected dd cfDNA guideline adoption could cap testing frequency per patient and constrain the assumed greater than one billion dollar TAM. This could result in lower realized average selling prices and test volumes, thereby pressuring both top line growth and future net margins.

- A prolonged environment of rising development, clinical and commercialization costs, coupled with a relatively fixed base of roughly 100 major U.S. transplant centers, could force Insight Molecular Diagnostics to increase spending on market access, clinical evidence and commercial infrastructure more than planned. This could drive sustained six million dollars plus quarterly cash burn and delay the path to positive earnings and healthy free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Insight Molecular Diagnostics is $9.0, which represents up to two standard deviations above the consensus price target of $7.0. This valuation is based on what can be assumed as the expectations of Insight Molecular Diagnostics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $15.2 million, earnings will come to $2.4 million, and it would be trading on a PE ratio of 131.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of $5.21, the analyst price target of $9.0 is 42.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Insight Molecular Diagnostics?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.