Last Update 27 Nov 25

Fair value Increased 14%IMDX: Expanding Clinical Trial Participation Will Drive Market Momentum

Analysts have raised their price target for Insight Molecular Diagnostics from $6.13 to $7.00 per share, citing stronger expected revenue growth and improving profit margins in their updated forecasts.

What's in the News

- Insight Molecular Diagnostics published results showing their GraftAssure assay enabled long-term non-immunosuppressed kidney transplant survival with no rejection, following CD19 CAR-T therapy in a complex patient case (study published in the American Journal of Transplantation).

- The company launched GraftAssureIQ for research use in summer 2024 and is developing GraftAssureDx as an in vitro diagnostic test kit, aiming to expand hospital access to transplant rejection testing.

- Insight Molecular Diagnostics is actively enrolling patients in a clinical trial for GraftAssureDx, now with participation from 10 leading transplant centers. The company is aiming for FDA authorization (clinical trial listing).

- A new multi-center patient registry targeting 5,000 enrollees over three years will collect real-world evidence on the GraftAssure kidney transplant rejection assay and its clinical utility in high-risk patients.

- In May 2025, Medicare increased reimbursement for GraftAssureCore to $2,753 per result. This reflects recognition of its value in the $1 billion market for transplant rejection testing.

Valuation Changes

- Consensus Analyst Price Target has increased from $6.13 to $7.00 per share. This reflects a higher fair value assessment.

- Discount Rate has risen slightly from 7.01% to 7.05%. This indicates a modest change in risk or return expectations.

- Revenue Growth forecasts have climbed significantly, from 35.1% to 41.0%.

- Net Profit Margin is projected to improve, rising from 14.4% to 16.0%.

- Future Price-to-Earnings (P/E) ratio has dropped from 174.4x to 121.6x. This suggests greater earnings potential relative to share price.

Key Takeaways

- Expanding clinical adoption and demographic trends are set to boost recurring revenue and gross margins through increased testing volume and broader market penetration.

- Strategic focus on high-margin digital PCR kits and new partnerships diversifies income sources, enhances profitability, and lessens dependence on external financing.

- Heavy reliance on a single customer, ongoing cash burn, and uncertain product adoption create substantial risks for revenue stability, profitability, and long-term market competitiveness.

Catalysts

About OncoCyte- Operates as a precision diagnostics company in the United States and internationally.

- Ongoing demographic shifts, including the global rise in organ transplants and aging populations, are expanding the total addressable market for advanced transplant rejection diagnostics, positioning OncoCyte to benefit from increased long-term testing volume and recurring revenue growth.

- Growing acceptance and adoption of precision medicine, along with recent claims expansions for high-frequency testing (e.g., 6 tests per patient in new screening protocols), could drive higher utilization rates of OncoCyte’s proprietary assays, leading to sustainable increases in revenue and gross margin as market penetration grows.

- Regulatory momentum and breakthrough device designation for companion drugs in antibody-mediated rejection (ABMR) is accelerating the clinical need for advanced monitoring tools like OncoCyte’s donor-derived cell-free DNA test, likely to improve payer coverage and support higher earning potential upon FDA clearance.

- The company's strategic shift toward high-margin, kitted molecular test products—supported by streamlined digital PCR workflows that are more cost-effective than legacy NGS methods—should improve net margins over time as the product mix evolves and direct-to-center adoption increases.

- Active expansion of partnerships and potential licensing agreements, evidenced by rising interest from large pharma and transplant centers in both transplant and oncology, provide new non-dilutive revenue channels that can underpin future earnings growth and reduce reliance on capital markets.

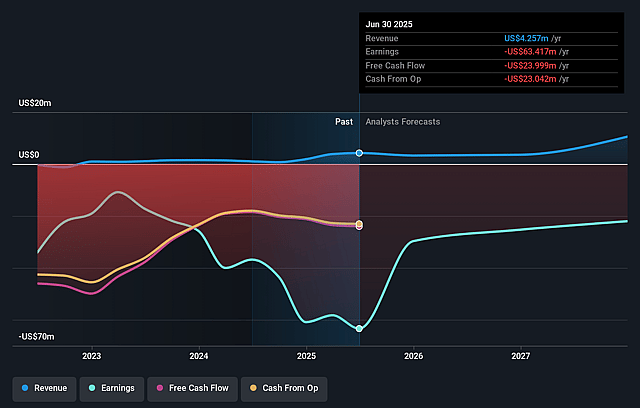

OncoCyte Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OncoCyte's revenue will grow by 29.7% annually over the next 3 years.

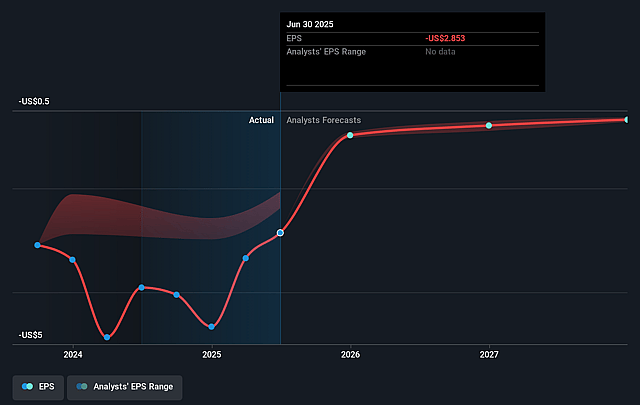

- Analysts are not forecasting that OncoCyte will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate OncoCyte's profit margin will increase from -1521.4% to the average US Biotechs industry of 12.3% in 3 years.

- If OncoCyte's profit margin were to converge on the industry average, you could expect earnings to reach $1.0 million (and earnings per share of $0.03) by about May 2028, up from $-58.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 179.4x on those 2028 earnings, up from -1.4x today. This future PE is greater than the current PE for the US Biotechs industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

OncoCyte Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s substantial dependency on a single large pharma customer for the majority of Q1 revenue highlights significant customer concentration risk and unpredictable revenue streams, which may disrupt stable long-term earnings.

- Persistent negative cash flow and a quarterly cash burn rate of ~$6 million, coupled with a lack of near-term commercial revenue, indicate ongoing reliance on external financing or capital markets, increasing dilution risk and pressuring future net margins and shareholder value.

- The clinical and commercial success of core products is highly contingent on achieving FDA approval and rapid physician adoption; delays, resistance to changing physician behavior, or slower switch-over by transplant centers could materially impact projected revenue growth and prolong path to profitability.

- The company is highly focused on a limited set of diagnostic products and is in an early commercialization stage; any underperformance or failure to gain reimbursement (e.g., delays with MolDX for DetermaIO) could materially constrain earnings and hamper sustainable revenue generation.

- Technological innovation in the molecular diagnostics sector is rapid and competitive; larger, better-financed competitors or next-generation platforms (NGS, multi-omics) may outpace OncoCyte’s offerings, eroding potential market share and putting long-term revenue and gross margin expansion at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.417 for OncoCyte based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.4 million, earnings will come to $1.0 million, and it would be trading on a PE ratio of 179.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $2.8, the analyst price target of $4.42 is 36.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.