Key Takeaways

- Breakthroughs in AI-driven diagnostics, digital health expansion, and strong clinical validation position CareDx for outsized revenue growth and margin acceleration beyond current forecasts.

- Advanced digitization and integration with major healthcare platforms streamline operations, enhancing net margins, cash flow, and creating sticky, high-margin recurring revenue streams.

- Regulatory changes, pricing pressure, customer consolidation, product concentration risk, and rising compliance costs threaten profitability, revenue stability, and margin resilience.

Catalysts

About CareDx- Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

- Analyst consensus anticipates significant volume growth and increased adoption of AlloSure and AlloMap testing, but the accelerated implementation of protocols, overwhelming scientific evidence from over 40 abstracts at major conferences, and strong clinical validation could drive annual testing volumes well beyond mid-teens growth expectations, materially impacting top-line revenue far ahead of current forecasts.

- While analysts broadly expect margin expansion from disciplined expense management and RCM improvements, the company's rapid digitization and anticipated integration with EPIC-aimed to cover 50% of test volume by next year-could drastically reduce administrative burden and boost payment cycles, leading to a faster, structural increase in both net margins and operating cash flow.

- CareDx's development and launch of next-generation AI-driven diagnostics (such as AlloSure Plus), combined with long-term data from global studies, positions it to define the clinical standard in personalized transplant care; this can unlock premium pricing power and sustained growth in average selling price, accelerating both revenue and gross margin expansion.

- The expanded push into digital health software, remote patient monitoring, and data analytics leverages the ongoing transition toward value-based, preventive healthcare, creating a highly sticky, high-margin recurring revenue stream that is still undervalued in long-range models-providing upside for both top-line and margin performance.

- The steady increase in transplant volumes globally, tied to demographic aging and higher rates of chronic disease, ensures not just consistent demand but an expanding market for multi-organ surveillance platforms-and CareDx's early clinical leadership and broad payer access provide a launchpad for outsized, compounding revenue growth over the next decade.

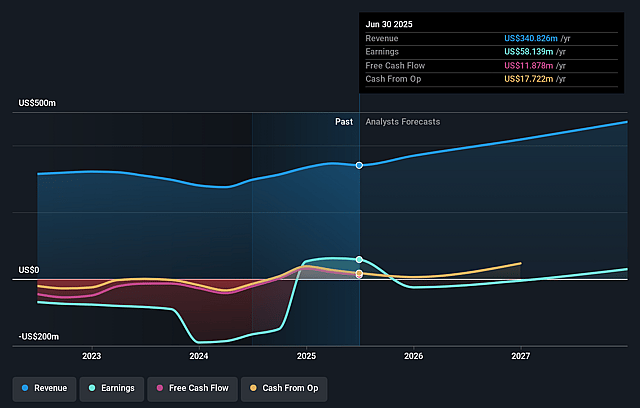

CareDx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on CareDx compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming CareDx's revenue will grow by 14.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 17.1% today to 1.8% in 3 years time.

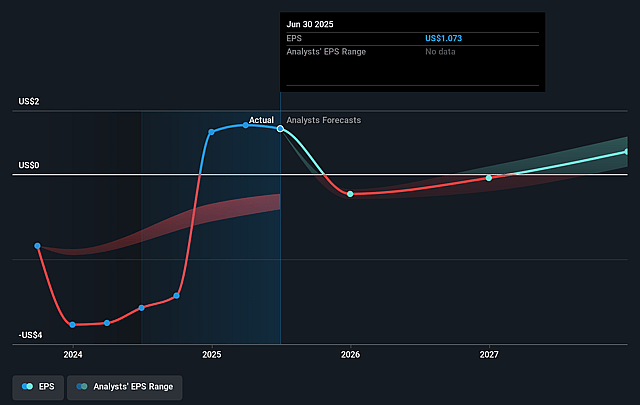

- The bullish analysts expect earnings to reach $8.9 million (and earnings per share of $0.18) by about September 2028, down from $58.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 198.7x on those 2028 earnings, up from 12.3x today. This future PE is greater than the current PE for the US Biotechs industry at 15.3x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

CareDx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Possible changes to Medicare reimbursement policies, such as the introduction of bundled payments and frequency limits on surveillance testing, could lead to annual headwinds of fifteen to thirty million dollars, which would negatively impact overall revenue growth and earnings stability.

- Continued scrutiny from payers, increasing cost-containment pressure, and uncertainty around the preliminary pricing recommendations for new testing codes threaten CareDx's ability to command premium pricing, putting downward pressure on average selling prices and compressing gross margins in the long run.

- CareDx's heavy reliance on its core AlloSure and HeartCare transplant diagnostics exposes it to product concentration risk; any slowdown in clinical adoption, competitive assays entering the market, or regulatory changes could drive revenue volatility and threaten sustained earnings.

- Ongoing consolidation among healthcare providers, including hospital groups and transplant centers, may give these customers greater bargaining leverage to negotiate lower contracted rates, reducing CareDx's profitability and potentially shrinking future net margins.

- Increasing data privacy regulations, cybersecurity compliance requirements, and operating expense pressures for ongoing R&D investments with an uncertain commercial payoff could elevate cost structures, reduce operating leverage, and erode net margin over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for CareDx is $28.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of CareDx's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $505.4 million, earnings will come to $8.9 million, and it would be trading on a PE ratio of 198.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $13.45, the bullish analyst price target of $28.0 is 52.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.