Key Takeaways

- Imminent shifts in reimbursement policies and industry consolidation threaten CareDx's pricing power, gross margins, and future revenue scalability.

- Growing regulatory scrutiny and increased competition in transplant diagnostics may slow market share gains and place long-term pressure on earnings momentum.

- Regulatory and reimbursement changes, product concentration, industry consolidation, and executive transition risks threaten CareDx's revenue stability, margin strength, and overall financial outlook.

Catalysts

About CareDx- Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

- Although the company is benefiting from sustained growth in transplant volumes and increased adoption of non-invasive molecular diagnostic panels such as AlloSure and AlloMap, it faces the prospect of new Medicare reimbursement policies that may introduce bundled payments and frequency limits, which could result in a $15 million to $30 million annual revenue headwind if implemented in their stricter forms, impacting top-line growth and earnings resilience.

- While advances in precision medicine, genomics, and digital monitoring tools are supporting increased physician adoption and expansion of CareDx's annuity-based testing model, escalating scrutiny by payers and policymakers around reimbursement for molecular diagnostics could drive further pricing pressure and limit average selling price expansion, weighing on gross margins and dampening revenue scalability.

- Despite recurring high-margin revenue from expanding test volumes and evidence of strong operating leverage with expenses growing much slower than sales, ongoing consolidation among hospitals and labs may increase buyers' pricing power, threatening CareDx's ability to maintain premium pricing and potentially compressing net margins over time.

- Although CareDx's deepening integration with digital health platforms like EPIC and growth in international markets are promising for broadening its addressable base, intensifying competition from both established diagnostics firms and innovative new entrants in transplant monitoring may erode its share in core markets, slowing future revenue growth and heightening risks to long-term earnings momentum.

- While operational excellence and enhanced revenue cycle management have recently driven marked improvements in cash flow and claim collection rates, the company remains vulnerable to overreliance on its dd-cfDNA franchise; potential demand shifts due to policy, clinical practice, or technology changes could disproportionately impair both revenue streams and net profitability in future periods.

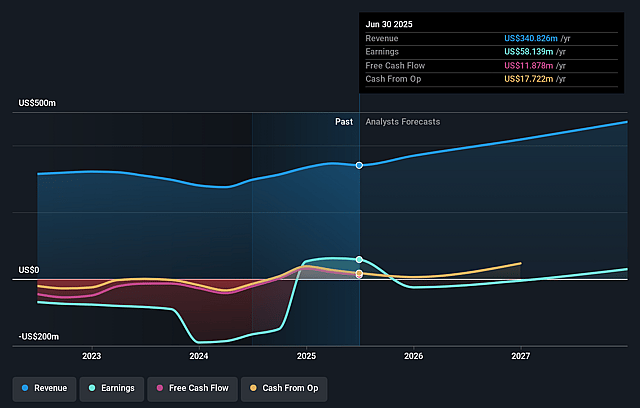

CareDx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on CareDx compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming CareDx's revenue will grow by 12.3% annually over the next 3 years.

- The bearish analysts are not forecasting that CareDx will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CareDx's profit margin will increase from 17.1% to the average US Biotechs industry of 18.3% in 3 years.

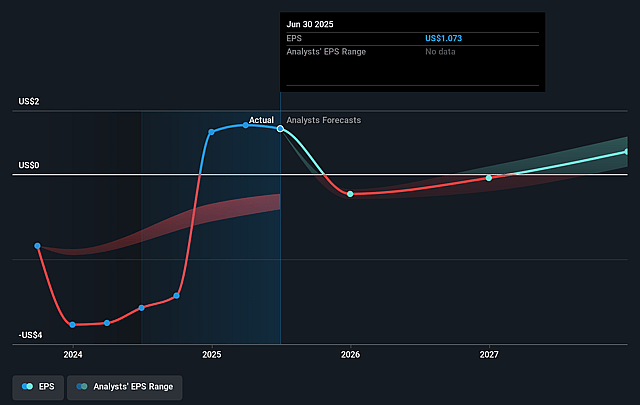

- If CareDx's profit margin were to converge on the industry average, you could expect earnings to reach $88.4 million (and earnings per share of $1.7) by about August 2028, up from $58.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, down from 11.7x today. This future PE is lower than the current PE for the US Biotechs industry at 15.3x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

CareDx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The upcoming draft LCD policy introduces potential negative scenarios, including bundled payments and limits on surveillance testing frequency, which management estimates could result in annual revenue headwinds of $15 to $30 million if implemented as written, directly impacting the company's top-line growth and profitability.

- Reimbursement uncertainty remains high, especially as new Medicare and payer rules could lead to situations where key products such as AlloMap Heart, when bundled within HeartCare, may no longer be separately reimbursed, exposing CareDx to sharp drops in revenue and gross margins in its core testing business.

- The heavy reliance on a small set of high-performing products-namely, Donor-Derived Cell-Free DNA solutions such as AlloSure and AlloMap-creates concentration risk, as any regulatory change, payer policy shift, or disruptive new competitor technology could disproportionately damage both revenue and net margins.

- Ongoing and potential consolidation among health systems and payers poses a threat of increased pricing pressure and weaker negotiating leverage for CareDx, which could erode average selling prices (ASP) and compress long-term gross margins.

- Leadership transition risk is present due to the retirement of the long-serving CFO and transition to a new CFO, and while the company asserts operational discipline, management changes in the context of uncertain reimbursement and a challenging payer environment could disrupt financial strategy and impair earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for CareDx is $14.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of CareDx's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $482.2 million, earnings will come to $88.4 million, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $12.81, the bearish analyst price target of $14.0 is 8.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.