Key Takeaways

- NEXT initiative enhancements in UI and AI-driven features could boost user engagement, driving more ad inventory and increasing revenue growth.

- Expansion in advertising formats and programmatic ad capabilities may unlock new monetization opportunities and improve profitability.

- Intentional short-term trade-offs focus on long-term product development, but challenges include shifts in ad spending, changing user metrics, and exploratory monetization strategies.

Catalysts

About Nextdoor Holdings- Operates a neighborhood network that connects neighbors, businesses, and public agencies in the United States and internationally.

- The launch of the NEXT initiative, with its enhanced user interface and features such as hyper-local alerts and AI-driven recommendations, is expected to significantly increase user engagement and interaction on the platform. This could drive higher engagement, leading to more ad inventory and potential revenue growth.

- The introduction of new advertising surfaces and formats with NEXT, such as dedicated spaces for different types of content, could open up new monetization opportunities by allowing advertisers to target users more effectively and with higher-value placements, potentially improving overall revenue.

- The incorporation of AI for recommendations and real-time content delivery can create a more personalized user experience, helping to retain and grow the user base, which could lead to sustained increases in both user engagement and revenue over time.

- Expansion of programmatic ad buying capabilities is anticipated to unlock new demand from large advertisers who are shifting budgets towards these automated channels, potentially improving revenues as these capabilities are rolled out later in the year.

- Continued cost management strategies, including reductions in stock-based compensation and improvement in EBITDA margins, are expected to enhance operating leverage, potentially improving overall net margins and profitability as revenue grows.

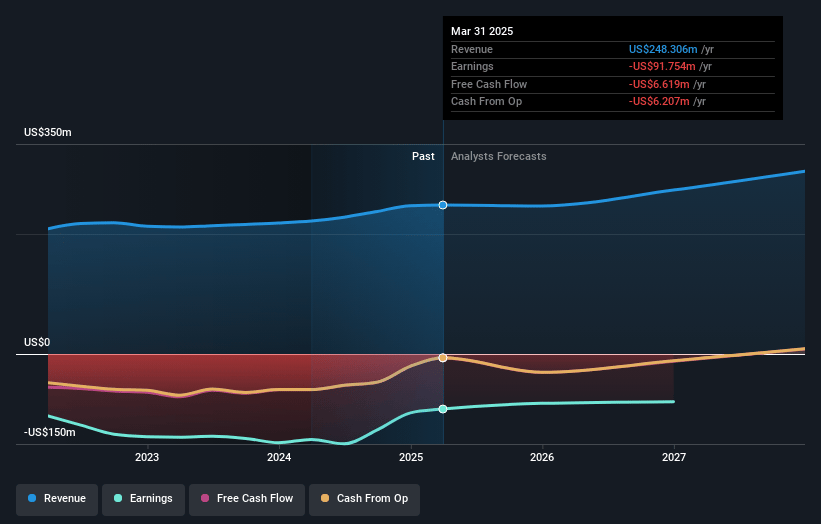

Nextdoor Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nextdoor Holdings's revenue will grow by 7.3% annually over the next 3 years.

- Analysts are not forecasting that Nextdoor Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Nextdoor Holdings's profit margin will increase from -37.0% to the average US Interactive Media and Services industry of 10.6% in 3 years.

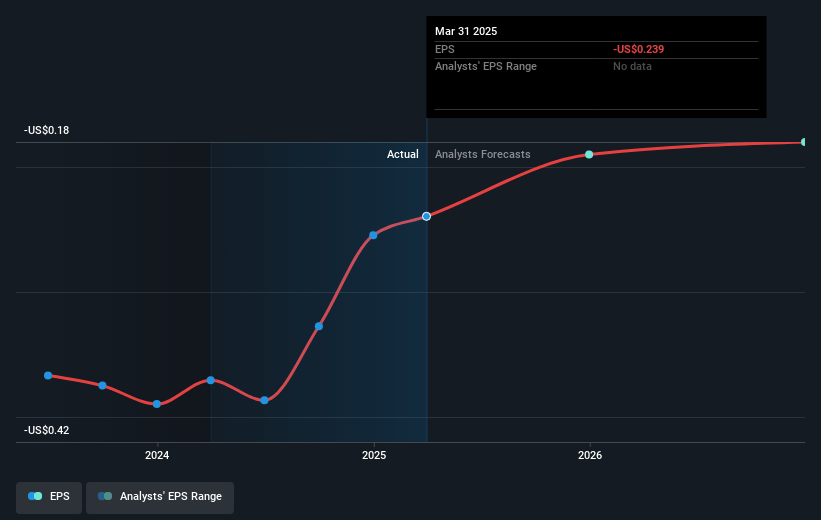

- If Nextdoor Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $32.5 million (and earnings per share of $0.08) by about May 2028, up from $-91.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.0x on those 2028 earnings, up from -6.0x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.1x.

- Analysts expect the number of shares outstanding to grow by 0.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Nextdoor Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift to NEXT involves intentional short-term trade-offs, potentially affecting immediate revenue and EBITDA as the company focuses on long-term product development and alignment rather than immediate financial gains.

- Some large advertisers have reduced spending due to shifting budgets toward programmatic ad buying, impacting short-term revenue growth until new demand channels are unlocked.

- The transition to platform WAU (Weekly Active Users) excludes users who only engage with emails, which may highlight a smaller active user base to advertisers, possibly affecting perceived value and ad revenue.

- Initial monetization strategies for new ad surfaces, including AI-driven features and alerts, are in exploratory stages, which could delay immediate financial benefits and impact earnings projections.

- Changes in user and advertiser expectations toward richer in-app experiences could require increased investment in user engagement initiatives, which might strain profit margins if not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.012 for Nextdoor Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.5, and the most bearish reporting a price target of just $1.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $307.2 million, earnings will come to $32.5 million, and it would be trading on a PE ratio of 30.0x, assuming you use a discount rate of 7.5%.

- Given the current share price of $1.45, the analyst price target of $2.01 is 28.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.