Key Takeaways

- Strategic development projects and expanded sports broadcasting rights are set to strengthen revenue streams and advertising income.

- Debt management and potential regulatory reforms could improve financial flexibility and competitive edge in broadcasting.

- Economic uncertainty, regulatory changes, and high debt pose challenges to revenue growth and financial flexibility, with potential impacts from shifts in media consumption habits.

Catalysts

About Gray Media- A multimedia company, owns and/or operates television stations and digital assets in the United States.

- The development and leasing of Assembly Studios and Assembly Atlanta is expected to provide significant financial contributions, enhancing overall company revenue by expanding production activities and finalizing partnerships for mixed-use development.

- Expanding sports broadcasting rights, such as the recent Atlanta Braves and Memphis Grizzlies deals, is anticipated to attract more viewers and advertisers, positively impacting advertising revenue and net margins.

- Projected political and digital ad revenue growth through improved leverage of digital audiences is expected to enhance total revenue, particularly during the high-value political cycles in 2026 and beyond.

- Debt reduction and refinancing efforts completed in 2024 position the company to lower interest expenses and strengthen the balance sheet, ultimately improving net earnings and financial flexibility for future growth opportunities.

- Regulatory reform discussions may lead to the relaxation of constraints on local broadcasters, providing Gray Media an opportunity to operate more efficiently, potentially increasing net margins and competitive positioning versus tech giants.

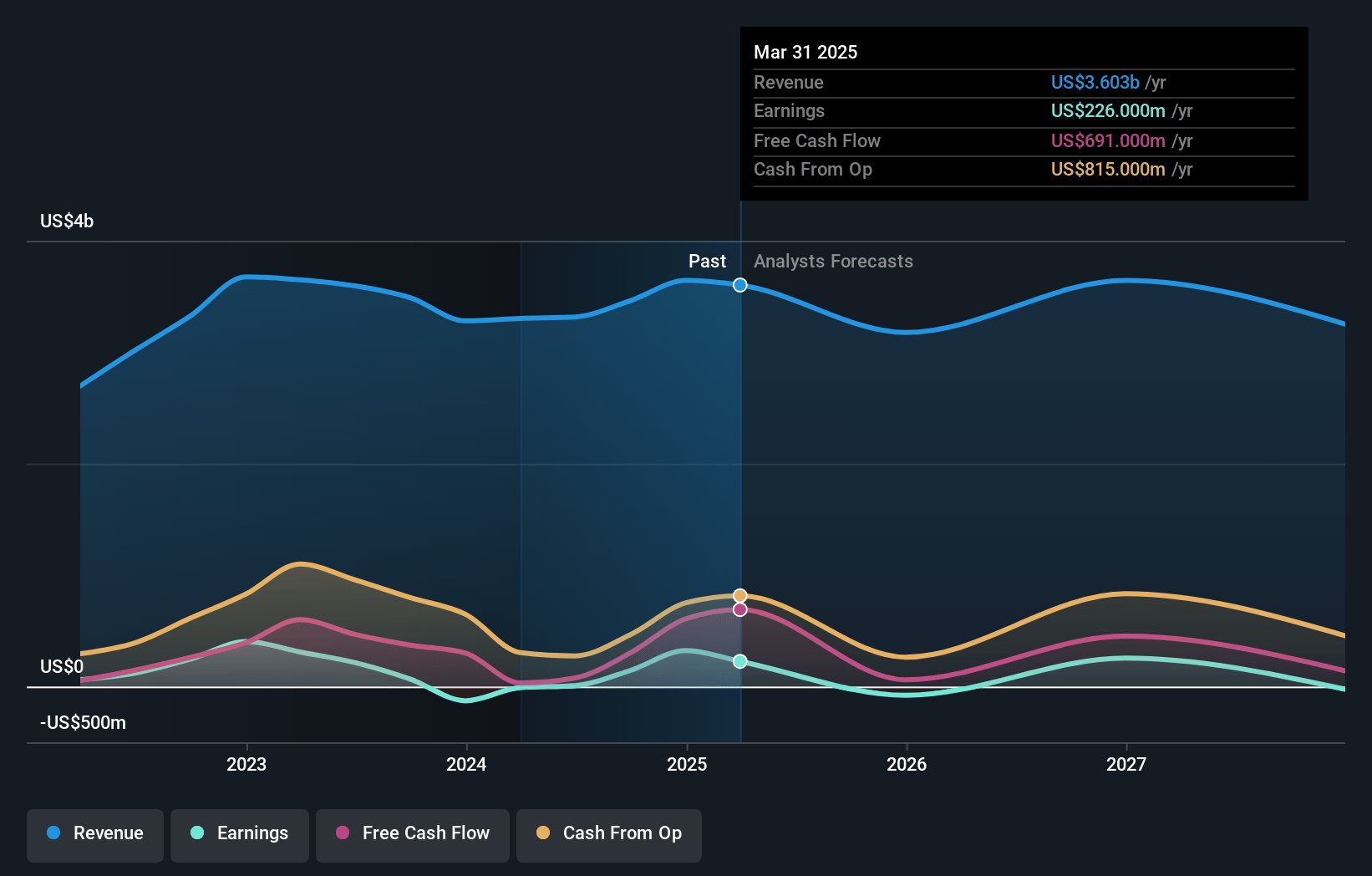

Gray Media Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gray Media's revenue will decrease by 3.5% annually over the next 3 years.

- Analysts are not forecasting that Gray Media will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Gray Media's profit margin will increase from 8.9% to the average US Media industry of 8.5% in 3 years.

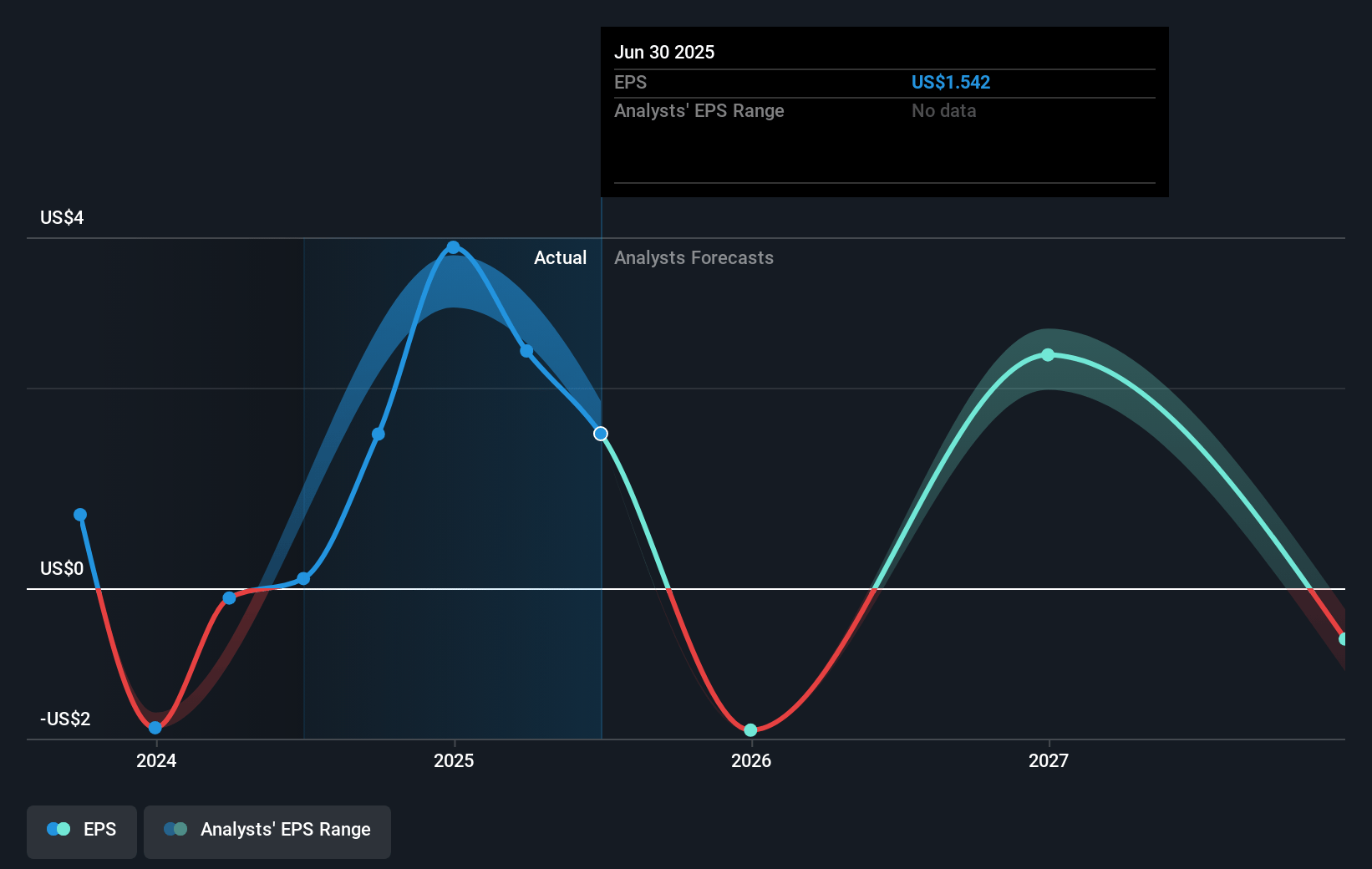

- If Gray Media's profit margin were to converge on the industry average, you could expect earnings to reach $279.5 million (and earnings per share of $2.56) by about May 2028, down from $323.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 2.9x on those 2028 earnings, up from 1.1x today. This future PE is lower than the current PE for the US Media industry at 16.8x.

- Analysts expect the number of shares outstanding to grow by 2.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Gray Media Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company anticipates potential regulatory changes, but any delays or decisions unfavorable to Gray could hinder its ability to compete effectively, potentially impacting net margins and revenue growth.

- The softness in core advertising revenue, particularly from the automobile sector due to economic uncertainty and tariffs, may continue and affect overall revenue and earnings.

- There is a notable decline in traditional MVPD subscriber base, which, despite signs of improvement, remains a concern for future retransmission revenue and net income stability.

- Gray faces risks from the competitive media landscape, especially regarding political ad revenues and the potential shift toward Connected TV platforms, which could pressure revenue and margins.

- With significant debt, even though reductions are being made, high leverage could limit financial flexibility for future investments or acquisitions, impacting net earnings and growth opportunities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.4 for Gray Media based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $279.5 million, and it would be trading on a PE ratio of 2.9x, assuming you use a discount rate of 11.4%.

- Given the current share price of $3.47, the analyst price target of $5.4 is 35.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.