Narratives are currently in beta

Key Takeaways

- Launching an ESPN streaming product and expanding content offerings aim to boost subscriber growth and positively impact revenue and earnings.

- Strategic expansion of Parks and integration of Hulu content into Disney+ are expected to drive income growth and enhance profit margins.

- Economic conditions, strategic execution risks, streaming costs, regulatory impacts, and international market challenges could all affect Disney's revenue, margins, and profitability.

Catalysts

About Walt Disney- Operates as an entertainment company worldwide.

- Disney's plan to launch an ESPN flagship streaming product is expected to enhance their sports content offering significantly by 2025, leveraging their established technology to increase ad revenue and potentially attract more subscribers, which should positively impact revenue and earnings growth.

- The robust pipeline of content, including major film releases through 2025 and beyond, is anticipated to enhance Disney’s streaming growth by bolstering engagement and reducing churn, leading to increased revenue generation.

- The expansion of Disney’s Parks and Experiences segment, including new cruise ships and enhancements in U.S. locations, is strategically planned to drive future operating income growth and attractive returns, thereby impacting net margins positively.

- Disney’s integration of Hulu content into Disney+ and the expansion of regional sports and entertainment offerings presents an opportunity for subscriber growth and increases in ARPU, which should enhance revenue and EBITDA margins.

- Disney is advancing its ad tech capabilities to further monetize its streaming platforms, which could improve profit margins as these advanced techniques are expected to generate higher ad revenues relative to costs.

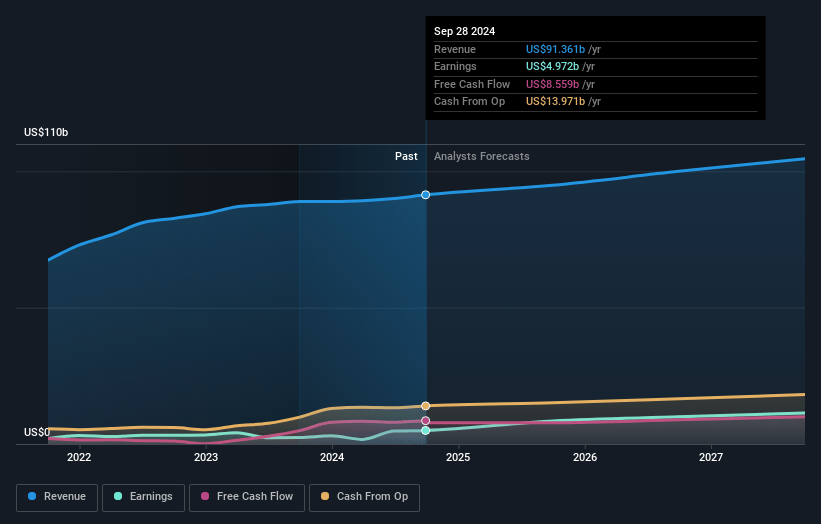

Walt Disney Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Walt Disney's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.4% today to 10.8% in 3 years time.

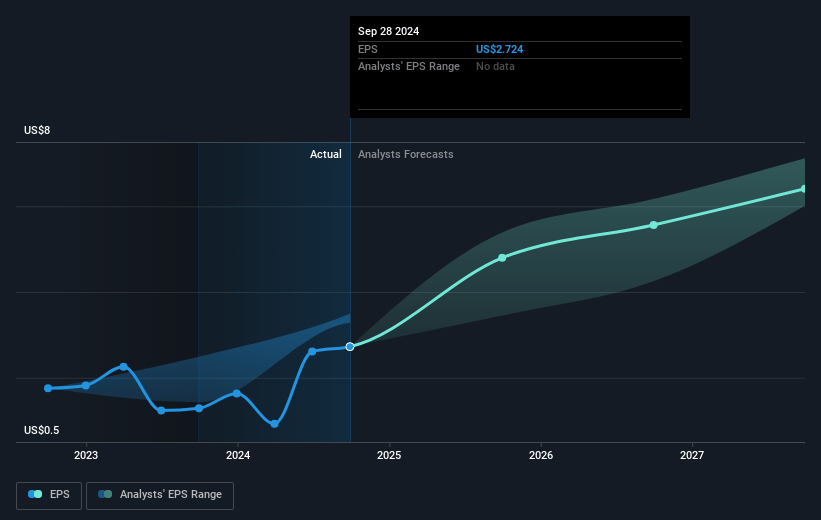

- Analysts expect earnings to reach $11.3 billion (and earnings per share of $6.4) by about November 2027, up from $5.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.8x on those 2027 earnings, down from 42.1x today. This future PE is greater than the current PE for the US Entertainment industry at 20.6x.

- Analysts expect the number of shares outstanding to decline by 0.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.86%, as per the Simply Wall St company report.

Walt Disney Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic or industry conditions and competition could adversely affect Disney's revenue and profitability, as these factors influence consumer spending, especially on discretionary products and experiences like theme parks and cruises.

- Risks associated with execution, such as potential strategic transactions and content spending, may impact Disney's ability to achieve the expected growth in earnings and can affect margins if not successfully managed.

- The integration and transition to streaming, including the ESPN flagship launch, involve significant costs and execution risks that could affect earnings if subscriber growth or revenue generation does not meet expectations.

- The impact of regulatory developments and legal frameworks might pose unforeseen costs or restrictions, which could affect Disney's overall profitability and cash flow management.

- International markets and local content strategies present both opportunities and risks; failure to successfully localize content or navigate international market dynamics could limit revenue growth or negatively impact net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $121.67 for Walt Disney based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $63.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $104.6 billion, earnings will come to $11.3 billion, and it would be trading on a PE ratio of 23.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of $115.45, the analyst's price target of $121.67 is 5.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$95.94

FV

22.1% overvalued intrinsic discount4.60%

Revenue growth p.a.

12users have liked this narrative

0users have commented on this narrative

6users have followed this narrative

2 months ago author updated this narrative

US$112.22

FV

4.4% overvalued intrinsic discount4.30%

Revenue growth p.a.

6users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

5 months ago author updated this narrative