Key Takeaways

- Increased licensing and production costs will see Disney's profitability decline or they'll pass on these increasing costs to subscribers and risk alienating them.

- Competition from non-traditional media platforms like YouTube or Tik-Tok could draw younger audiences away from Disney's services.

- Faltering viewership and increasing production costs threaten Disney's Linear Network the business.

Catalysts

Company Catalysts

Intense competition in the streaming space impacting Disney+ subscriber growth

When streaming platforms first appeared, they were like an online video store. For a small monthly fee, you could watch a huge range of new and classic movies and TV shows. However, as new entrants into the streaming market arrived - both third-party and from the production companies starting their own streaming services - the price to license certain popular content started to go up.

These production companies like Disney could offer their content with nil or minimal licensing costs, essentially making it unaffordable for third-party platforms. For instance, Netflix would always face an uphill battle in licensing a Paramount Pictures movie for less than Paramount’s own Paramount+ streaming service would.

This situation was initially a great option for these production companies as it allowed them to gain a very quick competitive advantage over the likes of Netflix when they first entered into the market, but there now exists another problem. While Disney+ does a great job of giving people access to Disney content, it doesn't offer a wide variety of other content. On it’s own, Disney+ does not have enough content to support the entertainment needs of an average audience. This might not be a problem on its own, but there are now so many streaming services that people may be starting to feel overwhelmed.

While this is only a personal anecdote, I am currently subscribed to several streaming platforms and I have noticed my consumption habits have changed. The companies that lack diversity in content only meet a specific need of mine. I don’t come to these platforms when I’m looking for something to watch. I only come to these platforms when they have something I’m already interested in watching and so I’m more likely to churn my subscription once that need is met. Interestingly, streaming services were supposed to make watching entertainment easier. But, the large number of different platforms has actually made things more complicated.

WhistleOut: Streaming Platforms and The Fight For New Original Content

As more and more streaming services start up, the battle for subscribers and exclusive content will get harder. The constant battle against the likes of Netflix, Amazon Prime Video, and HBO Max could make it difficult for Disney+ to keep their subscribers and attract new ones as subscribers are more likely to churn due to Disney’s lack of content diversity.

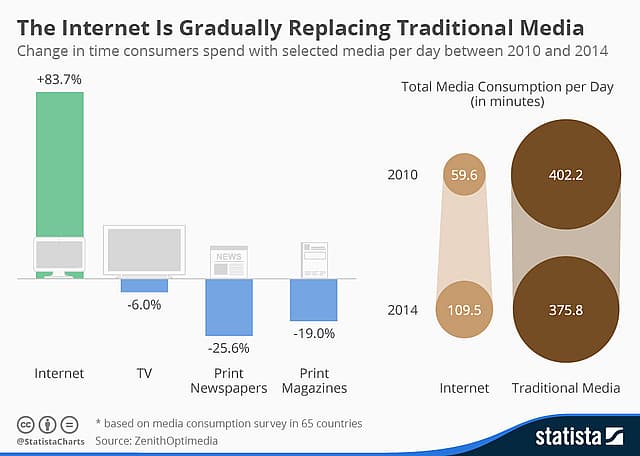

Competition from non-traditional media platforms takes viewers' eyes away from Disney

In addition to facing competition from fellow streaming services, Disney also contends with a new kind of adversary: non-traditional media platforms like YouTube, TikTok and Instagram. These platforms have mastered the art of short-form content, creating videos that keep viewers hooked with a constant stream of quick, satisfying hits of entertainment.

There’s two advantages this style of content has. Firstly, it’s not capital intensive. There’s no huge production company budgets, actors or licensing costs associated with it. It’s all generated by users. Secondly, this type of content has very few barriers to consumption. YouTube videos or Tik-Toks don’t require a backstory or understanding. You don’t have to watch from the first season to understand what’s going on – a stark departure from the movies or TV shows on Disney+ or Hulu that demand a viewer's commitment from the beginning. There’s next to no effort needed to consume them and hours can pass unnoticed when engaging with these snippets of content.

These non-traditional platforms have seized a considerable share of consumers' attention, potentially hampering Disney's ability to grow its audience. They've also attracted a significant portion of advertising dollars, which might limit Disney's potential to generate revenue from this avenue on their cable TV broadcasts and ad-supported subscriptions for Dinsey+ and Hulu.

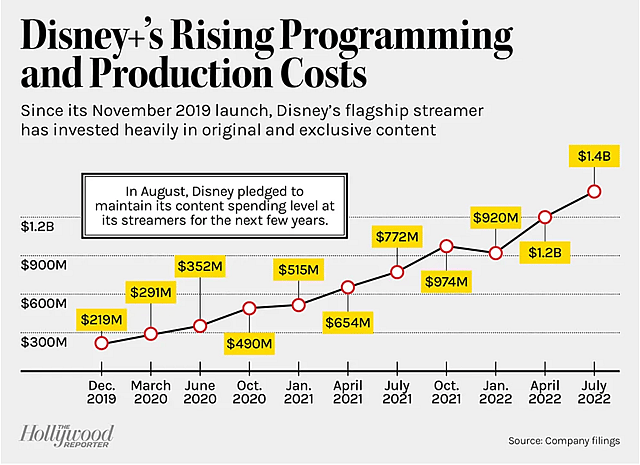

Increasing programming and production costs at Hulu and Disney+

As the inflation rears its ugly head, and as content markets become more competitive, Disney is facing escalating programming and production costs for its streaming platforms, Hulu and Disney+.

High-profile original series like the Marvel TV shows – Loki, The Falcon And The Winter Soldier, Ms. Marvel, WandaVision and Hawkeye – reportedly cost an astonishing $25 million per episode. While these marquee shows are crucial for attracting and retaining subscribers, the rising costs could impact Disney's profitability and limit its ability to invest in new content and marketing initiatives.

The Hollywood Reporter: Disney’s Soaring Production Costs

This problem also extends beyond streaming. In their traditional linear network segment, Disney is grappling with growing rights fees for sporting events. A notable example is the Indian Premier League (IPL) cricket. Although Disney managed to maintain some rights through Star Sports, the substantial $2.8 billion cost to retain streaming rights was deemed too steep. This strategic decision illustrates how rising costs can influence Disney's content acquisition strategies.

These increasing costs will inevitably put pressure on Disney's pricing model as well. Higher subscription prices may be necessary to offset production and rights costs, but such a move could risk alienating subscribers, particularly in an economic climate where many households are budgeting carefully. As a result, Disney could lose subscribers, exacerbating the financial strain on their already loss-making streaming segment. If these costs continue to rise unchecked, Disney's streaming services risk plunging further into the red, underscoring the delicate balancing act required in this competitive market.

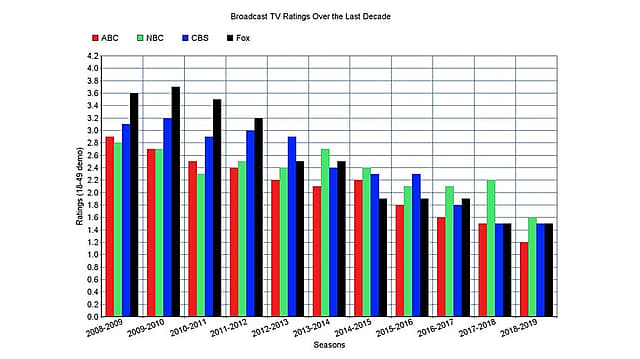

The erosion of cable television’s popularity puts pressure on Disney’s biggest money-maker

One significant headwind for Disney is the decline in cable television viewership, a trend spurred on by the rise of streaming platforms. Once the powerhouse of home entertainment, cable TV has seen a steady drop in subscribers, a phenomenon known as "cord-cutting". Consumers are increasingly choosing to forego the traditional cable subscription in favor of more flexible, often more affordable, streaming platforms.

Adweek: Linear TV Ratings Continue To Slide And “Never To Return”

This trend poses a particular challenge for Disney, whose linear network segment consisting of Disney, ESPN, National Geographic and ABC Network is still its largest source of revenue. With the shrinking cable viewership, the revenue from this segment has been experiencing a downturn. As more people "cut the cord", the pressure on Disney to pivot and adapt grows stronger.

While Disney+ and Hulu On Demand represent a proactive response to this shift, the migration from traditional television to streaming is far from a zero-sum game. Retaining and growing Disney Streaming’s subscriber base amidst the competition is a constant challenge, and one that is vital to counterbalance the decline in cable TV viewership.

Industry Catalysts

Slowing demand for streaming services

As consumers become overwhelmed with the number of streaming platforms available, demand for streaming services may plateau or even decline. This could make it more difficult for Disney to grow its subscriber base and maintain its market share in the streaming industry.

Prolonged economic uncertainty

Economic downturns and uncertainty could lead consumers to cut back on discretionary spending, such as travel and entertainment experiences. This may result in decreased attendance and revenue for Disney's theme parks and resorts.

Regulatory challenges

Disney's media and entertainment businesses may face increased regulatory scrutiny, particularly in regard to antitrust concerns, intellectual property rights, and content distribution. Any potential regulatory restrictions or legal issues could impact Disney's ability to grow and maintain its market share.

Assumptions

Assumptions

Disney Media and Entertainment Distribution

Direct-to-Consumer (Video Streaming)

In the face of an over-saturated streaming market and increasing competition from non-traditional media platforms, I believe the Direct-to-Consumer segment will experience challenges in retaining and growing its subscriber base. I’m assuming that subscriber numbers, currently at 157.4 million, will see a reduction due to the loss of IPL streaming rights, leading to an anticipated 15 million subscribers departing over the next five years. Despite recent explosive growth, I believe Disney+ is poised to see subscriber numbers begin to plateau, reaching 180 million subscribers by 2028, still falling behind rivals Netflix and Amazon Prime.

On the financial front, the rising costs of licensing and production could push subscription prices upwards, and by 2028, I anticipate that the average monthly revenue per subscriber could increase to $6.00 (up from $4.49) as a result of increases to subscription costs. This could result in annual Disney+ subscription revenue of approximately $12.96 billion.

Linear Networks (TV Broadcasts)

I strongly believe Linear Networks segment may face a tough road ahead in the next five years, as a result of lower viewership levels and declining advertising revenue due to increasing competition from alternative media platforms such as YouTube and TikTok and a general shift towards on-demand streaming content. Further complicating matters are the increasing programming costs, which will contribute to the significant financial impact on this segment. Over the five year period to 2028, I anticipate Linear Network revenues will decrease by 13% to reach $25 billion, down from the $28.7 billion reported in the 12 months to October 2022.

As a result of the above factors, Linear Networks, which was the only Disney Media and Entertainment Distribution (DMED) segment to experience a decline in both revenue and operating profit over the last quarter and six months respectively, will continue to face significant pressure on its profitability.

Content Sales/Licensing

I’m assuming that the Content Sales/Licensing segment of Disney's business will actually perform quite well over the next five years, far better than the rest of the DMED segment. Disney's strategic acquisitions of high-value franchises, alongside a promising release schedule from Pixar, I think there’s some growth to be had. I think that the upcoming releases of Avatar 3, 4 and 5, several Avengers movies, two new Star Wars movies in 2025 and 2027, and numerous Pixar releases will spur on a solid period for Disney in this area with a number of these movies likely to dominate the box office in their respective release periods. As a result of these factors, I predict that revenue in this segment will grow at a rate of approximately 12% per year, reaching $14.3 billion by 2028.

Disney Parks, Experiences and Products

Disney Parks and Experiences

While recent recovery in the Disney Parks and Experiences segment may be partially attributed to post-pandemic rebound, I’m assuming that the long-term outlook for the Parks and Experiences segment remains buoyant. While attendance figures improved drastically over a 1 year period, I do anticipate a stagnation in guest volumes (although I understand this is something that Disney is doing intentionally) over the next few years, with attendance for the company's two biggest parks - Magic Kingdom and Disneyland - expected to hover around their current 17.1M and 16.8M in annual attendance. Despite guest numbers leveling off, I still think Parks and Experiences will deliver some solid growth will be primarily driven by increased ticket prices and guest expenditures, resulting in annual segment revenues of $33 billion by 2028. The company's strategic management of guest numbers, alongside anticipated price increases, should sustain the segment's profitability despite stagnant attendance figures.

Disney Merchandising and Product sales

My assumptions for the Disney merchandising segment are fairly restrained but I do anticipate the segment experiencing some headwinds from increased materials and manufacturing costs. These increases could lead to higher pricing of Disney merchandise, potentially impacting the volume of sales. However, the extensive and beloved franchise portfolio of Disney is expected to cushion this effect to some extent - especially with some big name movies in the pipeline. With these factors in mind, I forecast revenue of $5.5 billion for this segment by 2028. This is indicative of a moderate 3% CAGR over the next 5 years. However, profitability could experience a slight dip due to these increased input costs.

Cash flow margins are harmed

The streaming wars are heating up, and Disney is facing formidable competition from the likes of Netflix, Amazon Prime Video, and HBO Max. To stay ahead, Disney has been investing heavily in original content, which is notably a high-cost endeavor. These increased production costs could put significant pressure on their profit margins over time.

Furthermore, Disney's Linear Networks division is also facing escalating programming costs, largely driven by inflation and stricter competition. The sports broadcasting rights in particular, relevant to Disney’s ESPN, have been skyrocketing in recent years. While these sports broadcasts are critical for maintaining their viewership, the cost of acquiring these rights is becoming increasingly burdensome.

I anticipate that the balance of these factors results in a hit to Disney’s ability to generate reliable cash flow. Currently the company has seen a cashflow yield of 10-12% over the last few years but I assume this will drop to around 9% for the next few years. For my valuation scenario, I’m running with the assumption that Disney’s free cash flow margin will drop to 9% for the next 5 years before returning to normality (11%) once costs inflation-driven cost rises stabilize.

No buybacks for the foreseeable future

I’m assuming that Disney shareholders will not see any share buybacks for the foreseeable future. In 2020, Disney suspended the payment of its dividend citing cash concerns and is yet to reinstate it. Despite conversations that Disney could reinstate the dividend by the end of the 2023 calendar year, i don’t believe this will be the precursor to the company buying back its own stock. Particularly with cash expenditure being a principle concern of the company and in my assumed catalyst, I think the shares outstanding for Disney will remain stable at 1.827 Billion shares outstanding.

Risks

Risks to my Narrative

Strong parks segment performance could boost company profitability

In a post-COVID world, Disney’s Parks and Experiences segment is likely to continue its role as a significant profit engine for the company. This division, encompassing Disneyland, Disney World, and other global theme parks, along with Disney cruises, resorts, and consumer products, has historically been a tremendous profitability driver for the whole business, helping justify incurring losses on the streaming segment.

Disney's Genie+ system, the new paid replacement for the FastPass system, provides another revenue stream within the segment by offering guests the ability to skip lines for an additional fee. While it's been a source of controversy among some guests, it represents a potentially profitable monetizing strategy for Disney. Furthermore, the continual delivery of new rides and experiences at Disney parks shows a commitment to capturing not only new guests to the parks, but entice returning guests too.

The strength of Disney’s Parks segment is a risk to my belief that increasing production costs at Hulu and Disney+ will harm the company’s overall profitability. If the parks segment remains strong enough, overall margins could improve despite the difficulty in the streaming segment.

Disney’s incredibly strong IP catalogue could help them win the streaming wars

The competition in the streaming wars is fierce and as stated previously, many platforms are turning to original productions to reduce licensing costs and to develop a unique catalogue of media to entice subscribers. This trend towards original content could be a huge benefit to Disney as they undoubtedly have the strongest media asset portfolio in the business. Disney Pixar, Marvel, Star Wars, the catalogues of 21st Century Studios and Searchlight Pictures are all under Disney’s umbrella and will be a huge draw for audiences looking for content they know and love. Although I previously spoke about a lack of content diversity could harm Disney, Disney could win via heading down the “quality over quantity” path and capturing new subscribers.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Bailey holds no position in NYSE:DIS. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.