Key Takeaways

- Ongoing Hollywood strikes have significantly reduced movie releases, pressuring future revenue and contributing to a box office decline, despite strategic initiatives to improve margins.

- Planned debt repayment with cash reserves may strain liquidity, constraining growth reinvestment and potentially affecting earnings with share dilution risks from convertible note settlement.

- Strong North and Latin American market share, cost management, and strategic initiatives contribute to revenue stability, growth potential, and investor confidence.

Catalysts

About Cinemark Holdings- Engages in the motion picture exhibition business.

- The lingering impact of the Hollywood strikes from 2023 caused a prolonged work stoppage on film production, leading to fewer tentpole releases and a 12% decline in the North American box office compared to the same period in 2024, suggesting potential future revenue challenges.

- Despite strategic initiatives aimed at margin improvement, the company's adjusted EBITDA margin was 6.7%, which remains relatively low, compounded by inflationary pressures on costs that could further squeeze net margins unless fully offset by increased attendance.

- The company's plans to repay a $460 million principal amount of convertible notes using cash reserves may impact liquidity, potentially limiting capacity for reinvestment in growth opportunities or additional share repurchases, which could affect earnings.

- While the company is leveraging flexible scheduling to optimize attendance, challenges such as limited auditorium capacity during high-demand periods may restrict revenue growth potential, particularly when blockbuster content is released in a more concentrated timeframe.

- The execution of $200 million in share repurchases was completed at an average price above the current exposure threshold of $22 per share, highlighting potential share dilution risks with the upcoming convertible note settlement, which may impact earnings per share.

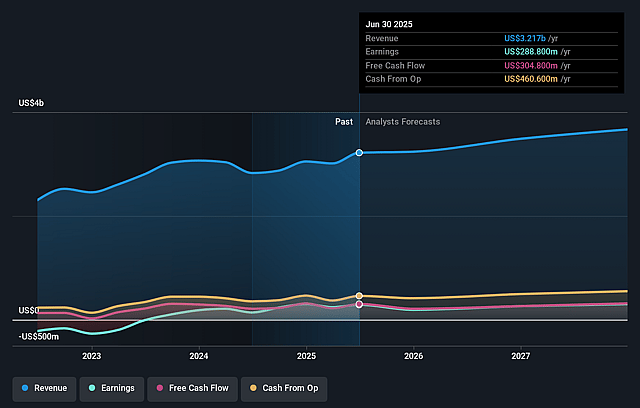

Cinemark Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cinemark Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cinemark Holdings's revenue will grow by 6.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.0% today to 8.2% in 3 years time.

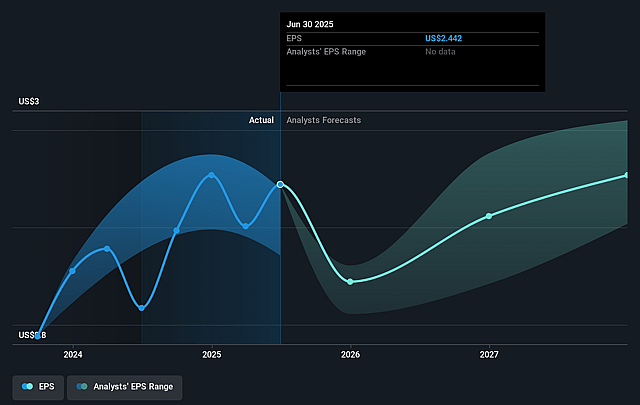

- The bearish analysts expect earnings to reach $299.9 million (and earnings per share of $2.4) by about July 2028, up from $241.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, down from 14.3x today. This future PE is lower than the current PE for the US Entertainment industry at 26.9x.

- Analysts expect the number of shares outstanding to decline by 5.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Cinemark Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cinemark Holdings has managed to outperform the market by maintaining a high market share both in North America and Latin America, which positively impacts their revenue stability and potential growth.

- The film release pipeline looks robust with upcoming blockbusters from major studios and newcomers like Amazon MGM committing to a substantial number of theatrical releases by 2027, which could enhance box office revenue.

- Cinemark's ability to manage costs effectively despite inflationary pressures and lower attendance levels shows strong operational controls, benefiting their net margins.

- The introduction of strategic initiatives, such as enhanced food and beverage offerings, has significantly increased concession per capita, which supports overall earnings.

- The resumption of dividend payments and substantial share buybacks reflect strong financial health and confidence in future cash flows, which may favorably impact share value and investor returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cinemark Holdings is $26.33, which represents two standard deviations below the consensus price target of $34.18. This valuation is based on what can be assumed as the expectations of Cinemark Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $299.9 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 11.6%.

- Given the current share price of $30.42, the bearish analyst price target of $26.33 is 15.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.