Last Update09 Sep 25Fair value Increased 2.09%

Analysts have raised their price targets for Roku—now at $103.27—on strong free cash flow forecasts, growing platform revenue from new partnerships and bundled offerings, and sustained momentum in connected TV advertising.

Analyst Commentary

- Bullish analysts are raising price targets based on strong free cash flow forecasts, with some projecting Roku could generate $1.6B in free cash flow by 2023 and see sustained high annualized returns.

- Upside revisions to platform revenue and EBITDA expectations are driven by anticipated benefits from partnerships—especially integration with Amazon's DSP—and new bundled subscription offerings, which are seen as meaningful catalysts for revenue growth.

- Strong quarterly results, particularly a beat-and-raise fueled by video advertising strength, reinforce Roku's status as a leading beneficiary of the continued shift to connected TV advertising.

- Analysts cite profitable expansion, revenue diversification, growing ad inventory, and enhanced content recommendation capabilities as factors supporting improved annual outlooks and offsetting external risks, such as tariffs.

- Positive outlooks are further underpinned by improvements in labor productivity, industry advertising sentiment recovery, and Roku’s “clean exposure” to connected TV, supporting a compelling risk/reward profile even as some believe recent partnership benefits are now largely priced in.

What's in the News

- Roku announced the nationwide launch of Howdy, a new ad-free SVOD service priced at $2.99/month, featuring content from partners such as Lionsgate, Warner Bros. Discovery, and FilmRise, and including Roku Originals (Key Developments, 2025-08-05).

- Roku’s Board of Directors authorized a share repurchase program of up to $400 million in Class A shares, funded by existing cash, with the program running until December 31, 2026 (Key Developments, 2025-07-31).

- The collaboration between Amazon Ads and Roku will give advertisers access to an estimated 80 million U.S. Connected TV households via Amazon DSP, enhancing addressability across major streaming apps and premium publishers, and will be available to all U.S. Amazon DSP advertisers by Q4 2025 (Key Developments, 2025-06-16).

- The exclusive partnership with Amazon aims to improve campaign performance, planning, and measurement at scale, leveraging advanced AI, clean room technology, and Roku’s extensive CTV footprint for increased efficiency and reach (Key Developments, 2025-06-16).

- No significant periodical news for Roku; recent periodical coverage was unrelated, focusing on Rockwell Automation (Periodicals, 2025-07-16).

Valuation Changes

Summary of Valuation Changes for Roku

- The Consensus Analyst Price Target has risen slightly from $101.15 to $103.27.

- The Future P/E for Roku has risen slightly from 53.93x to 55.39x.

- The Net Profit Margin for Roku remained effectively unchanged, moving only marginally from 6.12% to 6.09%.

Key Takeaways

- Migration from linear TV to streaming and digital ads is driving user growth, platform engagement, and higher-margin advertising revenue.

- Investments in content, self-service ads, and operational efficiency are improving margins, financial health, and supporting long-term revenue and earnings expansion.

- Competition, ad market dependency, content fragmentation, data regulation, and risky international expansion all threaten Roku's ability to grow revenue, margins, and platform engagement.

Catalysts

About Roku- Operates a TV streaming platform in the United States and internationally.

- The accelerating shift away from traditional linear TV toward streaming continues to expand Roku's total addressable market, supporting long-term growth in active users and increasing demand for its connected TV platform, which is expected to drive sustained double-digit platform revenue growth.

- The global migration of advertising budgets from linear TV to digital and connected TV, combined with Roku's successful rollout of new ad products (such as Roku Ads Manager) and deeper third-party DSP integrations, increases its share of high-margin digital advertising, which is showing up as both revenue growth and higher platform margins.

- Increased penetration of smart TVs and streaming devices globally, along with investments in expanding Roku's operating system and international distribution, are fueling persistent user growth and engagement, laying the foundation for continued revenue expansion.

- Ongoing investments in proprietary content (e.g., The Roku Channel), self-service ad solutions, and performance marketing are boosting user engagement and attracting new cohorts of advertisers (especially SMBs), adding incremental high-margin advertising revenue and broadening usage, which are supporting margin and earnings growth.

- Enhanced operational discipline, margin expansion through operating leverage, and the company becoming operating income positive ahead of schedule signal improving financial health and suggest a potential for net margin and earnings acceleration as monetization initiatives scale.

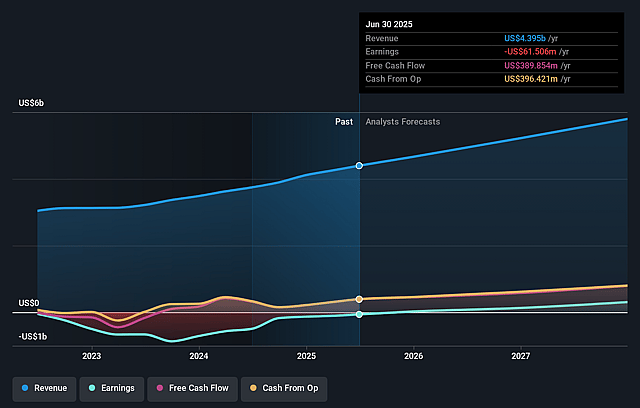

Roku Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Roku's revenue will grow by 11.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.4% today to 6.1% in 3 years time.

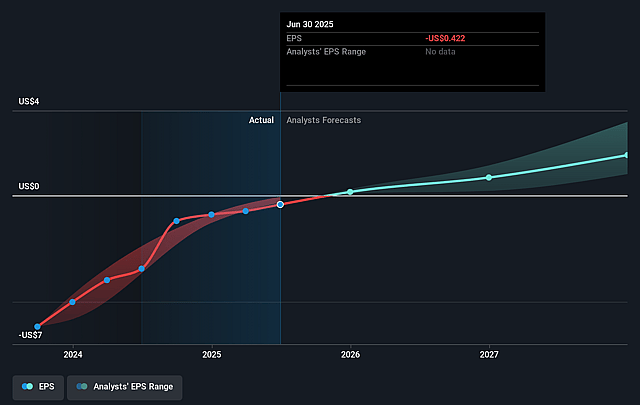

- Analysts expect earnings to reach $372.1 million (and earnings per share of $2.25) by about September 2028, up from $-61.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $513.6 million in earnings, and the most bearish expecting $149.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.9x on those 2028 earnings, up from -235.9x today. This future PE is greater than the current PE for the US Entertainment industry at 38.2x.

- Analysts expect the number of shares outstanding to grow by 1.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.05%, as per the Simply Wall St company report.

Roku Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the smart TV OS and streaming device market from large ecosystem players (such as Amazon, Google, Apple, and now Walmart/Vizio) risks commoditizing Roku's hardware, which could limit household penetration growth, pressure device revenues, and erode Roku's ability to maintain current levels of active accounts-ultimately impacting both top-line revenue and long-term earnings capacity.

- Despite strong performance, Roku's heavy reliance on advertising revenue makes it vulnerable to macroeconomic slowdowns, cyclical ad market contractions, or shifting digital ad budgets toward competitors, resulting in potential revenue volatility and compressing operating or net margins during periods of weaker ad demand.

- The proliferation of direct-to-consumer apps and continued content fragmentation may see major media companies withholding top-tier content or creating more walled gardens, diminishing Roku's platform value proposition, reducing user engagement/time spent, and limiting subscription or ad revenue potential.

- Increasing global privacy regulations and consumer data protection laws may restrict Roku's ability to leverage its proprietary data for targeted advertising, potentially stalling growth in its high-margin ad business and impacting long-term profitability.

- International expansion and new market entry, including performance-focused ad products for SMBs, carry significant execution and scaling risks; initial investments may not generate proportionate returns, which could keep net margins compressed or delay improvements in long-term operating income and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $101.154 for Roku based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.1 billion, earnings will come to $372.1 million, and it would be trading on a PE ratio of 53.9x, assuming you use a discount rate of 9.0%.

- Given the current share price of $98.47, the analyst price target of $101.15 is 2.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.