Key Takeaways

- Investment in innovative features and operational efficiencies aims to boost user engagement, streamline operations, and improve margins.

- Strategic share repurchases reflect a focus on enhancing shareholder value and improving earnings per share.

- Tinder's revenue declines, user acquisition struggles, and macro-level pressures pose challenges to sustaining growth and profitability for Match Group.

Catalysts

About Match Group- Engages in the provision of dating products.

- Tinder is focused on launching new features like mandated face photos and spotlight drops to improve user outcomes and engagement, which could enhance user experience and support revenue growth in the future.

- Hinge’s continued strong user growth and product innovations, such as AI-enabled features and Your Turn Limits, are building momentum, particularly in core English-speaking and European markets, potentially boosting revenue and market share.

- Azar’s expansion into the U.S. market is intended to leverage its successful model from Europe, and growing engagement among Gen Z users could contribute to revenue and user base enhancement.

- Match Group is implementing operational efficiencies by migrating additional brands to a shared tech platform, aiming to streamline operations and enhance net margins.

- Match Group’s strategy to deploy significant amounts of free cash flow for share repurchases indicates a focus on enhancing earnings per share and shareholder value.

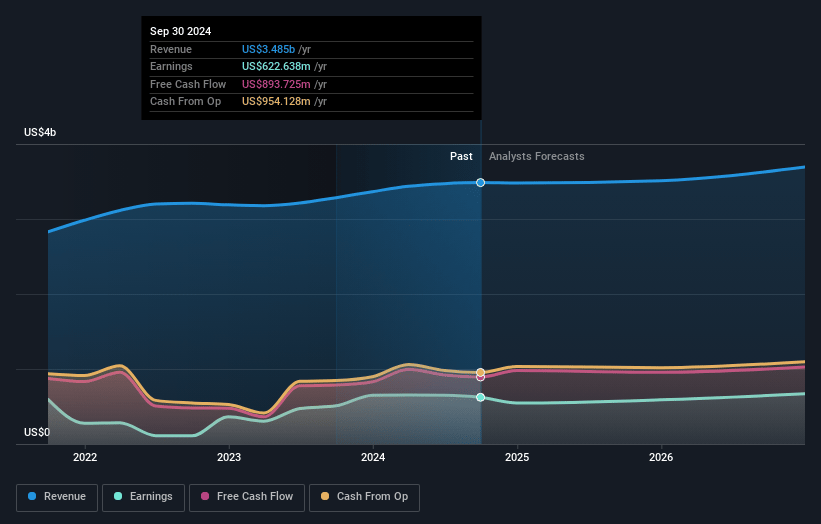

Match Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Match Group's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.9% today to 19.3% in 3 years time.

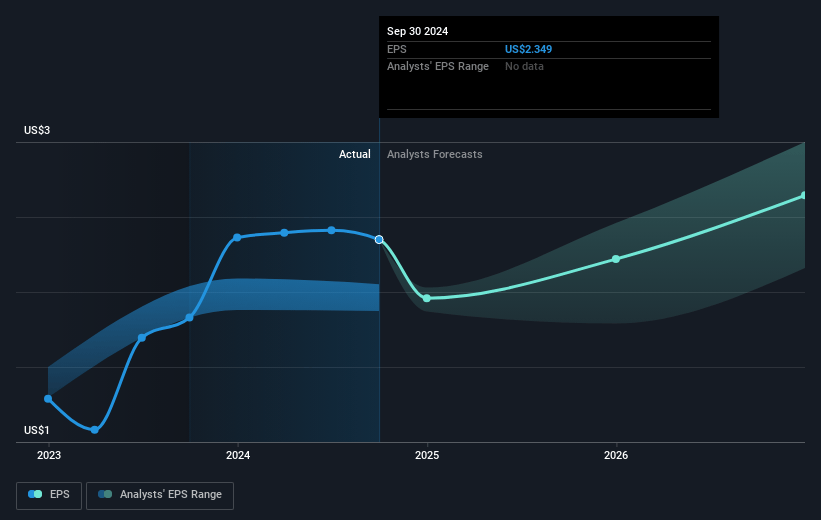

- Analysts expect earnings to reach $741.9 million (and earnings per share of $3.01) by about January 2028, up from $622.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $614.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 14.3x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 24.7x.

- Analysts expect the number of shares outstanding to decline by 0.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

Match Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tinder's direct revenue decline and the delayed rollout of a la carte initiatives could continue to impact revenue negatively if these issues are not resolved effectively. (Impacts revenue)

- The under-delivery on user acquisition, with Tinder's monthly active users (MAU) down 9% and new user trends weakening, suggests challenges in sustaining user growth and engagement, affecting future revenue streams. (Impacts revenue)

- The company's overall slower-than-targeted year-over-year growth rates for revenue and AOI, and an OI decline of 14% due to impairments, point to financial vulnerabilities and challenges in maintaining profitability targets. (Impacts earnings and net margins)

- Major user acquisition challenges on iOS, which typically hosts higher value users, pose a risk to revenues and could lead to further declines in high-margin segments if not addressed. (Impacts revenue and net margins)

- Macro-level pressures, such as expected pullbacks from large advertisers during the holiday period, may continue to negatively impact indirect revenue, affecting the overall financial health and outlook. (Impacts revenue)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.09 for Match Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.8 billion, earnings will come to $741.9 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 7.9%.

- Given the current share price of $35.42, the analyst's price target of $36.09 is 1.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives