Key Takeaways

- Expanding global adoption of digital dating and targeted innovation positions Match Group for sustained user growth, diversified revenue streams, and a larger addressable market.

- Enhanced AI-driven features, premium offerings, and efficient brand strategies support improved engagement, profitability, and long-term earnings growth amid maturing markets.

- Structural demographic trends, rising competition, user disengagement, regulatory pressures, and dependence on key brands pose significant risks to sustained revenue and earnings growth.

Catalysts

About Match Group- Engages in the provision of digital technologies.

- Match Group’s global brands are poised to benefit from rapidly expanding internet and smartphone penetration, especially in emerging markets, unlocking new user growth and diversifying revenue streams as more singles worldwide adopt digital dating platforms.

- Societal shifts, including growing acceptance of online dating across all age groups and later-in-life partnerships, expand the company’s addressable market and promise long-lasting, persistent demand, which raises the ceiling on total revenue and future earnings potential.

- Accelerated product innovation, particularly AI-driven features for matching, discovery, and safety, is expected to increase user engagement, retention, and brand differentiation, leading to higher average revenue per user and improving both near-term revenue and long-term net margins.

- Continued rollout of premium offerings, new subscription tiers, and a la carte monetization options—paired with improved merchandising and package optimization—are set to drive operating leverage, expanding overall profitability and supporting net margin growth over the next several years.

- The Power Portfolio strategy, leveraging cross-brand technological innovation and efficient rollout of niche, demographically-targeted apps, positions Match Group to capture growth in underpenetrated audiences, boosting both top-line growth and operational efficiency, which will sustain earnings expansion even as the core market matures.

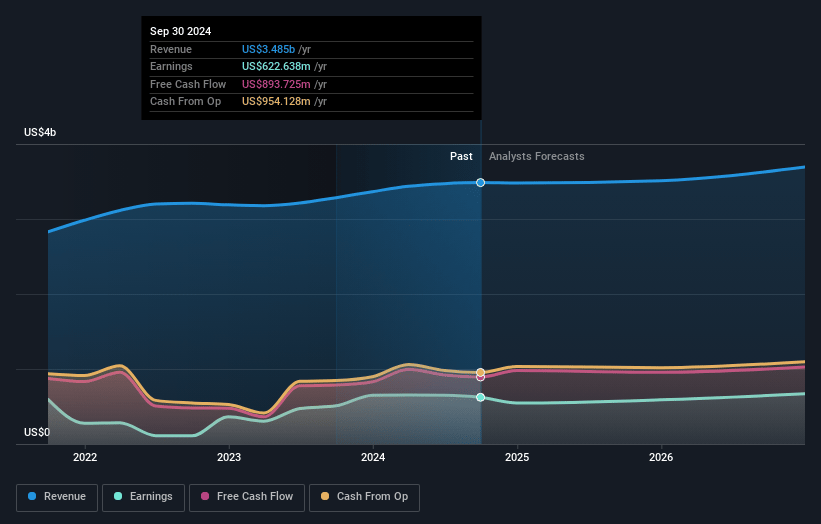

Match Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Match Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Match Group's revenue will grow by 4.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.8% today to 20.6% in 3 years time.

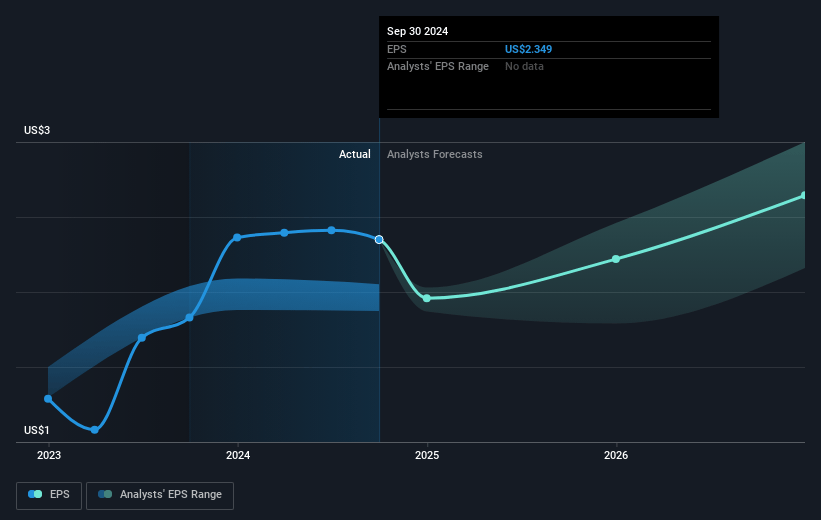

- The bullish analysts expect earnings to reach $809.8 million (and earnings per share of $3.91) by about April 2028, up from $551.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, up from 13.5x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 16.7x.

- Analysts expect the number of shares outstanding to decline by 5.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.72%, as per the Simply Wall St company report.

Match Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term demographic shifts, such as declining birth rates and aging populations in major markets, could shrink Match Group’s core addressable audience, which would restrict future growth in user numbers and potentially slow the company’s ability to grow revenue and earnings over the long run.

- Intensifying competition from niche and free dating platforms may continue to erode Match Group’s pricing power and stifle subscriber growth, risking both revenue expansion and future profit margins as users are more easily able to substitute with lower-cost or more customized alternatives.

- Rising digital disenchantment and user “app fatigue” present a risk that consumers will disengage from online dating platforms, which could negatively affect Match Group’s long-term user engagement, active user numbers, and ultimately its recurring subscription revenue base.

- Ongoing and future regulatory pressures related to data privacy, user safety, and trust—including compliance burdens introduced by features such as biometrics and face photo requirements—could increase Match Group’s operational and legal costs, potentially compressing net margins and reducing overall earnings.

- The company remains highly reliant on a few key brands, particularly Tinder, as reflected in the persistent focus on stabilizing and improving Tinder’s MAU trends; this concentration means that any sustained decline in the popularity of these core apps threatens top-line revenue growth and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Match Group is $45.51, which represents two standard deviations above the consensus price target of $36.02. This valuation is based on what can be assumed as the expectations of Match Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.0, and the most bearish reporting a price target of just $29.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.9 billion, earnings will come to $809.8 million, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of $29.71, the bullish analyst price target of $45.51 is 34.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:MTCH. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives