Key Takeaways

- User growth trends are improving but remain a downside risk to revenue and top-line growth if not recovered.

- Foreign exchange headwinds and cost pressures may compress margins, impacting profitability and earnings projections.

- The new CEO's leadership and focus on AI and innovation could enhance user experience and revenue, counteracting potential challenges in evergreen brand performance.

Catalysts

About Match Group- Engages in the provision of digital technologies.

- Match Group's user growth trends, particularly at Tinder, are showing signs of improvement, but the company is not yet projecting these trends to turn positive in the immediate term. This poses a downside risk to revenue growth expectations if the user base does not recover as anticipated, impacting the top line.

- There are significant foreign exchange headwinds expected in 2025 due to Tinder's international revenue exposure and primarily U.S.-based cost structure. This is likely to compress margins and impact profitability, posing a risk to net income and earnings projections.

- The company's strategy includes substantial investment in trust and safety features at Tinder, such as biometrics. While crucial for user satisfaction and long-term retention, these initiatives may temporarily suppress user growth and revenue as they potentially exclude bad actors from the platform, impacting short-term growth metrics.

- The growth of Match Group's emerging brands is expected to eventually offset declines in evergreen brands, but this transition may not occur rapidly enough to meet bullish revenue projections. If these emerging brands do not scale as expected, the anticipated revenue stabilization may be delayed, affecting overall revenue targets.

- Match Group's plan for margin expansion in 2025 involves at least 50 basis points of improvement, though this is on the low end of prior expectations due to cost pressures and FX impacts. If operational improvements or revenue growth do not materialize as planned, net margins could come under pressure, leading to lower earnings growth than forecasted.

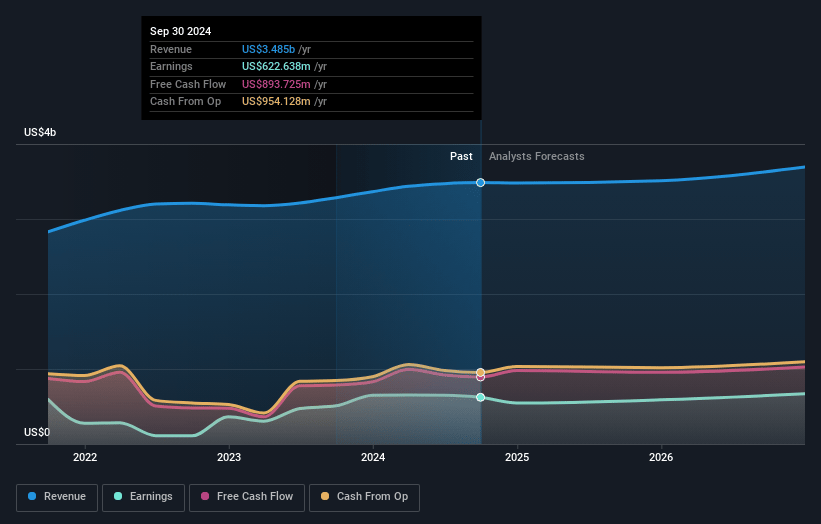

Match Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Match Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Match Group's revenue will grow by 1.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.8% today to 18.6% in 3 years time.

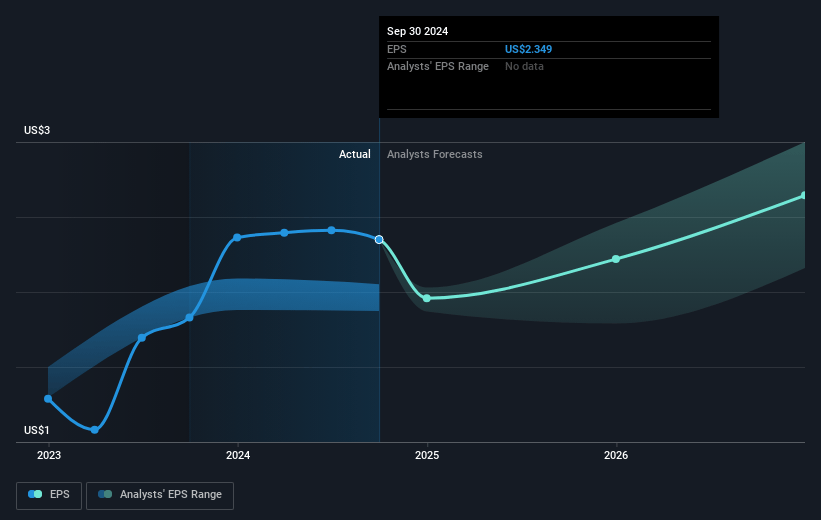

- The bearish analysts expect earnings to reach $680.4 million (and earnings per share of $2.4) by about April 2028, up from $551.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, down from 13.5x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 16.7x.

- Analysts expect the number of shares outstanding to decline by 5.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.7%, as per the Simply Wall St company report.

Match Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The new CEO, Spencer Rascoff, has a strong track record of leading category leaders in digital industries, and his experience could drive innovation and improve Match Group's revenue and net margins over time.

- Match Group's emphasis on leveraging AI for product innovation and enhancing user experience might lead to sustained growth and improved earnings, which could counteract any potential decline.

- Solid growth performance during the peak dating season and new product roadmaps for 2025 might lead to better-than-expected revenue growth and net margins.

- The rollout of improved trust and safety features and continuous enhancement of product features such as the AI-driven matching algorithm could improve user retention and engagement, thus potentially boosting revenue.

- Investments in emerging brands, alongside a strategic focus on demographic-focused products, could counterbalance any revenue declines in evergreen brands, improving the company’s overall earnings outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Match Group is $30.52, which represents one standard deviation below the consensus price target of $35.59. This valuation is based on what can be assumed as the expectations of Match Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.0, and the most bearish reporting a price target of just $29.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $680.4 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 8.7%.

- Given the current share price of $29.64, the bearish analyst price target of $30.52 is 2.9% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:MTCH. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.