GOOGL is a stock that I am very excited about for multiple reasons. For this I will be talking and touching up on a lot of things that were released today in their Q2 2025 Earnings Report.

For their most recent quarter here are their main results:

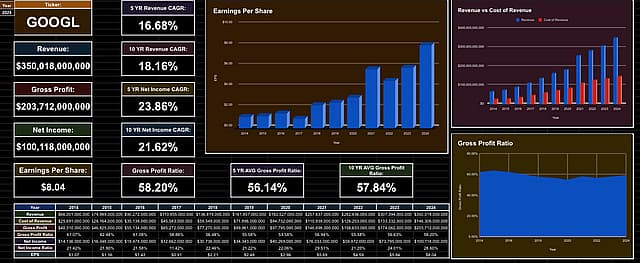

Revenue: $81.72 Billion (+14% yoy)

EPS: $2.31 (+22% yoy)

Ad Revenue: $71.34 Billion

Cloud Revenue: $13.62 Billion (+32% yoy)

- Cloud Operating Margin: 20.7% (+9.4% yoy)

Operating Income: $31.27 Billion

Operating Margin: 32.4%

GOOGL absolutely smashed it out of the park on this one with a double beat for the quarter. The two things that got me the most excited from this surprisingly enough actually comes from their platform for Youtube and their Cloud space.

Youtube: Youtube has always been an absolute champ when it comes to bringing in revenue for GOOGL. However the thing that caught my attention for it actually might not be what you think; and actually is surrounded by their Youtube Shorts that is on the platform. Their were two big things that this hit. The first was that they are now averaging 200 Billion daily views which is an absolutely insane amount activity. Especially when you put into perspective the opportunity for ad revenue from that. But to add on it GOOGL actually revealed that their Shorts are now earning as much revenue per watch hour as regular videos. Many may not view it as this but I believe that this is going to be huge for them in their chance to monetize their Shorts. Especially for two big reasons as well. First off if they are able to generate more income from this then they are able to offer creators more funds; and with that it means they can slowly steal away more influencers from tiktok and instagram reels. Especially with how tiktok is coming out with a new app for America; if GOOGL can jump on this opportunity then they can grow the average daily views even higher which will bring in even more ad revenue.

The second thing relates to their Google Cloud service. Year over year their revenue was up 32% which is insane. Especially when you think that GOOGL hasn't even gained a large part of the data cloud market. They even have created deals with the likes of OpenAi; and continuing to get more and more large deals. This could end up I believe if they approach it right, being one of if not their biggest source of revenue coming down the line. Just QoQ they saw their service grew by 28%, which is insane for it only being from a single quarter. If they can keep this going then they have big opportunities.

And for this I am not even going to get into their smaller services like their Google Fiber or Waymo............which however I do believe has large earnings potential for them.

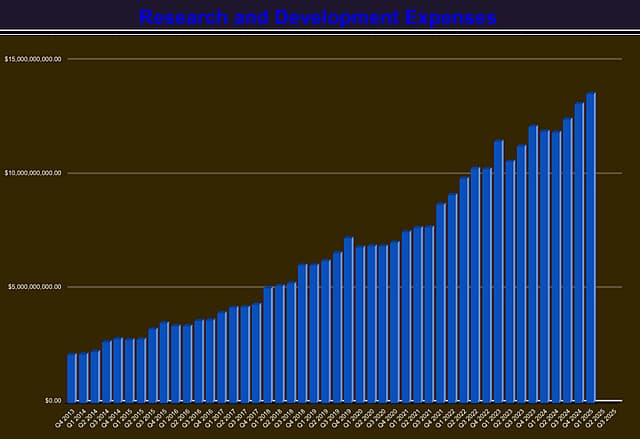

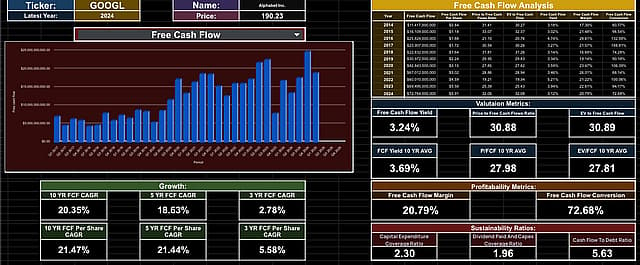

The final thing touches up on their Ai that they have been continually improving which is Gemini. Just the Gemini app has 450 Million monthly users and with their Ai mode in the chrome browser they have over 100 million users (only from US and India). They continue to create a more and more effective tool that is catching wave and honestly can compete incredibly well with other bots. Personally Gemini is my go to for Ai and has been what I have been using most recently and I love it. Along with all of this they even announced capex spending for the year of $85 Billion for 2025. Below I will show a graphic for their historical R and D.

GOOGL continues year in and year out to spend more and more on developing new technologies and perfecting what they have going for them. Some might find this concerning's; but personally as a LT investor this makes me have a lot of faith in the future of the company.

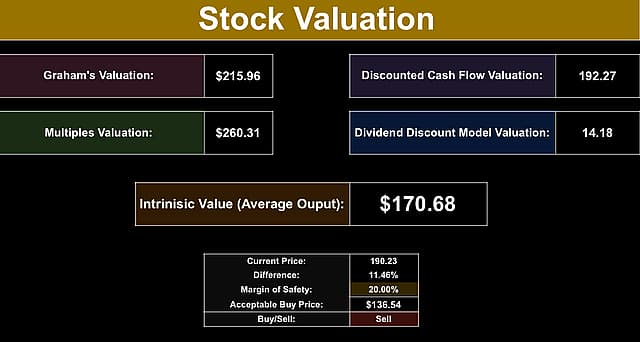

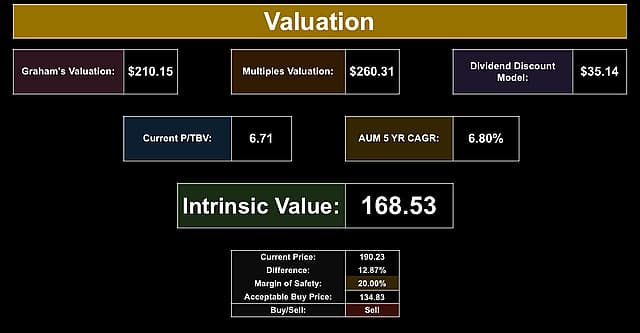

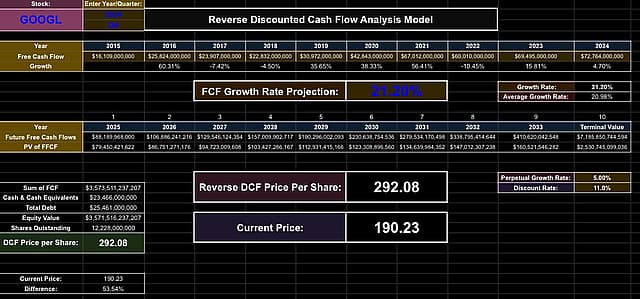

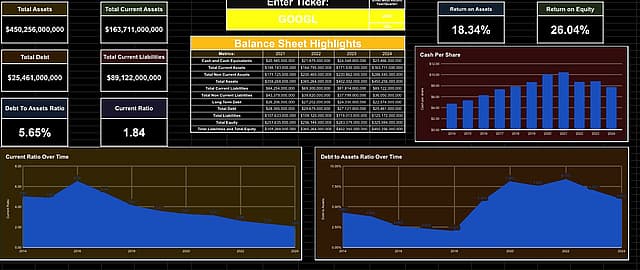

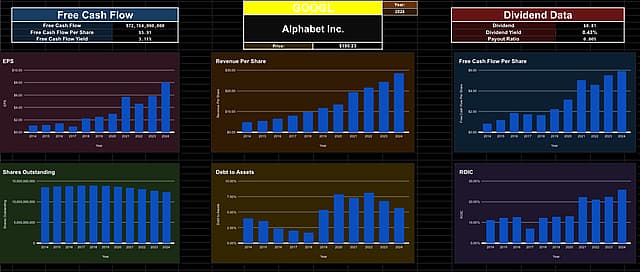

Below I will include my other projections I have run:

Based off of all the analysis's I have run I have come to the conclusion that I value GOOGL at a current price of $229.22.

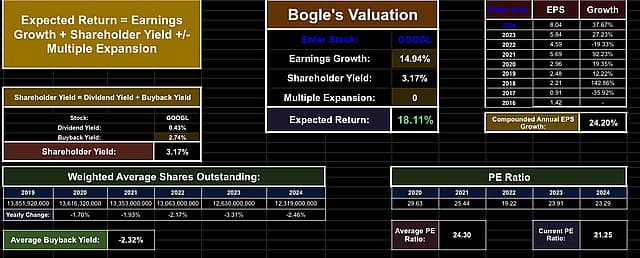

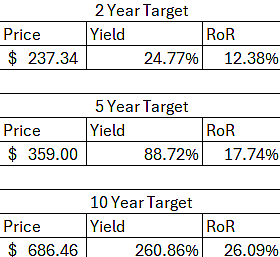

Below I have run my averages especially targeted around their HG and their SG Rate.

Based off of all this data I have come to the conclusion that I am willing to spend up to $225 on GOOGL as that would give me a rough compounded return of 20%. Until I run these numbers again $225 will be my firm target but anything below I am more then comfortable spending on GOOGL. Anything past that will then take me below my annual compounded return of 20% a year for a 10 year period.

Have other thoughts on Alphabet?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Zwfis has a position in NasdaqGS:GOOGL. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.