Narratives are currently in beta

Key Takeaways

- Strategic repositioning as a Commerce Media leader and key partnerships are poised to drive sustainable growth, expand margins, and significantly boost revenue.

- Investments in AI, first-party data, and partnerships aim to optimize earnings and enhance market share, while reducing client churn and reliance on third-party cookies.

- Leadership transition, reliance on partnerships and AI, cookie transition, and economic uncertainties present risks to revenue and margins for Criteo.

Catalysts

About Criteo- A technology company, provides marketing and monetization services on the open Internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific.

- Criteo's strategic repositioning as a Commerce Media powerhouse with an emphasis on Retail Media is expected to drive sustainable growth and expand margins, thereby positively impacting revenue and net earnings.

- The company's launch of Commerce Go, a platform that streamlines campaign creation and management, has shown to increase media spend activation and reduce client churn, suggesting potential improvements in net margins due to higher operational efficiency.

- The collaboration with Microsoft Advertising to transition retailers to Criteo's monetization technology stack by 2025 indicates anticipated demand growth and improved scalability, which could boost revenue substantially.

- The expansion of partnerships with major retailers like JCPenney, Office Depot in the U.S., and Metro AG in Europe is expected to enhance Criteo's market share and repeat revenue from these relationships.

- Continued investment in AI-driven performance enhancements and the use of first-party data for targeting, creating value across channels is likely to support retargeting growth, optimizing earnings per share by reducing reliance on third-party cookies.

Criteo Future Earnings and Revenue Growth

Assumptions

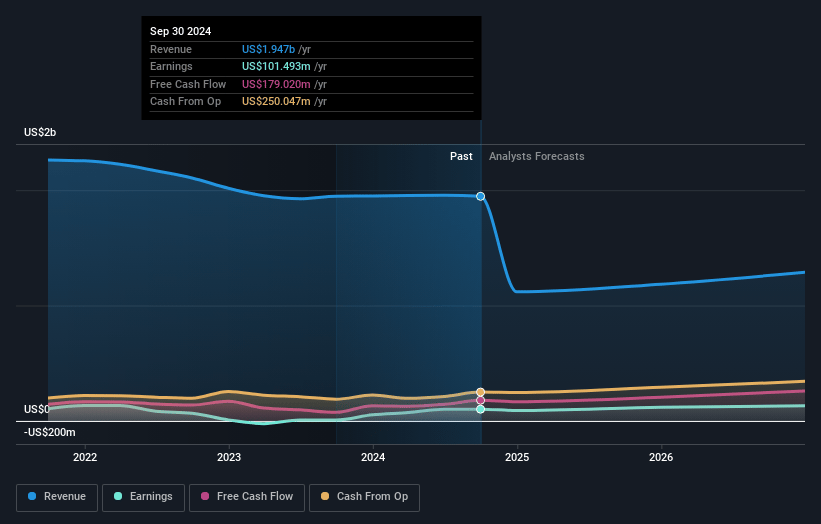

How have these above catalysts been quantified?- Analysts are assuming Criteo's revenue will decrease by -18.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 18.0% in 3 years time.

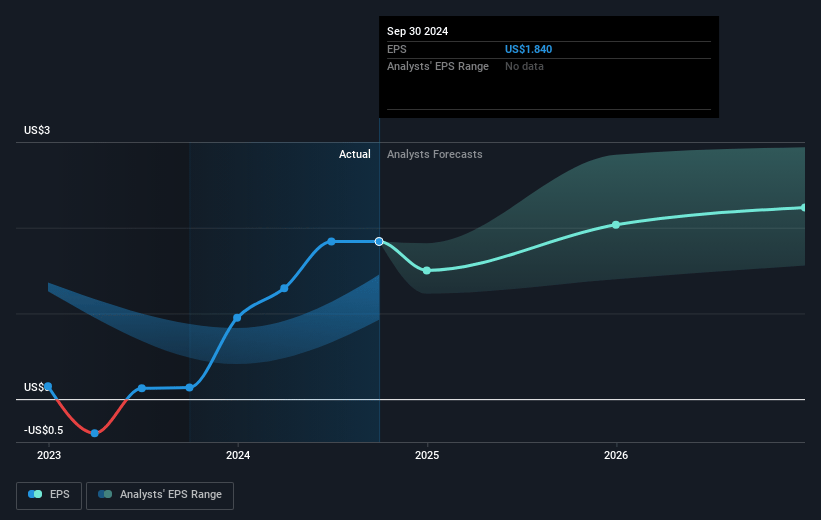

- Analysts expect earnings to reach $191.9 million (and earnings per share of $3.46) by about October 2027, up from $102.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $125.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2027 earnings, down from 23.4x today. This future PE is greater than the current PE for the US Media industry at 13.6x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.73%, as per the Simply Wall St company report.

Criteo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The announcement of Megan Clarken's upcoming retirement as CEO introduces leadership transition risk, potentially affecting company strategy and operations, which could impact revenue and earnings.

- The success of Retail Media is heavily reliant on continued partnerships and expansion with large retailers like Microsoft, Costco, and Albertsons; any disruptions or underperformance in these partnerships could impact revenue growth and net margins.

- Increasing reliance on AI for performance enhancements and automation introduces technological execution risk, such as potential system failures or inefficiencies, which could adversely affect earnings.

- The strategic shift away from using third-party cookies suggests reliance on alternative data sources, which may be limited or less effective, potentially impacting performance media revenue and net margins.

- Economic uncertainties and potential changes in consumer spending patterns, particularly in discretionary categories like fashion and department stores, could adversely affect advertising spend and revenue across the Retail Media and Performance Media segments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $57.46 for Criteo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.1 billion, earnings will come to $191.9 million, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 6.7%.

- Given the current share price of $42.66, the analyst's price target of $57.46 is 25.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives