Narratives are currently in beta

Key Takeaways

- Bumble's transformation initiatives and product innovations are anticipated to drive user engagement and revenue growth with improved customer satisfaction.

- Strategic marketing efforts in international markets show promise in enhancing user acquisition and contributing to revenue and earnings growth.

- Bumble's financial instability, decreasing revenue, and strategic repositioning challenges reflect prolonged uncertainty, asset valuation concerns, and pressure on profitability and growth.

Catalysts

About Bumble- Provides online dating and social networking platforms in North America, Europe, internationally.

- Bumble's transformation initiatives, including improving marketing strategies and enhancing product development, are expected to drive customer acquisition and engagement, positively impacting revenue growth.

- The company is focused on building a healthier ecosystem and innovating customer experiences, aiming to increase user satisfaction and retention, which could lead to higher net margins over time.

- New product features, such as updated matching algorithms and AI-enabled customer service tools, are anticipated to boost user experience and engagement, potentially leading to increased revenue and earnings.

- Bumble's commitment to evolving its revenue strategy, including pricing optimizations and reducing paywall friction, seeks to enhance conversion rates and lifetime value, supporting revenue growth and profitability.

- Strategic marketing rebalancing efforts, particularly in international markets, have shown promising results in user acquisition, which is expected to contribute positively to Bumble's revenue and overall earnings potential.

Bumble Future Earnings and Revenue Growth

Assumptions

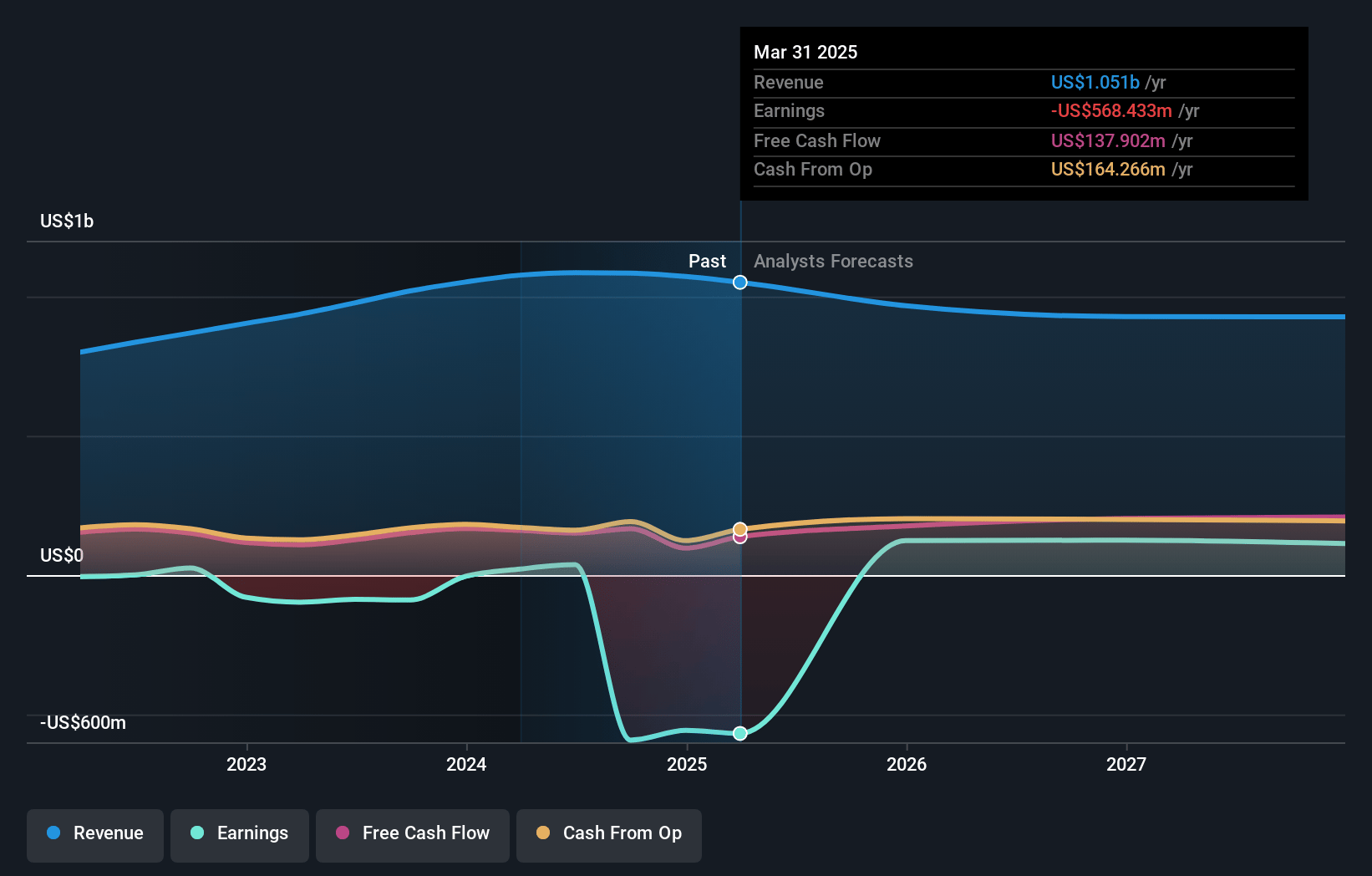

How have these above catalysts been quantified?- Analysts are assuming Bumble's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -54.6% today to 15.4% in 3 years time.

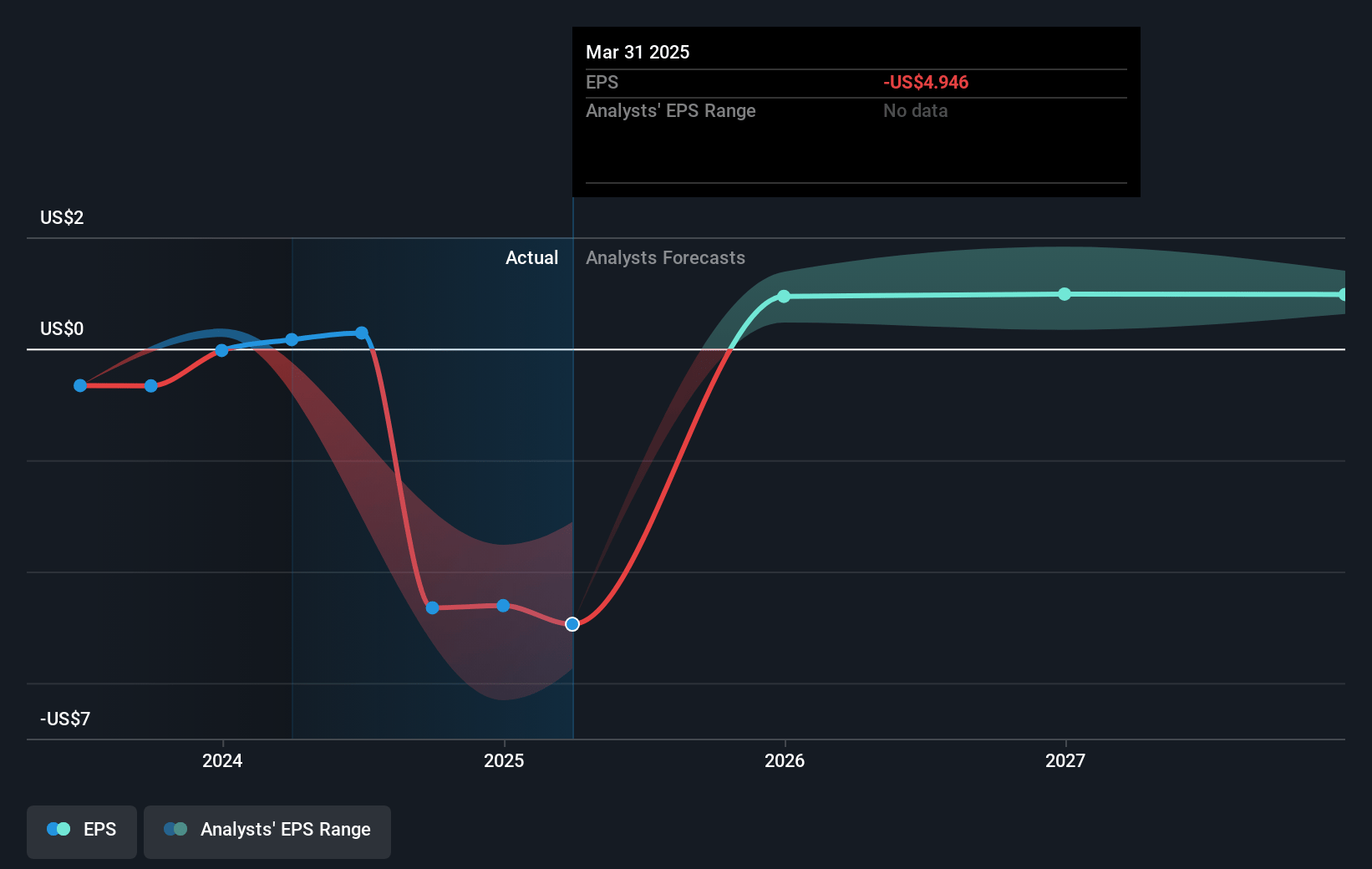

- Analysts expect earnings to reach $168.9 million (and earnings per share of $0.77) by about January 2028, up from $-592.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $120 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from -1.5x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 12.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

Bumble Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bumble reported a GAAP net loss of $849 million in Q3 2024, primarily due to a noncash impairment charge related to intangible assets and goodwill, which signals potential issues with asset valuation and could impact financial stability and investor confidence. [Earnings]

- The company's total revenue was down 1% in Q3 2024 and is expected to decline 5% year-over-year in Q4, reflecting struggles to generate growth, which could impact overall revenue and future financial performance. [Revenue]

- The decline in Average Revenue Per Paying User (ARPPU) by 10% year-over-year due to geographic mix shifts suggests challenges in maintaining revenue per user, affecting profitability and margins. [Net Margins]

- The need for multiple quarters to realize the benefits from Bumble's strategic repositioning and transformation initiatives indicates a prolonged timeline for seeing positive revenue impacts, which could prolong financial uncertainty and pressure. [Revenue]

- Bumble's strategy involves shifting marketing focus, but this includes higher marketing spends and rebalancing that may not immediately translate to revenue growth, and if ineffective, could pressure cost structure and margins. [Net Margins]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.07 for Bumble based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $168.9 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of $8.02, the analyst's price target of $8.07 is 0.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives