Key Takeaways

- Rising copper surplus and weak demand may pressure prices, affecting revenue despite potential economic measures from key consumers.

- Delays in projects and falling molybdenum prices could hinder Southern Copper's growth and profitability, impacting net margins and revenue expectations.

- Southern Copper's increased production and favorable metal prices could boost revenues and earnings, supported by strong cost management and diversified income streams.

Catalysts

About Southern Copper- Engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

- The anticipated surplus of 100,000 tons of copper in 2024 could pressure copper prices, negatively impacting revenue, especially if demand from key consumers like China remains weak despite expected economic measures.

- The expected decrease in molybdenum prices, with an 8% drop in 2023, might continue, affecting the company's by-product profitability and reducing overall net margins as molybdenum represents a significant part of sales.

- Ongoing challenges such as illegal mining activities at the Los Chancas project and potential delays with environmental assessments might hinder future production growth, adversely impacting Southern Copper's revenue expectations.

- Protests and community relations issues surrounding the Tia Maria project could lead to project delays or increased costs, limiting expected future revenue contributions and pressurizing net income.

- The transition to meet growing zinc demand involves significant capital expenses, which might not yield expected returns promptly if market demands fluctuate, potentially leading to strained cash flows or reduced earnings if forecasts are too optimistic.

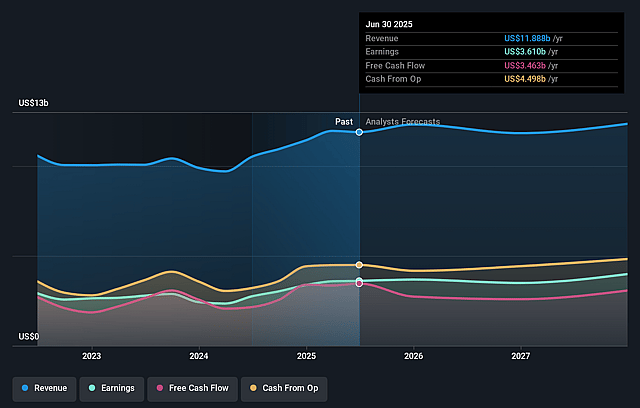

Southern Copper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Southern Copper compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Southern Copper's revenue will decrease by 1.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 29.5% today to 30.3% in 3 years time.

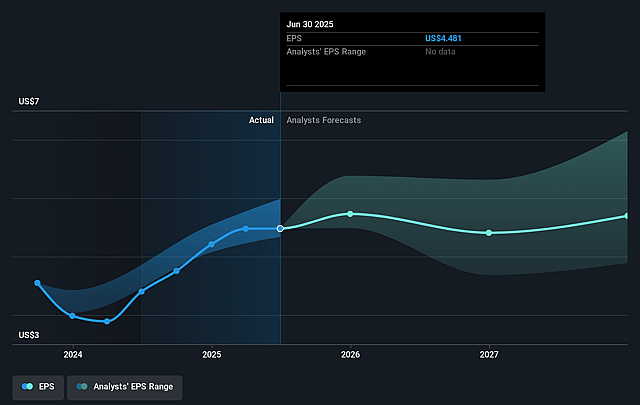

- The bearish analysts expect earnings to reach $3.3 billion (and earnings per share of $4.11) by about April 2028, down from $3.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, up from 19.3x today. This future PE is greater than the current PE for the US Metals and Mining industry at 19.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Southern Copper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The London Metal Exchange copper price saw an increase of 10% from an average of $3.79 to $4.17 per pound in the third quarter, with an expectation of a slight market surplus in 2024, indicating potential for steady or improving revenues from higher copper prices.

- Southern Copper's copper production increased by 11% quarter-on-quarter, suggesting potential for increased sales and revenue if production efficiencies continue or improve further.

- Southern Copper forecasts a 7% increase in copper production in 2024 compared to 2023 due to higher production at multiple sites, which could lead to higher revenues and increased earnings if market demand remains steady or grows.

- Sales in the third quarter of 2024 increased by 17%, with notable growth in silver sales (46%) and zinc sales (61%), suggesting diversified income streams that can support net income growth if commodity prices remain favorable.

- The company's adjusted EBITDA margin increased to 57% in the third quarter compared to 52% a year earlier, which reflects successful cost management and could indicate potential for improved net margins and earnings sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Southern Copper is $73.93, which represents one standard deviation below the consensus price target of $97.83. This valuation is based on what can be assumed as the expectations of Southern Copper's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $153.03, and the most bearish reporting a price target of just $67.97.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $11.0 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 7.5%.

- Given the current share price of $81.84, the bearish analyst price target of $73.93 is 10.7% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Southern Copper?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.