Key Takeaways

- Strategic projects to enhance efficiency and production capacity could boost margins and drive future earnings growth.

- Transitioning to direct customer agreements may stabilize revenue streams and improve profitability.

- Operational inefficiencies, unpredictable pricing, and rising costs threaten Packaging Corporation's earnings and net margins despite sales growth.

Catalysts

About Packaging Corporation of America- Manufactures and sells containerboard and uncoated freesheet (UFS) paper products in North America.

- The company has implemented new price increases for its linerboard and medium, effective January 1, 2025. This is expected to drive higher sales revenues as customers have accepted higher prices, reducing the pressure of inflation on costs.

- There are several strategic capital projects aimed at optimizing operations and increasing production efficiency, such as major enhancements and reconfigurations of production lines and facilities. This should positively impact net margins by reducing operational inefficiencies and improving throughput.

- Packaging Corporation of America is nearing completion on key growth projects, including a state-of-the-art box plant in Phoenix, Arizona. This project is set to consolidate operations and significantly enhance production capabilities, potentially boosting future earnings through increased capacity and efficiency.

- The company is actively moving away from index-based pricing in favor of direct agreements with customers, which should lead to more stabilized and predictable revenue streams, positively impacting profitability and cash flow management.

- The company continues to see strong demand across its packaging segment, with record shipment levels achieved. The ability to successfully manage growth and scale operations efficiently can lead to positive future revenue projections and earnings growth.

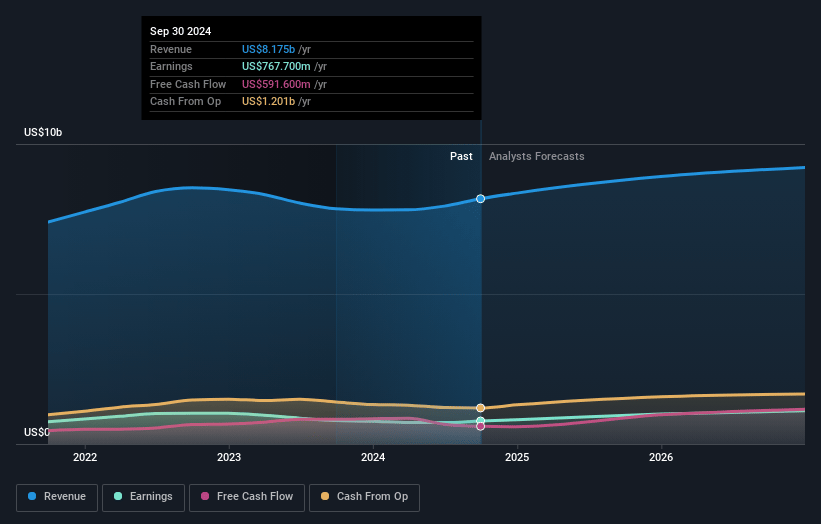

Packaging Corporation of America Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Packaging Corporation of America compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Packaging Corporation of America's revenue will grow by 4.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.5% today to 11.2% in 3 years time.

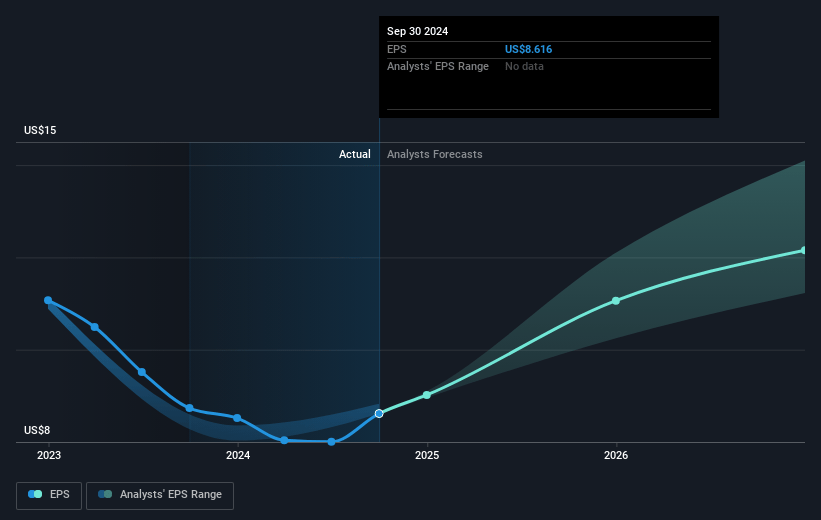

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $12.26) by about April 2028, up from $799.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.4x on those 2028 earnings, up from 21.3x today. This future PE is greater than the current PE for the US Packaging industry at 22.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.23%, as per the Simply Wall St company report.

Packaging Corporation of America Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The RISI Publication did not recognize the recent price increases for linerboard and medium as implemented by PCA, which may hinder expected price predictability and thus impact future revenues.

- Higher operating costs due to inflation pressures across PCA's cost structure, including labor, energy, and materials, may erode net margins despite increased sales.

- The unresolved transition away from relying on indexed pricing continues to impact PCA's predictability in pricing adjustments, which could lead to unexpected variances in earnings if not effectively managed.

- The company is experiencing inefficiencies due to extensive capital projects and disruptions across multiple plants, which could temporarily affect production efficiency and margins.

- Seasonal and unexpected weather impacts, as well as cost increases in rail logistics and other areas, may lead to higher than anticipated operating expenses, affecting net income projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Packaging Corporation of America is $258.68, which represents one standard deviation above the consensus price target of $219.73. This valuation is based on what can be assumed as the expectations of Packaging Corporation of America's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $265.0, and the most bearish reporting a price target of just $144.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $9.7 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 25.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $190.65, the bullish analyst price target of $258.68 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:PKG. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.