Narratives are currently in beta

Key Takeaways

- Strategic divestitures and a refreshed operating model aim to optimize the portfolio, enhance profitability, and drive margin improvements.

- Focusing on high-growth markets and expanding regional expertise could increase innovation and capture revenue, improving future earnings.

- Potential customer inventory adjustments, soft consumer demand, adverse forex impacts, and significant leverage could affect revenue, margins, and stability for IFF.

Catalysts

About International Flavors & Fragrances- Manufactures and sells cosmetic active and natural health ingredients for use in various consumer products in the United States, Europe, and internationally.

- The planned divestiture of the Pharma Solutions business in the first half of 2025 is expected to improve IFF’s portfolio optimization and deleverage, enhancing focus and potentially boosting future earnings growth.

- IFF's new business-led operating model and strategy refresh, emphasizing end-to-end responsibility and accountability, are contributing to stronger financial performance and could drive future sales increases and margin improvements.

- Investment in creative centers in key high-growth locations such as Shanghai, Mexico City, and India aims to expand regional expertise, potentially leading to revenue growth by better serving customer needs in these important markets.

- The company's focus on core end markets and high-growth areas, combined with improved employee engagement, suggests an enhanced ability to innovate and capture sales, potentially resulting in higher future revenues and improved net margins.

- IFF’s increased financial guidance for 2024, paired with a focus on achieving net debt to credit-adjusted EBITDA below 3x post-divestiture, indicates a strengthened capital structure and improved capacity for profitability and earnings growth.

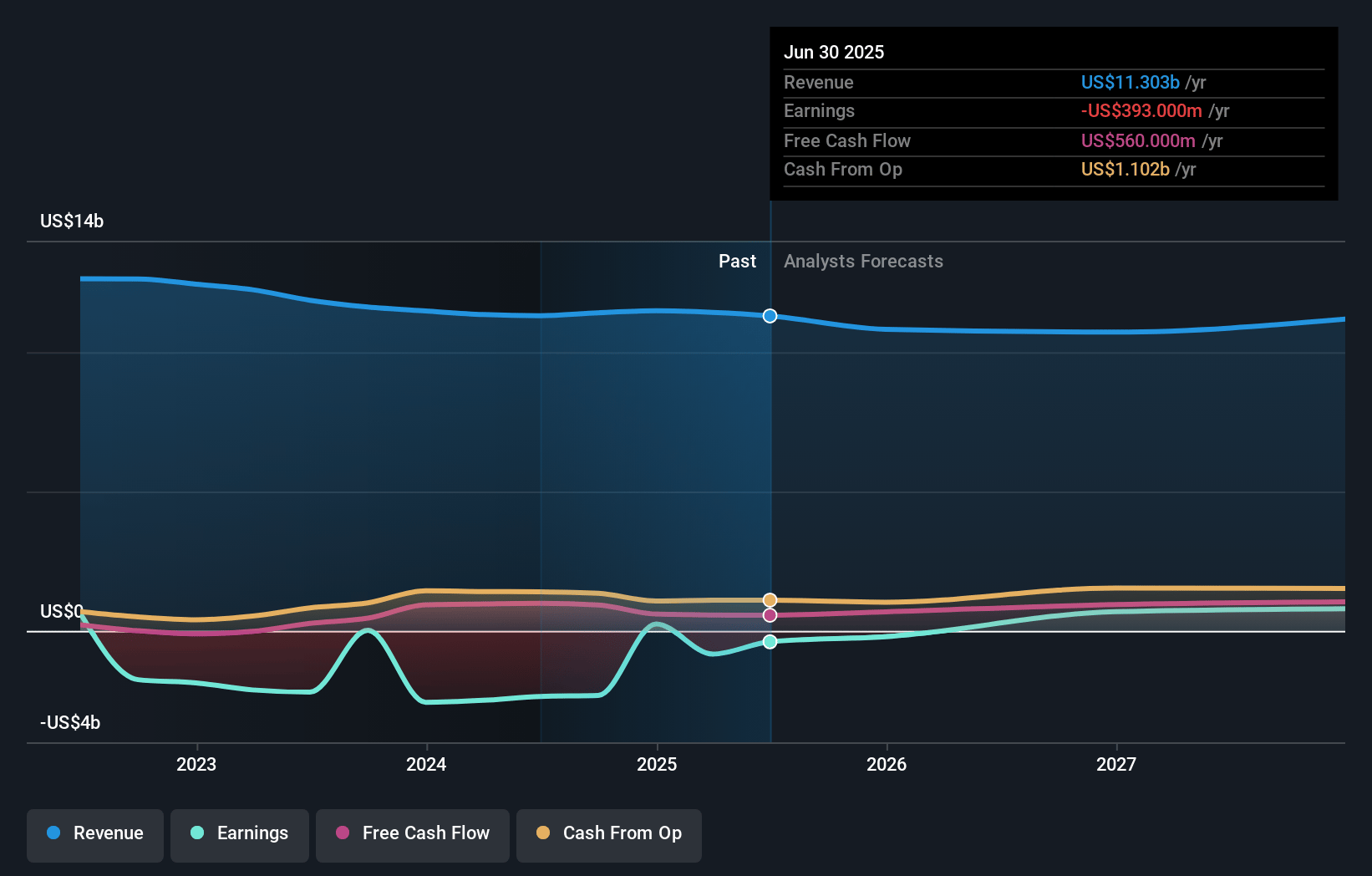

International Flavors & Fragrances Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming International Flavors & Fragrances's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -20.3% today to 7.7% in 3 years time.

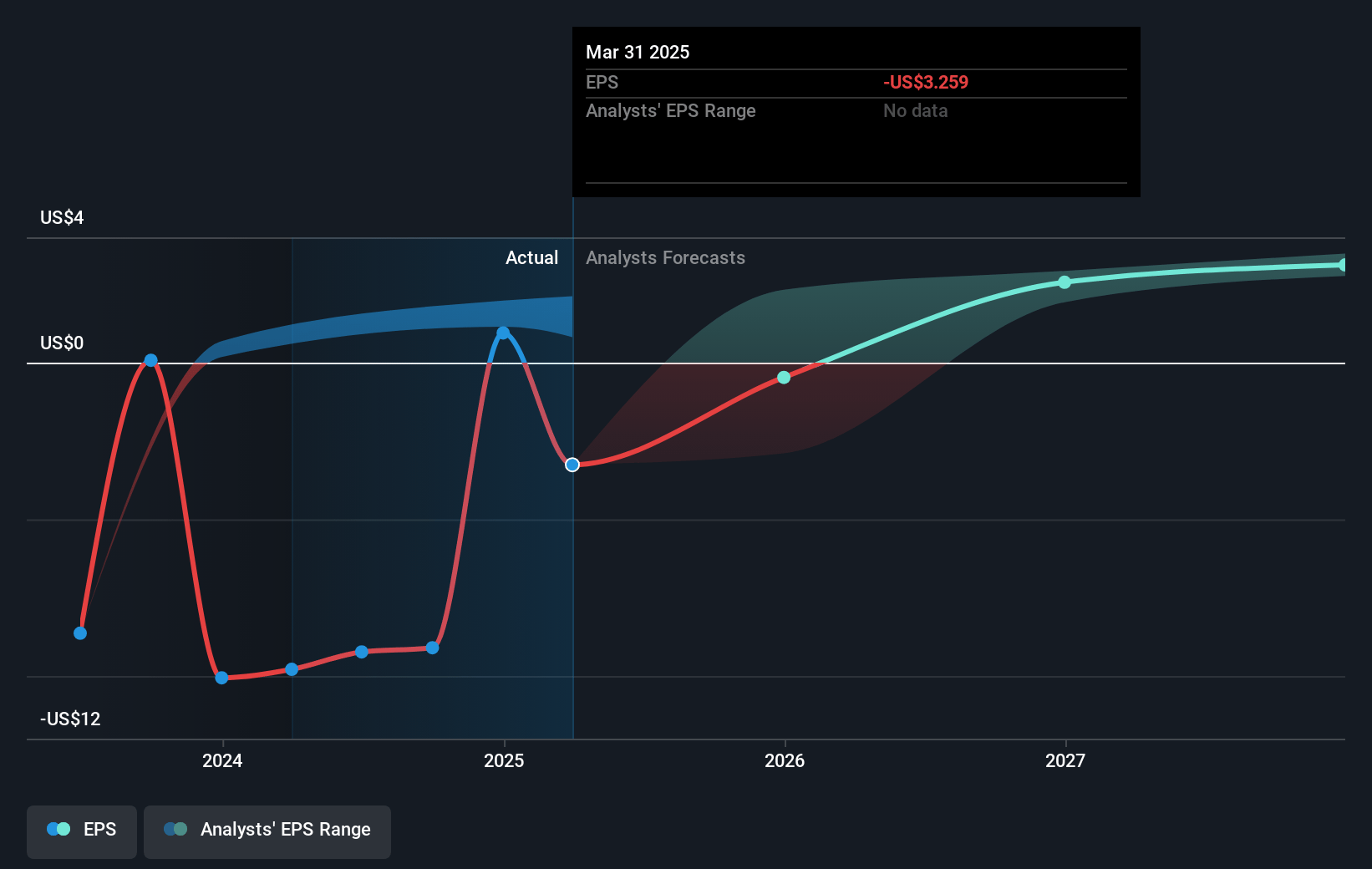

- Analysts expect earnings to reach $892.7 million (and earnings per share of $3.47) by about January 2028, up from $-2.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.4x on those 2028 earnings, up from -9.5x today. This future PE is greater than the current PE for the US Chemicals industry at 22.6x.

- Analysts expect the number of shares outstanding to grow by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

International Flavors & Fragrances Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Concerns have been highlighted regarding potential customer inventory adjustments at year-end, which may affect IFF's fourth-quarter volume expectations and thus impact overall revenue.

- There is a cautious outlook on soft end consumer demand in key markets such as food, home, and personal care, which might hinder future revenue growth.

- The company's performance is subject to adverse foreign exchange impacts, particularly affecting sales growth and other expenses, which can have implications for net margins.

- The ongoing turnaround in Functional Ingredients includes volume recovery offset by price adjustments, which may affect profit margins and overall earnings stability if not managed carefully.

- There is significant leverage on the balance sheet, with gross debt totaling approximately $9.1 billion and a net debt to credit-adjusted EBITDA of 3.9x, posing risks to the company's leverage position and potentially impacting net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $104.96 for International Flavors & Fragrances based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $77.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.5 billion, earnings will come to $892.7 million, and it would be trading on a PE ratio of 37.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of $86.54, the analyst's price target of $104.96 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives