Key Takeaways

- Scaling leach operations and completing the PT-FI smelter are pivotal for boosting revenue and improving operational efficiency by 2025.

- Demand growth from electrification trends and cost-saving via automation should enhance revenue and net margins significantly.

- Geopolitical risks in Indonesia and copper price volatility threaten Freeport-McMoRan's revenue and cash flow stability, while operational and technological uncertainties add further challenges.

Catalysts

About Freeport-McMoRan- Engages in the mining of mineral properties in North America, South America, and Indonesia.

- Freeport-McMoRan is focused on scaling their leach opportunity, aiming to reach a production run rate of 300 million pounds of copper by the end of 2025, with a longer-term target of 800 million pounds per year by 2030. This initiative is expected to significantly boost revenue from increased copper production.

- The ongoing recovery and expected completion of the PT-FI smelter project in Indonesia by 2025, following a fire incident, are critical for Freeport-McMoRan's operational efficiency. The smelter's completion should improve net margins by reducing dependency on exports and export-related taxes.

- Market demand growth driven by electrification trends, particularly in the U.S. and China, is likely to support a favorable pricing environment for copper, improving Freeport-McMoRan's revenue prospects and potentially widening net margins due to increased demand.

- Cost-saving initiatives in the U.S. operations, including improved efficiencies and automation such as the deployment of autonomous trucks, are expected to lower unit production costs, thus enhancing net margins.

- The company's exploration and potential long-term development of the Kucing Liar ore body and other resources in the Grasberg district, as part of their expansion plans, present opportunities for revenue growth and sustained earnings over the next decade and beyond, contingent upon securing necessary operational extensions and agreements with the Indonesian government.

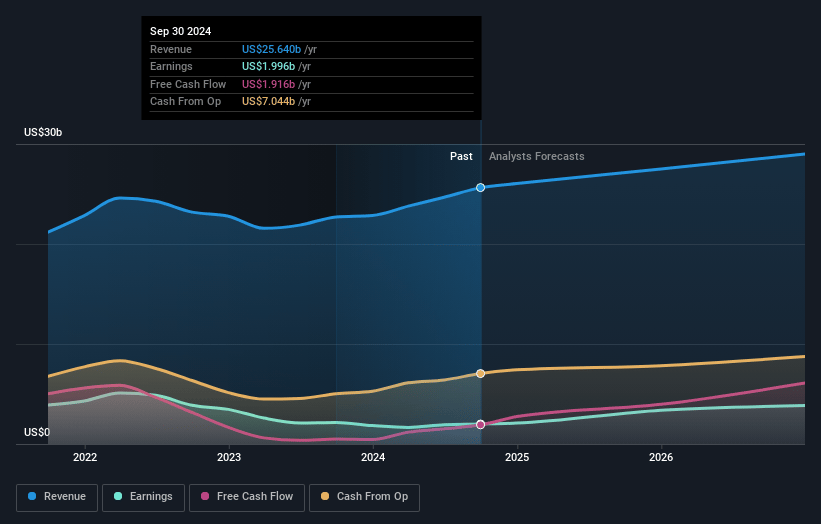

Freeport-McMoRan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Freeport-McMoRan compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Freeport-McMoRan's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.4% today to 9.9% in 3 years time.

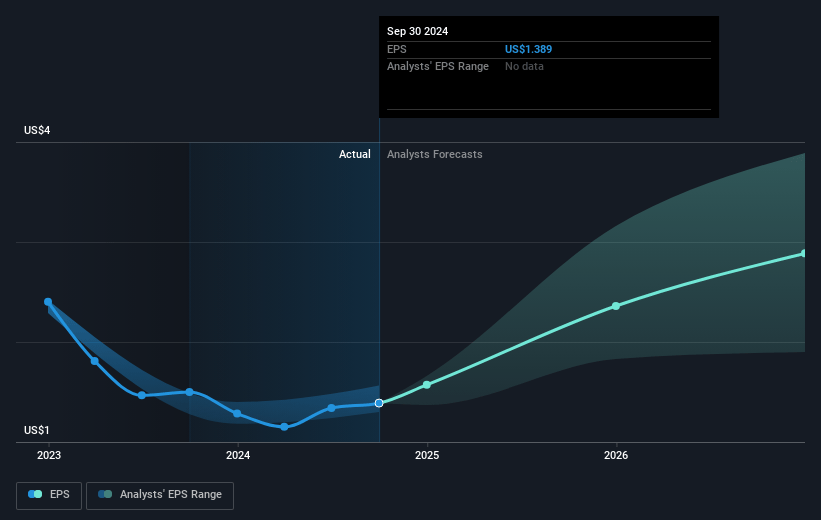

- The bearish analysts expect earnings to reach $2.6 billion (and earnings per share of $1.82) by about April 2028, up from $1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.9x on those 2028 earnings, up from 23.9x today. This future PE is greater than the current PE for the US Metals and Mining industry at 19.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.69%, as per the Simply Wall St company report.

Freeport-McMoRan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Freeport-McMoRan faces geopolitical risks in Indonesia, where government approval delays and policy changes could affect operating licenses and export permissions, ultimately impacting their revenue and cash flows.

- The company's reliance on copper price fluctuations introduces significant revenue volatility as each $0.10 per pound change in copper price affects annual EBITDA by approximately $425 million.

- The ramp-up of the PT-FI smelter after recent fire damage poses operational risks and affects the timeline for full production integration, potentially impacting net margins and cash flows.

- There is competition and uncertainty around the technological advancements in copper leaching at their Bagdad site, and managing costs without proven outcomes poses risks to achieving projected margins and efficiency gains.

- Despite strong current performance, potential legislative and tariff changes in the U.S. and globally could affect market demand and Freeport's ability to maintain projected margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Freeport-McMoRan is $38.17, which represents one standard deviation below the consensus price target of $46.09. This valuation is based on what can be assumed as the expectations of Freeport-McMoRan's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.04, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $25.9 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 26.9x, assuming you use a discount rate of 7.7%.

- Given the current share price of $31.35, the bearish analyst price target of $38.17 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:FCX. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives