Narratives are currently in beta

Key Takeaways

- Investments in green ammonia and carbon capture projects could initially stress capital expenditure, impacting future margins before revenue contributions materialize.

- Dependency on global nitrogen demand and regulatory approvals introduces uncertainties that could affect revenue growth and future earnings.

- Strong demand, strategic investments in clean energy, and favorable market dynamics support CF Industries' robust revenue and future growth potential.

Catalysts

About CF Industries Holdings- Engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally.

- CF Industries expects to invest significantly in new projects, such as the green ammonia and Donaldsonville Carbon Capture projects, which may not yield immediate financial benefits and could initially stress capital expenditure. This could impact future net margins due to the high upfront costs before revenue contributions materialize.

- The company is betting on global nitrogen demand staying strong due to reduced supply from key regions like China and Europe. If this supply-demand balance does not materialize as expected, CF Industries may face challenges in maintaining revenue growth.

- CF Industries' ambitious plans for low-carbon and blue ammonia production rely heavily on regulatory approvals for carbon capture and sequestration permits, which carry uncertainty. Delays or denials could postpone expected tax benefits like the 45Q credits, impacting future earnings.

- CF Industries' dependency on the spread between North American and European natural gas prices offers an attractive short-term margin opportunity; however, volatility in global energy markets could compress margins, unsettling future earnings predictions.

- The company’s aggressive share repurchase program, while reducing share count and potentially increasing EPS, might limit financial flexibility for strategic investments if future cash flow underperforms due to unforeseen operational challenges.

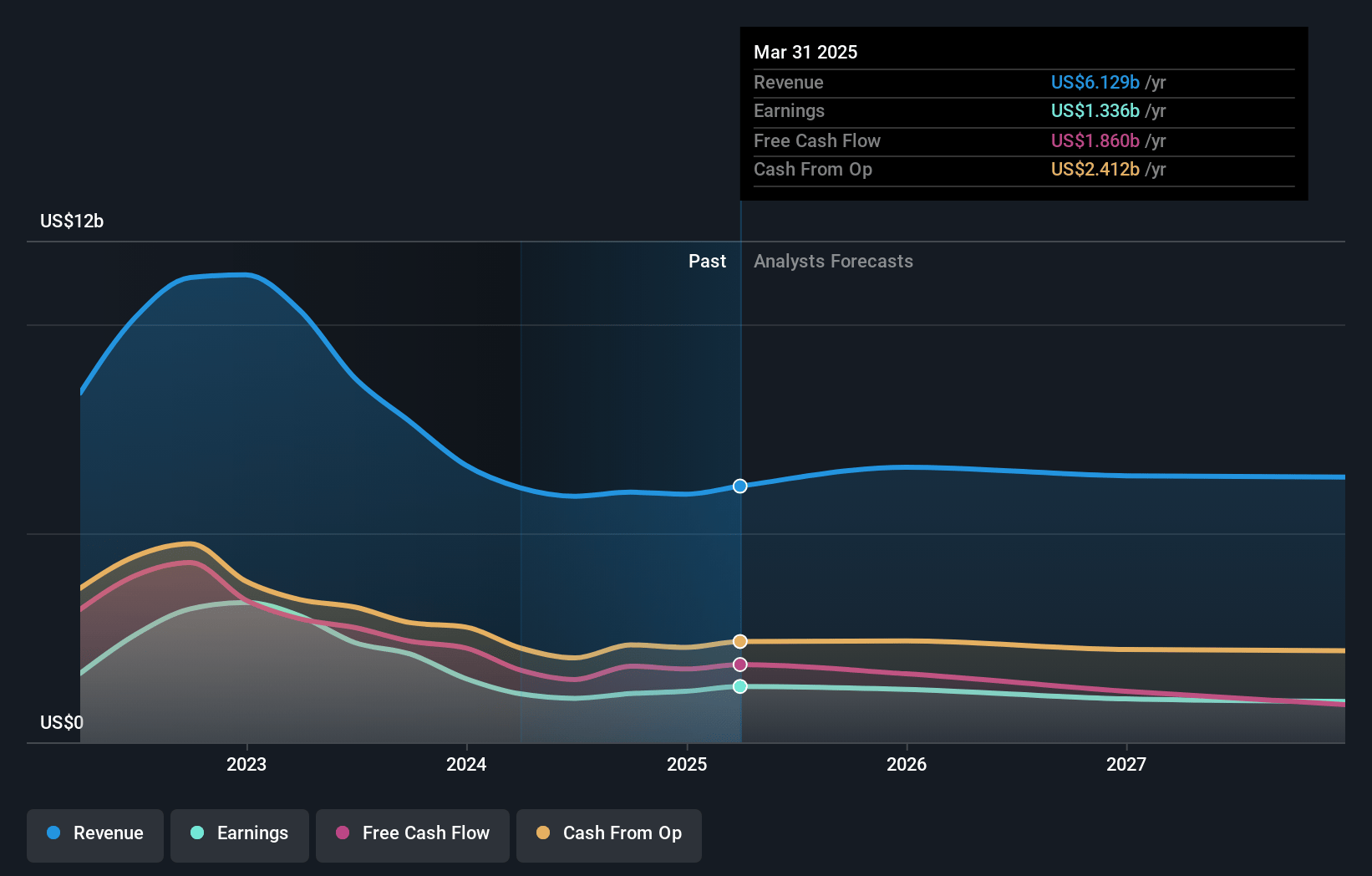

CF Industries Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CF Industries Holdings's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.5% today to 14.9% in 3 years time.

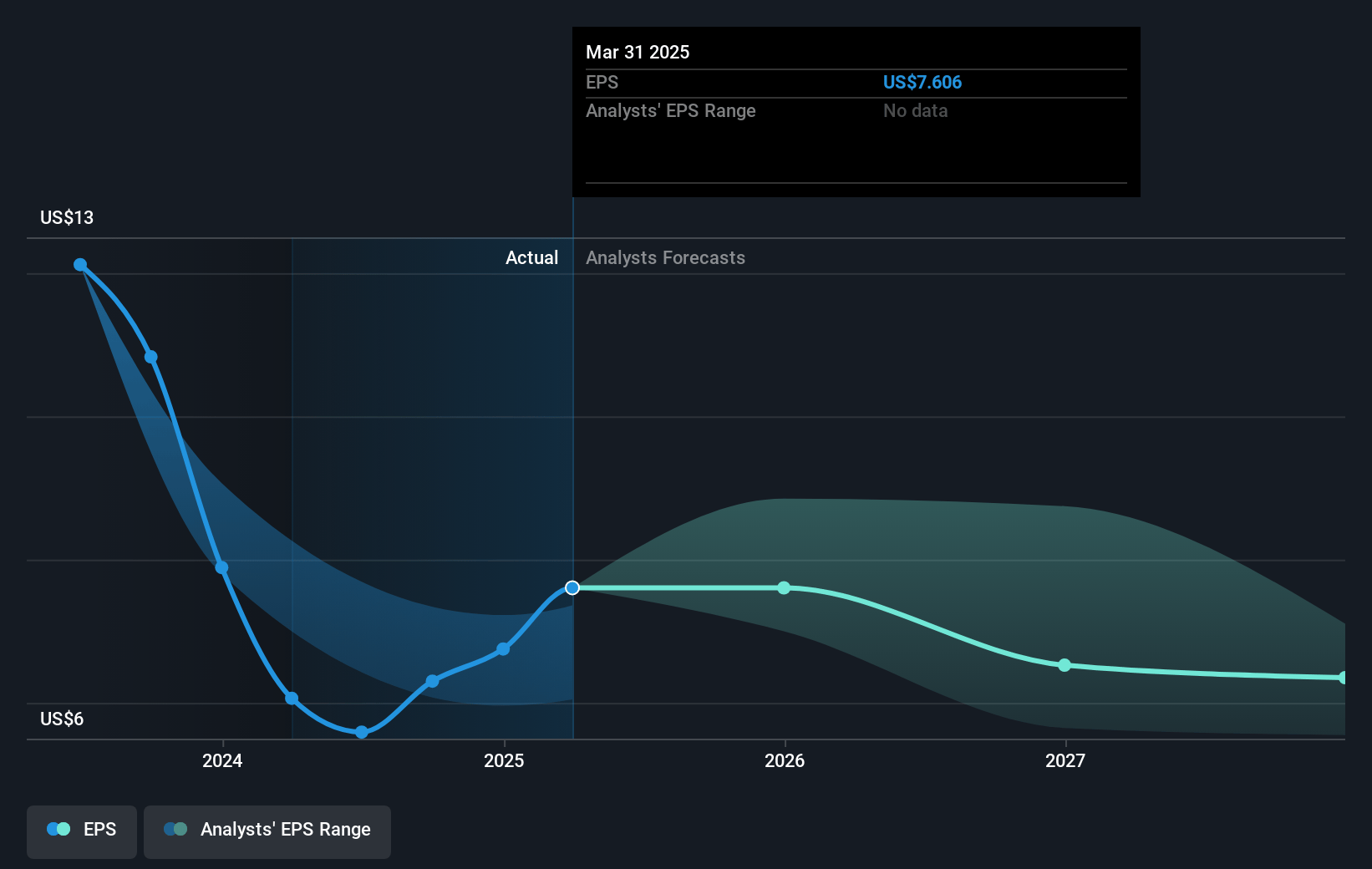

- Analysts expect earnings to reach $929.3 million (and earnings per share of $5.6) by about January 2028, down from $1.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.3 billion in earnings, and the most bearish expecting $701.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.9x on those 2028 earnings, up from 13.5x today. This future PE is lower than the current PE for the US Chemicals industry at 22.6x.

- Analysts expect the number of shares outstanding to decline by 1.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

CF Industries Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong demand for nitrogen products globally, including robust import requirements from countries like Brazil, India, and others, may support higher-than-expected revenue and earnings for CF Industries.

- The company benefits from a strong inventory position and efficient operations, with low cash flow-conversion costs allowing for continued capital returns to shareholders, which can positively impact net margins.

- CF Industries' investment in green and low-carbon ammonia projects, alongside partnerships with companies like Exxon, positions it well for future growth in the clean energy sector, potentially enhancing long-term earnings.

- Global nitrogen market dynamics are favorable, with reduced exports from China and constraints in Trinidad and Egypt suggesting strong price support, which can positively affect revenue.

- The ongoing share repurchase program, with nearly $1.5 billion remaining, suggests a commitment to improving earnings per share through reduced share count.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $91.74 for CF Industries Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $115.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.2 billion, earnings will come to $929.3 million, and it would be trading on a PE ratio of 19.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of $90.25, the analyst's price target of $91.74 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives