Key Takeaways

- Structural demand declines, persistent oversupply, and regulatory pressures are set to erode core business profitability and underutilize Celanese's asset base.

- High leverage and slow transition to sustainable materials risk constraining financial flexibility and undermining long-term competitive positioning.

- Structural cost reductions, portfolio synergies, resilient cash flow, and alignment with key industry trends position Celanese for margin expansion and sustainable long-term growth.

Catalysts

About Celanese- A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

- The rapid expansion of global decarbonization mandates and tightening restrictions on petrochemical-derived products threaten to structurally reduce demand across Celanese's core acetyls and engineered materials businesses; this persistent secular headwind could erode long-term revenues and leave key asset bases underutilized, impairing capacity-driven earnings growth.

- Growing regulatory pressure and taxation on single-use plastics and industrial emissions are expected to drive up Celanese's operating costs and force continual investment in compliance, compressing net margins in both traditional and high-value product segments over time.

- Ongoing oversupply and intense price competition in the chemicals market, particularly exacerbated by Chinese overcapacity and limited visibility into end market recovery, are projected to keep global acetyls and high-volume engineered materials prices depressed, pressuring both sales volumes and margins for multiple years.

- Elevated leverage following large-scale acquisitions, including the DuPont Mobility & Materials deal, leaves Celanese with limited financial flexibility, and high interest costs threaten to constrain future margin expansion and reduce free cash flow available for reinvestment or shareholder returns as debt matures.

- The company's continued lag in rapid R&D-driven diversification into bio-based and fully sustainable polymers risks losing share to competitors aligned with advanced recycling and renewable solutions, stifling new business development and putting sustained pressure on long-term earnings and revenue growth.

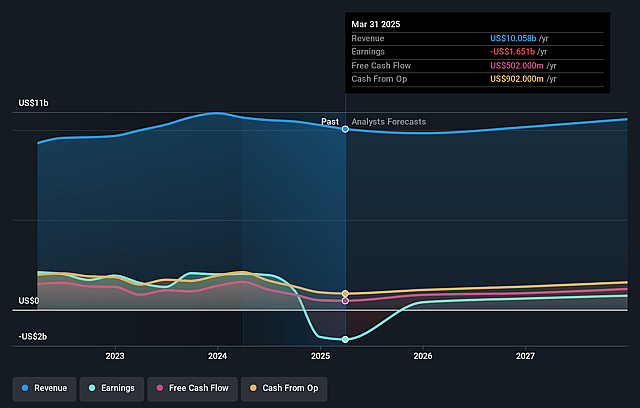

Celanese Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Celanese compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Celanese's revenue will decrease by 0.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -16.1% today to 9.5% in 3 years time.

- The bearish analysts expect earnings to reach $929.4 million (and earnings per share of $8.56) by about September 2028, up from $-1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, up from -3.1x today. This future PE is lower than the current PE for the US Chemicals industry at 25.8x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Celanese Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Celanese's management is executing structural cost reductions and business model enhancements, which are resulting in a substantially lower fixed cost base, particularly in high-margin Western Hemisphere acetyls and its Engineered Materials division, suggesting the potential for significant margin expansion when demand recovers.

- Demand in end markets like automotive and construction is currently at historic lows, but management sees volumes being far below normalized levels, meaning even a modest cyclical or secular rebound in these markets could lift revenues and EBITDA significantly above current run rates.

- The company's integration of the DuPont Mobility & Materials acquisition is unlocking asset and product mix synergies, boosting operational flexibility and allowing for more make-to-order offerings and production on the lowest-cost assets, positioning Celanese for sustained long-term revenue and earnings growth.

- Celanese is consistently generating strong free cash flow, even in cyclical troughs, with sustainable working capital improvements and robust operational cash generation, which reduces balance sheet risk and provides resources for deleveraging or strategic investments that could support long-term net income.

- Long-term secular tailwinds in electric vehicles, sustainability-driven materials, and the onshoring of manufacturing in North America and Europe directly align with Celanese's portfolio and cost-advantaged assets, providing an opportunity for accelerating revenue and profit growth as these trends materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Celanese is $40.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Celanese's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $9.8 billion, earnings will come to $929.4 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 12.3%.

- Given the current share price of $44.64, the bearish analyst price target of $40.0 is 11.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Celanese?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.