Last Update30 Apr 25Fair value Increased 2.64%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Strategic decision to utilize existing facilities and external manufacturing minimizes capital expenditures, enhancing scalability and net margins by reducing fixed costs.

- Increased capacity and demand from key clients like General Motors suggests potential earnings growth, boosting EBITDA and long-term profitability.

- Reliance on a single OEM and modular expansions could pose risks to revenue stability amid changing demand and unforeseen capacity constraints.

Catalysts

About Aspen Aerogels- Designs, develops, manufactures, and sells aerogel insulation products primarily for use in the energy industrial, sustainable insulation materials, and electric vehicle (EV) markets in the United States, Asia, Canada, Europe, and Latin America.

- Aspen Aerogels is positioned for significant future revenue growth through expansion in the EV thermal barrier market, with expected new program launches, such as the Volvo Truck PyroThin Thermal Barrier Design Award, which is anticipated to generate at least $45 million per year in revenue starting in 2026.

- The strategic decision to cease construction of Plant 2 and instead leverage incremental capacity at the East Providence facility and utilize external manufacturing will reduce capital expenditures and maintain scalability, positively impacting net margins by minimizing fixed costs.

- With anticipated demand from customers like General Motors, where Aspen serves as the sole source of thermal barriers, the potential ramp-up in vehicle production post-Q1 could drive significant earnings growth if GM reaches its 2025 target of 300,000 units.

- Increased capacity and flexibility from the external manufacturing facility in China, expected to supply the additional demand by 2026, provides a low-capital alternative to meet long-term growth targets, enhancing EBITDA margins by reducing dependency on large capital projects.

- Cost restructuring expected to save $8 million per quarter will protect EBITDA, improving overall profitability by maintaining lower operational costs, aligning the company's fixed cost structure with 2023 levels.

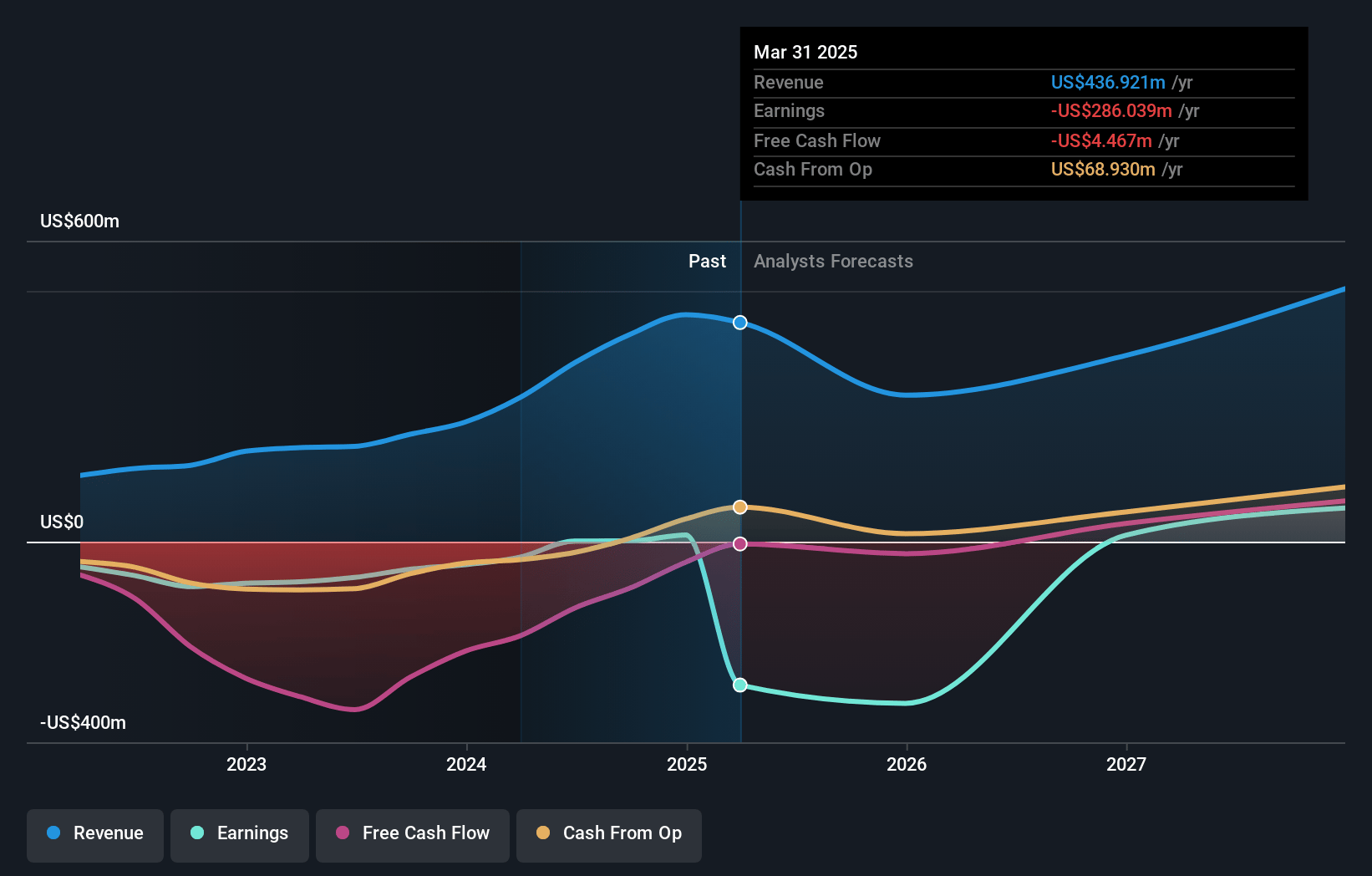

Aspen Aerogels Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aspen Aerogels's revenue will grow by 16.5% annually over the next 3 years.

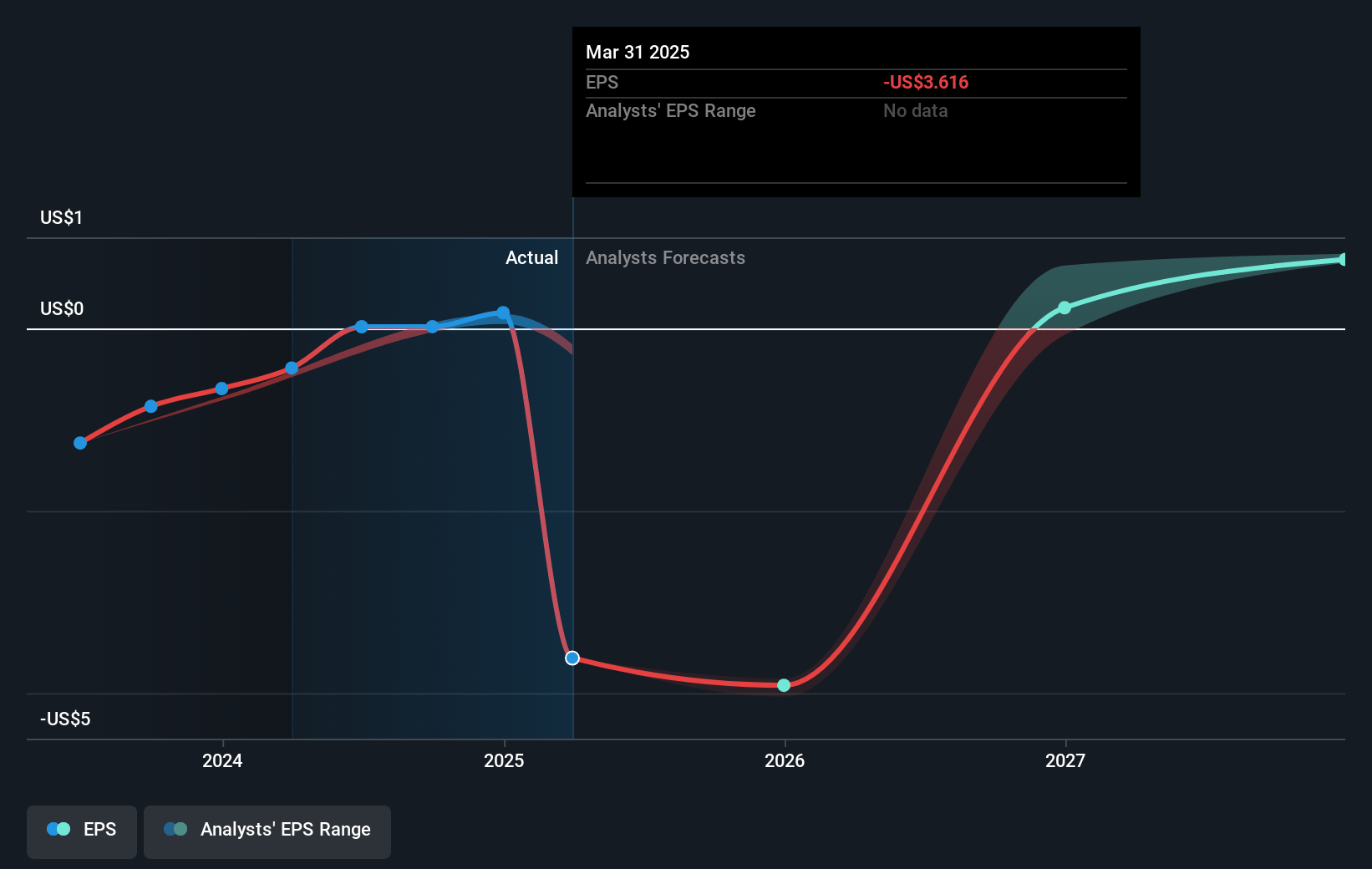

- Analysts assume that profit margins will increase from 3.0% today to 12.4% in 3 years time.

- Analysts expect earnings to reach $88.6 million (and earnings per share of $1.02) by about April 2028, up from $13.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $112.0 million in earnings, and the most bearish expecting $63.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, down from 33.1x today. This future PE is greater than the current PE for the US Chemicals industry at 19.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Aspen Aerogels Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decision to cease construction of Plant 2 in Georgia and instead relying on modular expansions could lead to capacity constraints if demand spikes unexpectedly, potentially impacting revenue growth.

- Ongoing tariff concerns, particularly with imports from China, can affect cost structures and net margins despite current strategies to mitigate such risks.

- Fluctuations in the demand for EV components in North America and Europe, along with uncertainty surrounding regulatory support for EVs, may lead to variability in revenue and profit margins.

- The reliance on a single major OEM (GM) for thermal barriers exposes Aspen to risks if GM revises its production targets or experiences operational disruptions, affecting revenue stability.

- High fixed costs and restructuring efforts to reduce them may not yield the desired cost savings quickly enough, hence having implications for net income and earnings if sales do not meet expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.5 for Aspen Aerogels based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $715.8 million, earnings will come to $88.6 million, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 7.6%.

- Given the current share price of $5.4, the analyst price target of $17.5 is 69.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.