Last Update01 May 25

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Transition to commercial production and strategic design changes aim to significantly boost future revenue and margins through improved unit economics and production efficiency.

- Strong demand and strategic expansion plans present revenue growth potential, but operational risks and debt financing could impact net earnings.

- Origin Materials' unique PET solution and expanded production capacity may significantly boost revenue and margins amid growing customer commitments.

Catalysts

About Origin Materials- Operates as a carbon-negative materials company.

- Origin Materials is transitioning to commercial production with its CapFormer System, targeting a $65 billion market of PET bottle caps, which could significantly boost future revenue.

- By implementing design modifications and retrofits to existing CapFormers, Origin expects to increase production throughput and improve unit economics, likely enhancing net margins.

- Plans to introduce new cap formats, including larger formats, which the company believes will offer better margins due to manufacturing efficiencies, could drive future earnings growth.

- Strong indicative demand that exceeds current fulfillment capacity suggests robust future revenue potential, but also presents operational risks if supply chain expansion cannot keep pace.

- Financing growth through debt due to perceived undervaluation of the stock may impact net earnings due to interest expenses, although faster payback periods per CapFormer line could mitigate this impact.

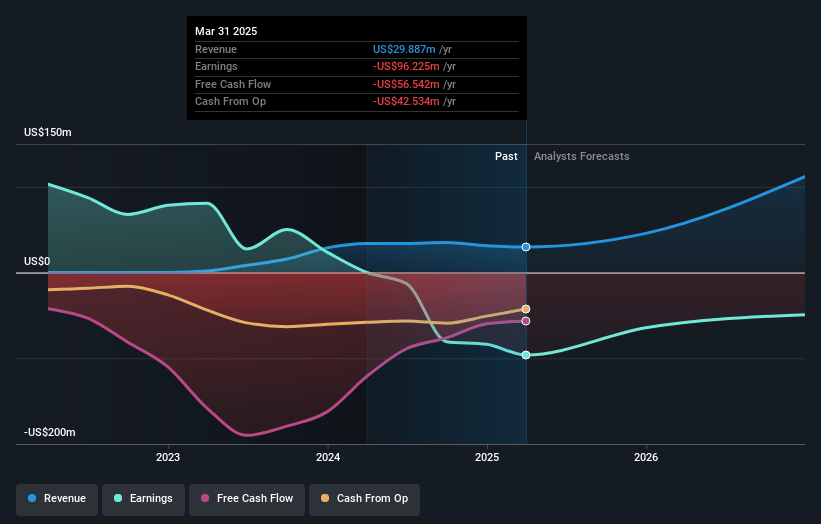

Origin Materials Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Origin Materials's revenue will grow by 80.4% annually over the next 3 years.

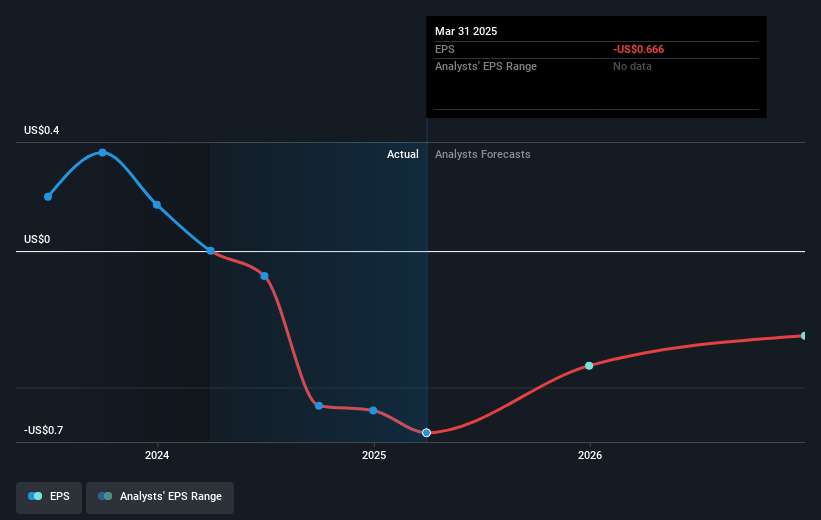

- Analysts are not forecasting that Origin Materials will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Origin Materials's profit margin will increase from -267.6% to the average US Chemicals industry of 7.7% in 3 years.

- If Origin Materials's profit margin were to converge on the industry average, you could expect earnings to reach $14.1 million (and earnings per share of $0.1) by about May 2028, up from $-83.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.1x on those 2028 earnings, up from -1.3x today. This future PE is lower than the current PE for the US Chemicals industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Origin Materials Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Origin Materials has successfully commenced commercial production and is shipping products to a growing customer base, which could strengthen revenue streams.

- The company has a unique solution for the $65 billion PET cap market, and strong initial demand could lead to increased revenues and margins.

- Future upgrades and design modifications are expected to double production capacity, which could significantly enhance output and improve unit economics, positively impacting earnings.

- The company has multiple MOUs with customers who are waiting for qualification, indicating strong commitment and potential future revenue growth.

- Origin Materials is expanding its production capability with three new CapFormer lines nearing completion and plans to have eight lines by the end of 2025, potentially leading to substantial revenue and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $0.5 for Origin Materials based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $183.8 million, earnings will come to $14.1 million, and it would be trading on a PE ratio of 6.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $0.72, the analyst price target of $0.5 is 44.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.