Key Takeaways

- Regulatory uncertainty, slow international adoption, and heavy regional concentration pose risks to Bioceres' growth and margin expansion despite favorable trends for sustainable agriculture.

- Rising industry competition and dependency on successful new product launches threaten pricing power, profitability, and stable free cash flow amid volatile market conditions.

- Concentration in Argentina, reliance on one-off gains, uncertain international adoption, industry competition, and evolving regulations collectively threaten Bioceres' future growth and margin stability.

Catalysts

About Bioceres Crop Solutions- Provides crop productivity solutions.

- While Bioceres stands to benefit from the growing global push for sustainable agriculture and increased acceptance of biological crop solutions-which positions its newly approved RinoTec platform and broader biologicals portfolio for long-term demand and margin expansion-the company faces significant operational risk if the pace of regulatory approvals slows or key markets enhance restrictions on GM crops, potentially constraining future revenue growth.

- Although a rising global population and food security concerns should expand the addressable market for Bioceres' proprietary technologies like HB4 drought-tolerant seeds, slow adoption rates relative to projections and limited penetration outside core Latin American markets may delay meaningful revenue contributions and erode returns on ongoing R&D investments.

- While cash flow performance has improved due to working capital optimization and seed business restructuring, much of this gain is nonrecurring in nature; without sustained growth in higher-value markets and greater diversification away from Argentina, future net margin improvement may prove elusive due to continued currency volatility and regional risk.

- Despite ongoing industry trends toward replacing synthetic chemicals with bio-based crop solutions, intensified competition from better-capitalized global agrochemical companies and potential industry consolidation could compress Bioceres' pricing power and limit its ability to scale EBITDA margins as planned.

- While Bioceres' expansion into the U.S., Brazil, and Mexico provides avenues for top-line growth and leverage of recent regulatory wins, the company's reliance on successful execution of multiple new product launches, unpredictable weather patterns, and evolving global trade barriers could inject volatility into both earnings growth and free cash flow conversion in the coming years.

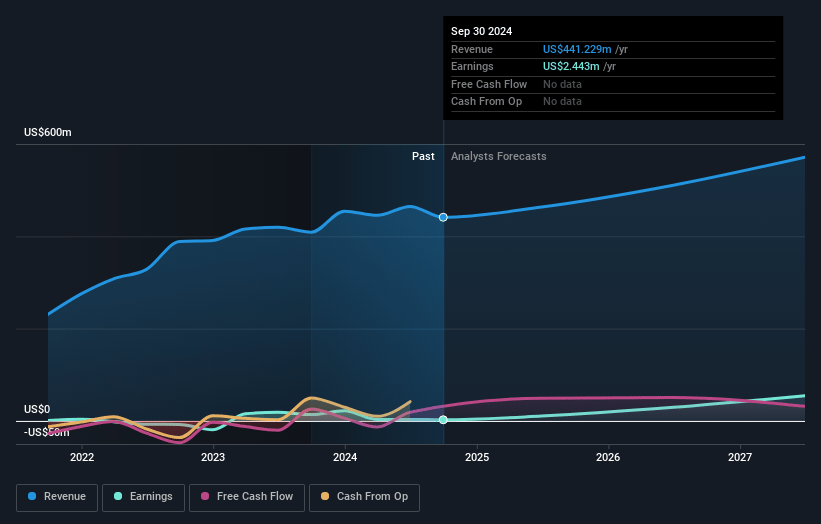

Bioceres Crop Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bioceres Crop Solutions compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bioceres Crop Solutions's revenue will grow by 10.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.4% today to 7.2% in 3 years time.

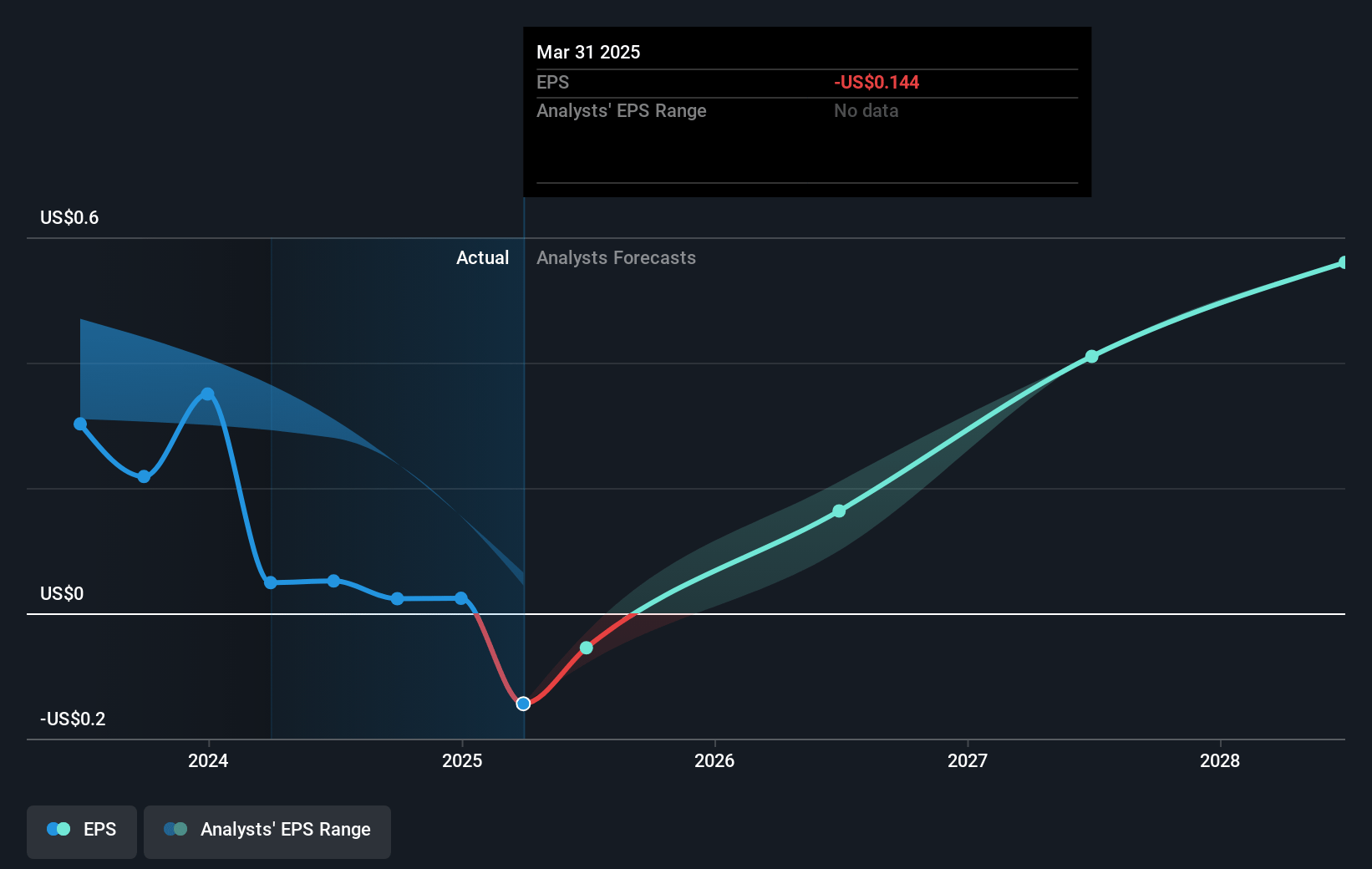

- The bearish analysts expect earnings to reach $36.6 million (and earnings per share of $0.56) by about July 2028, up from $-9.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.8x on those 2028 earnings, up from -26.4x today. This future PE is greater than the current PE for the US Chemicals industry at 22.7x.

- Analysts expect the number of shares outstanding to decline by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 30.97%, as per the Simply Wall St company report.

Bioceres Crop Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bioceres' continued heavy reliance on the Argentine market exposes it to significant country-specific risks, including currency volatility, political instability, and agricultural policy changes, which could result in unpredictable revenues and inconsistent earnings if macroeconomic normalization falters or adverse policy shifts occur.

- The transition to a lighter, more focused seed business model has been supported by one-off working capital releases and divestment of HB4 grain inventories, which will not recur in future periods, potentially leading to lower cash flow generation and margin dilution unless new product launches or geographic expansion quickly offset this effect.

- Despite regulatory progress, the pace of commercial adoption for flagship technologies like HB4 soybean and wheat outside Latin America remains uncertain and extended, and delayed uptake in key geographies could cause underutilization of R&D spending and lower future revenue growth.

- Intensifying industry competition and ongoing consolidation among larger agrochemical and seed multinationals may put Bioceres at a disadvantage in terms of market share, bargaining power, and pricing, risking pressure on both revenues and net margins over the long term.

- Rising regulatory scrutiny, shifting consumer preference toward non-GMO and organic products, and unpredictable international trade and tariff environments (especially in the US and EU) could constrain Bioceres' ability to penetrate new markets and limit the addressable revenue pool, impacting both sales growth and long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bioceres Crop Solutions is $6.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bioceres Crop Solutions's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $511.1 million, earnings will come to $36.6 million, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 31.0%.

- Given the current share price of $3.81, the bearish analyst price target of $6.0 is 36.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.