Key Takeaways

- Higher claims severity and aggressive competition in medical liability insurance threaten underwriting profitability and compress margins for ProAssurance.

- Market contraction and increased sector concentration heighten earnings volatility and undermine premium revenue growth prospects.

- Consistent operating earnings growth, enhanced underwriting discipline, and technology-driven efficiency are boosting profitability, margin improvements, pricing power, and long-term earnings potential.

Catalysts

About ProAssurance- Through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States.

- Escalating frequency and magnitude of nuclear verdicts in malpractice cases threaten to drive claims severity higher than current pricing can accommodate, putting sustained pressure on loss ratios and eroding underwriting profitability for ProAssurance in core medical professional liability lines.

- Rapid advances in healthcare automation and AI create new and evolving risk exposures that may outpace ProAssurance's underwriting and claims management capabilities, forcing costly investments in adaptation and reducing their ability to maintain competitive margins and earnings growth.

- The shrinking pool of practicing physicians, combined with fewer new entrants into the profession, is likely to shrink the overall market for medical liability insurance over time, structurally capping premium revenue growth even as competition intensifies for a declining customer base.

- Persistent concentration in the medical professional liability segment leaves the company increasingly vulnerable to sector-specific shocks, making earnings and revenue growth volatile and limiting the effectiveness of diversification initiatives highlighted in recent quarters.

- Ongoing aggressive rate competition, especially from larger and more diversified carriers flush with excess capital, is intensifying margin compression and risks derailing ProAssurance's ability to achieve meaningful premium increases, directly threatening both top-line revenue ambitions and future improvements in net margins.

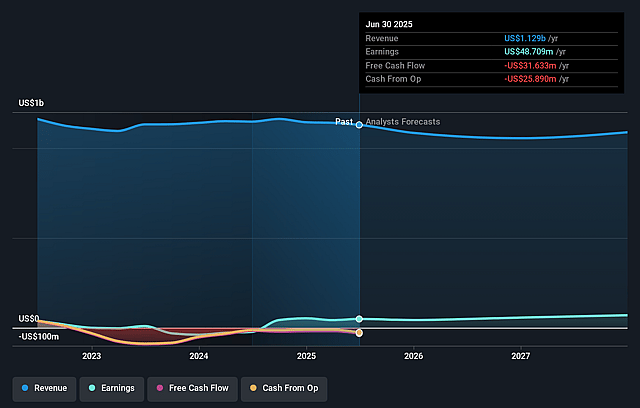

ProAssurance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on ProAssurance compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming ProAssurance's revenue will decrease by 1.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.7% today to 7.1% in 3 years time.

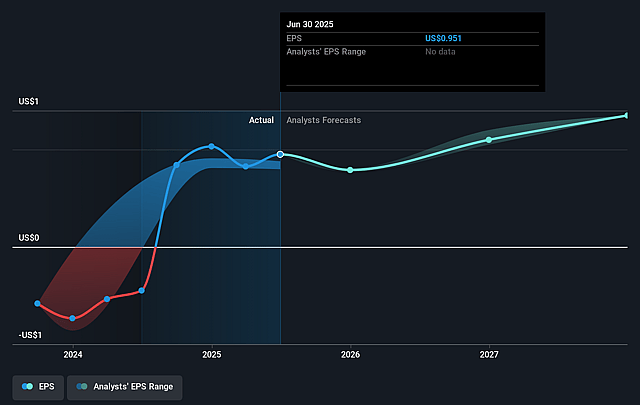

- The bearish analysts expect earnings to reach $76.5 million (and earnings per share of $1.48) by about July 2028, up from $42.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, down from 28.7x today. This future PE is greater than the current PE for the US Insurance industry at 14.2x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

ProAssurance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ProAssurance has demonstrated consistent improvement in operating earnings for five consecutive quarters, supported by ongoing premium increases, enhanced underwriting discipline, and positive claims experience, which are likely to strengthen both margins and long-term earnings.

- The company's technology and innovation investments, such as predictive analytics for risk selection and new AI-ready platforms, are improving operational efficiency and underwriting profitability, which could result in sustained improvement in net margins and future earnings.

- The favorable trend of reserve development, particularly beneficial claims closures relative to expectations and ongoing reductions in loss and loss adjustment expense ratios, suggests improved risk assessment and the potential for continued earnings outperformance.

- Despite competitive pressures, ProAssurance has successfully achieved significant cumulative premium rate increases-nearly 70% in its MPL line since 2018-and maintained solid policyholder retention, which supports revenue stability and pricing power going forward.

- Net investment income rose 12% year-over-year, aided by higher yields and strong returns from limited partnerships and equity investments, improving overall profitability and contributing directly to growth in book value per share and equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for ProAssurance is $18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ProAssurance's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $76.5 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of $23.79, the bearish analyst price target of $18.0 is 32.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ProAssurance?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.