Last Update 29 Oct 25

Analysts have slightly adjusted their price target for ProAssurance, maintaining a fair value estimate of $22.67 while taking into account a marginally lower outlook for revenue growth and profit margins.

What's in the News

- ProAssurance reported it repurchased zero shares between April 1, 2025 and June 30, 2025, resulting in no additional spending on buybacks in this period (Key Developments).

- With this update, the company has fully completed its buyback program. Since February 24, 2011, it has repurchased a total of 12,758,534 shares, which represent 22.5% of outstanding shares and $490.42 million in total repurchases (Key Developments).

Valuation Changes

- The Fair Value Estimate remains steady at $22.67 per share, with no change from the previous analysis.

- The Discount Rate is unchanged at 6.78%.

- Revenue Growth projections have declined modestly, moving from -1.80% to -2.14%.

- The Net Profit Margin is slightly lower, changing from 6.69% to 6.66%.

- The Future P/E Ratio has increased marginally, rising from 20.06x to 20.37x.

Key Takeaways

- Strategic initiatives in medical professional liability and renewal premium increases are enhancing profitability and future margins.

- Investments in AI tools and analytics aim to optimize processes, improve efficiency, and bolster revenue through better client retention.

- Challenging legal conditions, strategic business foregoance, and competitive pressures are squeezing margins, while disciplined cost management may increase expenses and impact profitability.

Catalysts

About ProAssurance- Through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States.

- ProAssurance is showing consistent improvement in operating earnings due to strategic initiatives in its medical professional liability business, likely impacting future revenue and margins positively.

- The company is successfully implementing renewal premium increases and re-underwriting efforts, which have contributed to a significant improvement in the accident year loss and LAE ratio since 2019, enhancing future profitability and earnings.

- Strategic investments in AI tools and predictive analytics are expected to optimize underwriting and claims processes, potentially improving operational efficiency and net margins.

- New innovations, like the AI-ready web portal and tools for risk management, aim to enhance customer experience and operational workflows, potentially bolstering revenue through improved client retention and acquisition.

- ProAssurance’s Workers' Compensation segment is leveraging partnerships and analytics to manage medical loss trends, which could improve future combined ratios and contribute to stronger net margins.

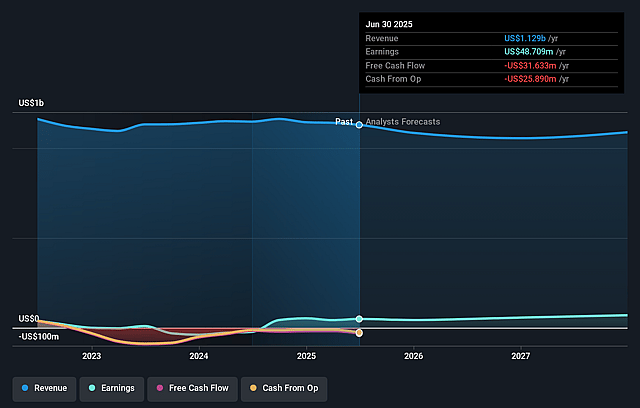

ProAssurance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ProAssurance's revenue will decrease by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 7.0% in 3 years time.

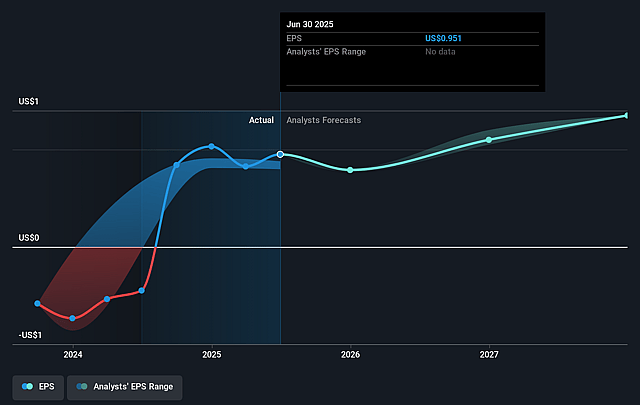

- Analysts expect earnings to reach $73.1 million (and earnings per share of $1.35) by about September 2028, up from $48.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.6x on those 2028 earnings, down from 25.1x today. This future PE is greater than the current PE for the US Insurance industry at 14.6x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

ProAssurance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ProAssurance faces a challenging legal environment characterized by social inflation and eroding tort reforms, impacting their ability to manage legal costs effectively, which could adversely affect their net margins and earnings.

- The company is foregoing some renewal and new business opportunities that do not meet their rate adequacy expectations, which could limit revenue growth in the near term.

- Increased competition in the insurance market, coupled with excess capital among competitors, may pressure ProAssurance to maintain aggressive pricing strategies, potentially squeezing profit margins and affecting net income.

- The company has experienced negative impacts on its net income due to participation in Lloyd's Syndicates, with unexpected increases in reserves for aviation risks, which could continue to affect financial results adversely.

- ProAssurance's commitment to maintaining discipline may lead to higher expense ratios, particularly due to increased incentive compensation costs compared to previous years, which could negatively impact the operating expense structure and net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.667 for ProAssurance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $73.1 million, and it would be trading on a PE ratio of 19.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $23.75, the analyst price target of $22.67 is 4.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.