Key Takeaways

- AI adoption and underwriting discipline are driving improved profitability, margin expansion, and a durable competitive edge in specialty healthcare liability insurance.

- Demographic shifts and digital healthcare trends offer lasting premium growth opportunities as the company targets new risk segments and expands market share.

- Competitive intensity, demographic shifts, and rising legal costs are restricting premium growth and profitability while exposing the company to persistent expense and reserve adequacy pressures.

Catalysts

About ProAssurance- Through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States.

- Analysts broadly agree that premium rate increases and underwriting discipline have improved profitability, but this may significantly understate the long-run operating leverage: with almost 70 percent cumulative rate hikes since 2018, continuing robust retention and increasing book value per share, future earnings growth could accelerate meaningfully as medical liability pricing remains firm and top-line growth resumes.

- Analyst consensus highlights the efficiency gains from AI and data analytics, but this likely underrates the transformation underway-ProAssurance's rapid rollout of AI-powered tools across underwriting, claims, and policyholder interface could enable industry-leading expense ratios and margin expansion, particularly as its technology adoption creates a lasting competitive moat in complex healthcare liability lines.

- Favorable demographic and healthcare trends, including a rapidly aging U.S. population and the expanding volume of healthcare services provided, are set to fuel sustained multi-year growth in overall premium volumes; this creates a powerful backdrop for revenue acceleration as ProAssurance increases market share in specialty liability.

- The accelerating shift toward digital healthcare delivery and telemedicine is opening up fresh, underpenetrated insurance segments. ProAssurance's early adoption of innovative policy forms and AI-enhanced underwriting positions the company to become the market leader in new risk categories, unlocking incremental revenue streams and superior risk selection.

- With an exceptionally strong balance sheet, enhanced investment income from higher portfolio yields, and flexibility for both organic and acquisitive growth, ProAssurance is positioned to generate double-digit growth in book value and earnings per share as the industry's structurally higher pricing regime and investment returns persist.

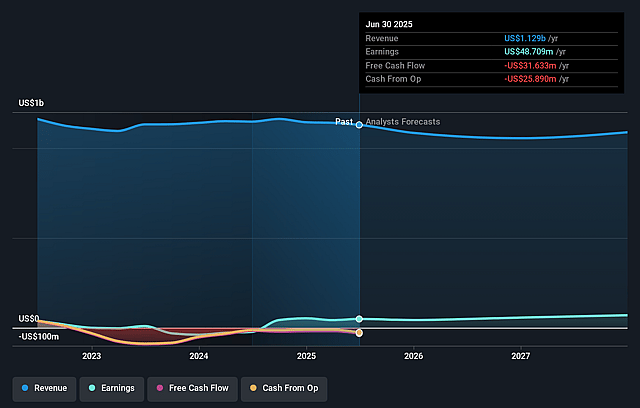

ProAssurance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ProAssurance compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ProAssurance's revenue will decrease by 1.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.3% today to 7.2% in 3 years time.

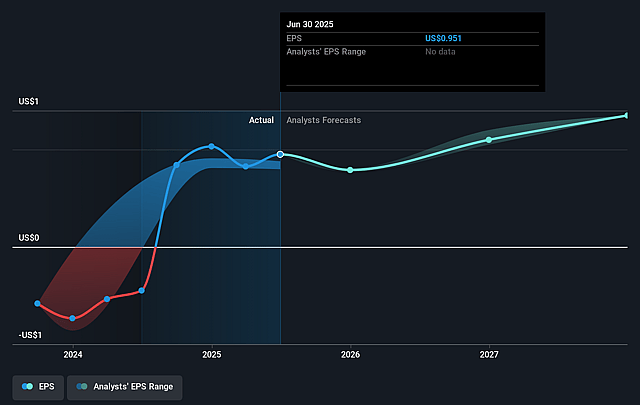

- The bullish analysts expect earnings to reach $76.8 million (and earnings per share of $1.49) by about September 2028, up from $48.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, down from 25.0x today. This future PE is greater than the current PE for the US Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

ProAssurance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competitive pressures and excess capital in the medical professional liability market are suppressing premium growth and could further compress gross written premium and net margins, as noted by management's continued emphasis on underwriting discipline over growth and willingness to forgo retention.

- Persistent declines or stagnation in the number of practicing physicians due to demographic shifts, together with continued consolidation of healthcare providers, threatens to gradually shrink the addressable market for ProAssurance, restricting opportunities for sustainable premium growth and negatively impacting top-line revenue over time.

- Ongoing industry trends of social inflation, rising jury awards, and legal system abuse are driving higher loss costs and claims severity, which, if not fully offset by premium rate increases, can lead to weaker loss ratios and pressure long-term profitability and earnings.

- Continued reliance on favorable prior year reserve development to support operating results may mask ongoing challenges in accurate risk pricing and reserve adequacy; any future adverse reserve development would directly depress net income and potentially erode book value per share.

- Rising expense ratios, partly driven by increasing agent and incentive compensation as well as headcount reductions, suggest sustained upward pressure on the company's cost base, which may further compress underwriting margins if earned premium growth continues to trend flat to negative.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ProAssurance is $25.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ProAssurance's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $76.8 million, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $23.71, the bullish analyst price target of $25.0 is 5.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.