Key Takeaways

- Strong operational efficiency and profitability support net margins, with a low combined ratio indicating robust operational performance.

- Growth strategies include launching a new carrier and focusing on high ROE areas, enhancing revenue and earnings prospects.

- The decision not to raise policyholder rates despite storm-related claims pressures revenues, while reliance on reinsurance and expansion strategies risks future profitability and financial strain.

Catalysts

About HCI Group- Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in Florida.

- HCI's recent acquisition of 42,000 policies from Citizens is expected to contribute approximately $200 million to its total in-force premium, leading to an additional $35 million in gross premiums earned in the fourth quarter, positively impacting revenue.

- The company’s strong underlying profitability is highlighted by a low combined ratio of 70%, indicating robust operational efficiency that is likely to support net margins.

- Strategic plans to launch a fourth admitted carrier, Tailrow, by early 2025 present new opportunities for growth, potentially increasing future earnings through business expansion.

- Continued focus on high ROE (Return on Equity) areas, coupled with innovative risk selection practices that adapt to climate change impacts, positions HCI to maintain strong revenue and earnings growth.

- The decision to maintain stable insurance rates in Florida over the next year could strengthen customer loyalty and retention, supporting sustained premium income and stable net margins.

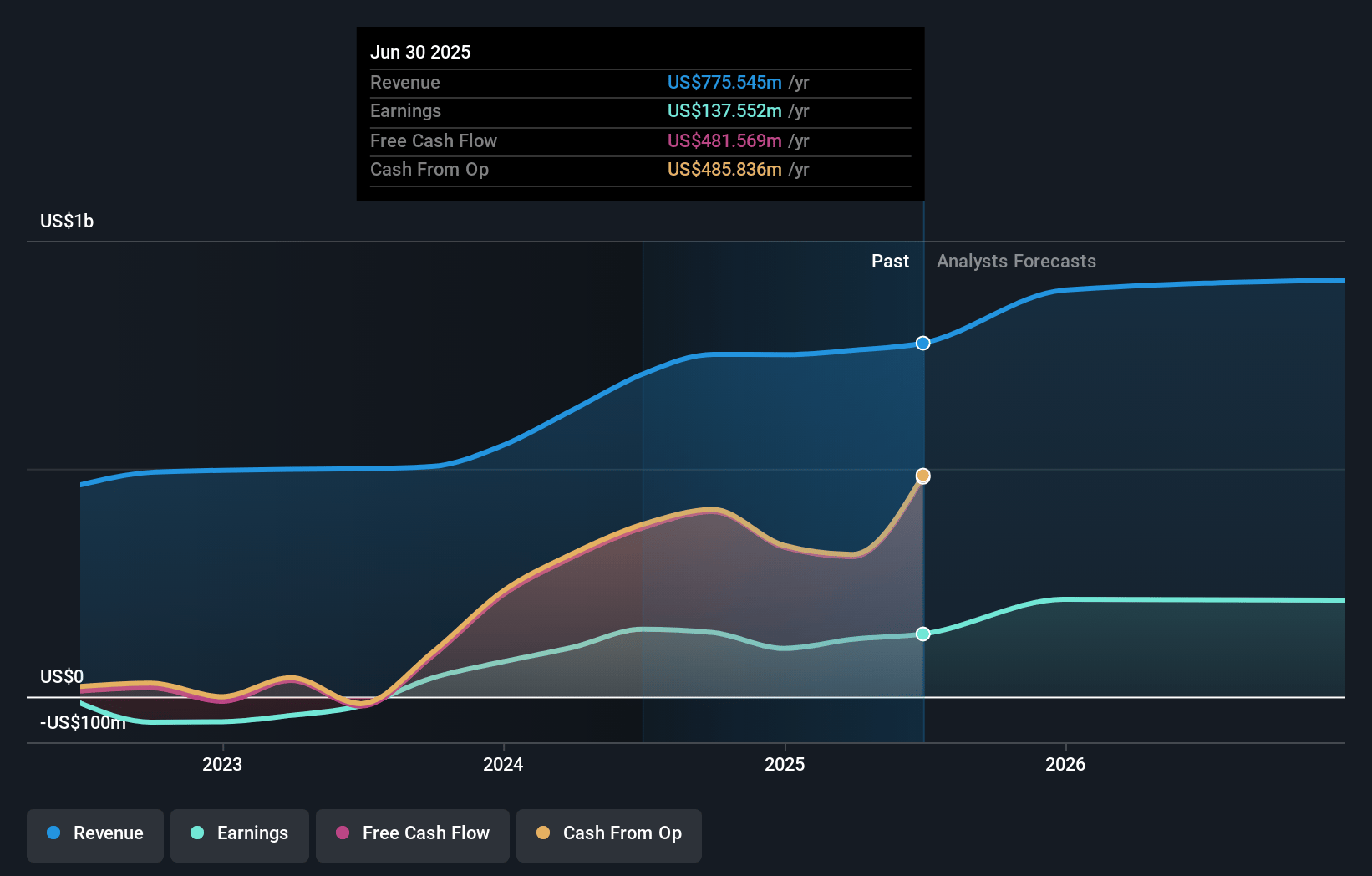

HCI Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HCI Group's revenue will grow by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.7% today to 14.0% in 3 years time.

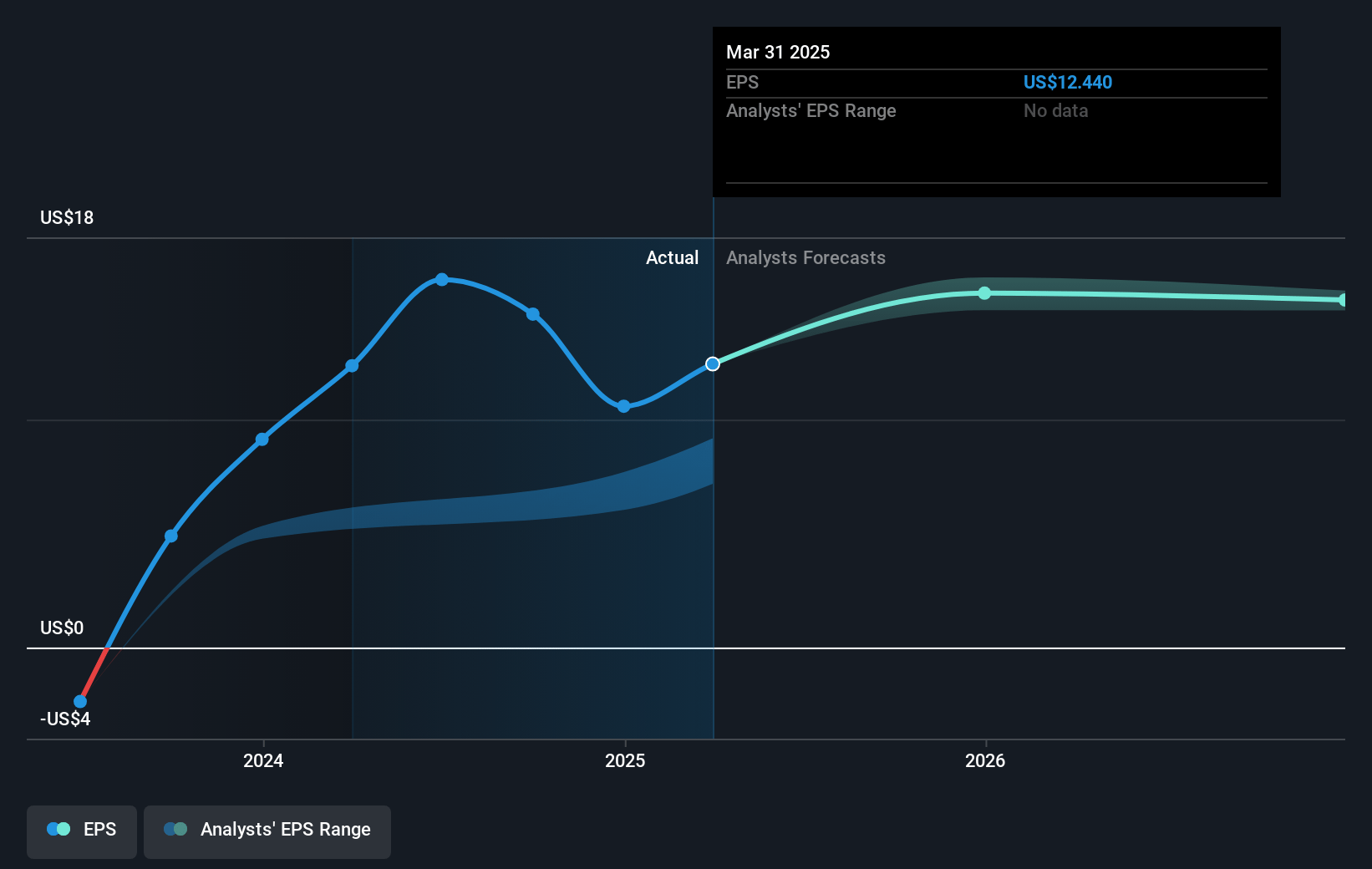

- Analysts expect earnings to reach $136.1 million (and earnings per share of $12.56) by about January 2028, down from $140.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, up from 9.2x today. This future PE is lower than the current PE for the US Insurance industry at 12.8x.

- Analysts expect the number of shares outstanding to grow by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.19%, as per the Simply Wall St company report.

HCI Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of recent hurricanes (Debby, Helene, and Milton) has led to substantial claims, resulting in significant expenses that could negatively affect net margins and future earnings.

- HCI Group has chosen not to increase policyholder rates in Florida despite the active storm season, which may put pressure on revenues by limiting potential increases that could offset higher claims costs.

- The company's reliance on its reinsurance program, particularly after multiple hurricanes, could result in increased future costs or adjustments, impacting net margins and earnings.

- A strong commitment to expanding in the competitive Florida market without increasing rates may challenge future profitability and pressure financial conditions.

- The company's strategy to grow through depopulation from Citizens and start new carriers like Tailrow introduces execution risk and could strain resources, affecting margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $142.75 for HCI Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $150.0, and the most bearish reporting a price target of just $126.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $972.3 million, earnings will come to $136.1 million, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $122.89, the analyst's price target of $142.75 is 13.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

BE

BenFranklin1776

Community Contributor

Has an extreme amount of inside trading.

Jul 11 First quarter dividend of US$0.40 announced Dividend of US$0.40 is the same as last year. Ex-date: 16th August 2024 Payment date: 20th September 2024 Dividend yield will be 1.8%, which is about the same as the industry average.

View narrativeUS$138.75

FV

15.3% undervalued intrinsic discount23.40%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

0users have followed this narrative

7 months ago author updated this narrative