Catalysts

About WD-40

WD-40 develops and markets high performance maintenance and specialty products that protect, lubricate and preserve equipment for consumers and professionals worldwide.

What are the underlying business or industry changes driving this perspective?

- The company has captured only about one quarter of its estimated global potential for WD-40 Multi-Use Product and a little over one tenth for WD-40 Specialist, and continued geographic expansion and deeper penetration in large markets such as India, China and Latin America are key focus areas for pursuing additional revenue growth and potentially expanding earnings power.

- Premium formats like Smart Straw and EZ Reach already account for roughly half of Multi-Use sales and continue to grow at a high single digit to low double digit compound rate, which may steadily lift average selling prices and support gross margin above the current 55 percent level.

- Growth in higher value WD-40 Specialist, with a five year compound annual growth rate above 14 percent and traction across all regions, positions the portfolio to tilt toward more professional and industrial users, supporting mix driven revenue growth and potentially higher net margins.

- Ongoing investments in digital commerce, including AI enabled systems and global e commerce capabilities, are improving brand visibility, data driven marketing and channel reach, and may accelerate top line growth while leveraging the fixed cost base to enhance earnings.

- Supply chain optimization, disciplined global sourcing and the divestiture of lower margin home care and cleaning brands are simplifying the business and freeing resources for core maintenance products, supporting gross margin above 55 percent and contributing to operating income and EPS growth within or above stated guidance ranges.

Assumptions

This narrative explores a more optimistic perspective on WD-40 compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

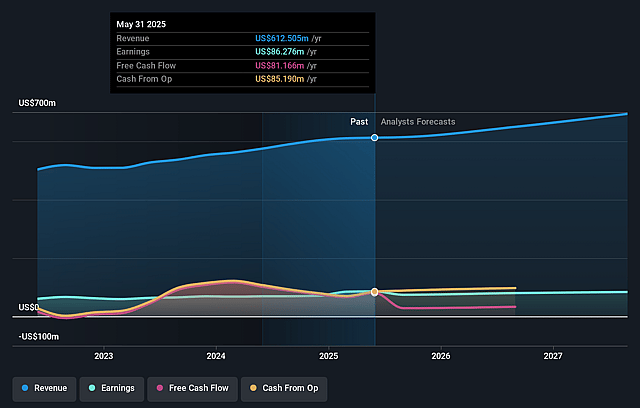

- The bullish analysts are assuming WD-40's revenue will grow by 6.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 14.6% today to 13.1% in 3 years time.

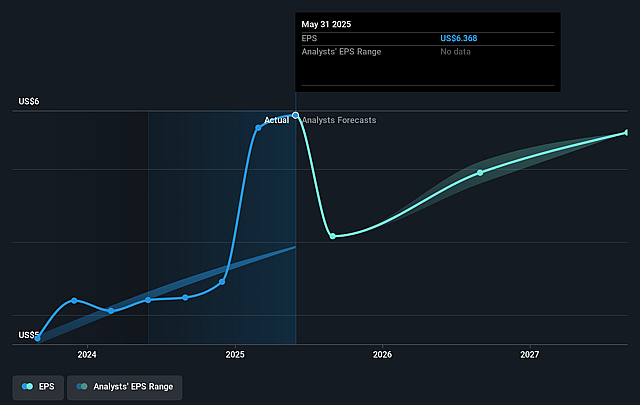

- The bullish analysts expect earnings to reach $98.5 million (and earnings per share of $7.4) by about December 2028, up from $90.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 50.2x on those 2028 earnings, up from 30.4x today. This future PE is greater than the current PE for the US Household Products industry at 17.4x.

- The bullish analysts expect the number of shares outstanding to decline by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Growth in key regions such as the Americas and Asia Pacific is already running below long-term targets, with Americas revenue growth under the 5 to 8 percent goal and Asia Pacific below the 10 to 13 percent goal. This suggests the large stated addressable markets may prove harder to monetize than expected and could limit future revenue growth and earnings expansion.

- The strategy to divest Home Care and cleaning brands and concentrate even more on maintenance products increases reliance on a single category. Any saturation of WD-40 Multi-Use and Specialist demand or new competitive entrants could pressure pricing power and ultimately constrain revenue and net margin growth.

- Recent margin gains are heavily dependent on lower specialty chemical costs, favorable pricing, and ongoing supply chain savings. Persistent cost volatility, tariffs and higher warehousing and freight expenses, particularly in the Americas, could erode gross margin above 55 percent and reduce profitability and earnings.

- Distributor led growth in Asia Pacific and parts of EMEA introduces volatility in order timing and sales mix. If distributors cut inventories or shift focus due to local macroeconomic or geopolitical shocks, WD-40 could see uneven sales, less favorable product mix and downward pressure on both revenue and gross margin.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for WD-40 is $300.0, which represents up to two standard deviations above the consensus price target of $264.5. This valuation is based on what can be assumed as the expectations of WD-40's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $229.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $752.5 million, earnings will come to $98.5 million, and it would be trading on a PE ratio of 50.2x, assuming you use a discount rate of 7.0%.

- Given the current share price of $204.03, the analyst price target of $300.0 is 32.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on WD-40?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.