Key Takeaways

- Growing losses, high debt, and reliance on short-term financing threaten sustainability and value, increasing pressure for costly fundraising or debt that suppress earnings.

- Shifting consumer demand, regulatory hurdles, and strong competitors limit growth potential for Vivos's treatments, jeopardizing expansion and market position.

- Accelerated demand, scalable high-margin partnerships, proven rollout expertise, acquisition pipeline, and improved insurance coverage together position the company for rapid, profitable growth.

Catalysts

About Vivos Therapeutics- Operates as a medical technology company that develops and commercializes treatment modalities for patients with dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults.

- Significant operational losses and persistent lack of profitability threaten the company's ability to sustain growth, especially as rising interest rates and tighter capital markets increase borrowing costs, making it more difficult to fund future acquisitions and investments; this situation could lead to further equity dilution or expensive debt that suppresses earnings and long-term shareholder value.

- The company's reliance on expensive, short-term financing to complete acquisitions like Sleep Center of Nevada, combined with mounting liabilities-which reached $21.5 million with only $4.4 million in cash-imperils future net margins as increased debt service and refinancing risks eat into any anticipated gross margin improvements.

- Despite an optimistic outlook for expansion, Vivos remains exposed to weakening discretionary healthcare spending as persistently high inflation and elevated cost of living may lead patients to reduce or defer non-emergency treatments; this trend puts ongoing revenue growth at risk, particularly for elective oral appliances.

- Dependence on a scaling model driven by recruiting and deploying highly specialized sleep optimization teams presents concentration risk, and any failure to rapidly staff or integrate new teams, coupled with stringent and time-consuming payer credentialing, may slow expansion and stall top-line growth.

- The intensified regulatory scrutiny over healthcare claims and patient data, coupled with the increasing prevalence of alternative and established OSA treatments such as CPAP, implantables, and telehealth-driven interventions, could diminish Vivos's addressable market, challenge reimbursement rates, and ultimately compress both future revenue and operational profitability.

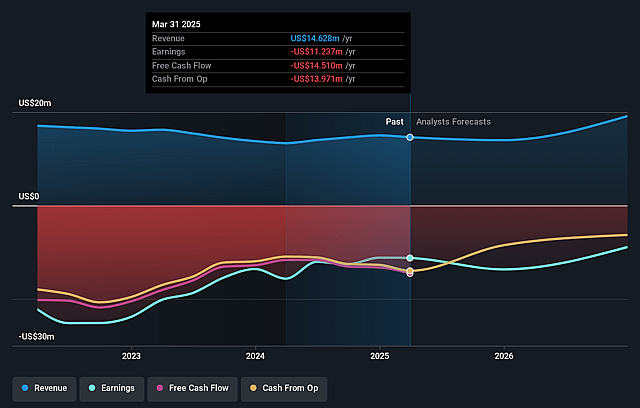

Vivos Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vivos Therapeutics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vivos Therapeutics's revenue will grow by 30.3% annually over the next 3 years.

- The bearish analysts are not forecasting that Vivos Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vivos Therapeutics's profit margin will increase from -99.5% to the average US Healthcare industry of 5.4% in 3 years.

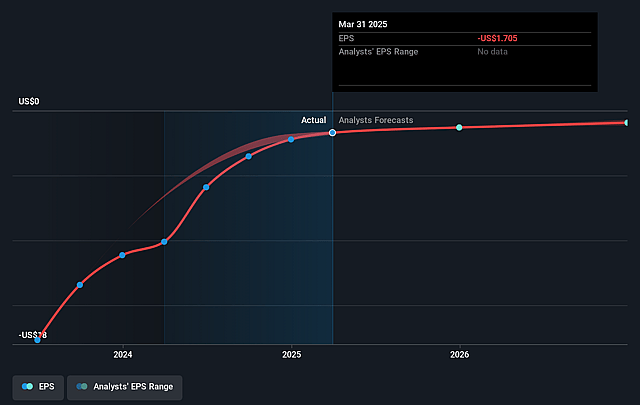

- If Vivos Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $1.7 million (and earnings per share of $0.19) by about September 2028, up from $-14.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, up from -2.4x today. This future PE is greater than the current PE for the US Healthcare industry at 21.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vivos Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapidly rising patient demand for Vivos' therapy at the newly acquired Sleep Center of Nevada, along with SCN medical staff enthusiasm and faster-than-expected facility expansions, indicates untapped market potential that could significantly propel revenue growth as additional Sleep Optimization teams are deployed and the model is scaled.

- Initial financial results from the pivot to sleep center-based partnerships and acquisitions, including immediate revenue boosts and high contribution margins above fifty percent per SO team, support management's confidence that the new operating model is both scalable and accretive to profit margins.

- The proven ability of Vivos' senior management team to execute large-scale multi-site rollouts from their dental service organization background de-risks the operational scalability of this model, making wider geographic expansion more likely to deliver sustained increases in revenue and earnings.

- A robust pipeline of potential acquisitions and affiliations, with management reporting significant national inbound interest, suggests that rapid market share and revenue expansion are achievable, which would be expected to lift both topline results and future net earnings.

- Enhanced insurance reimbursement following the 510(k) FDA clearance for treatment of severe sleep apnea with Vivos appliances opens up a broader patient pool, likely improving patient access, increasing volumes, and driving recurring healthcare revenues and improving net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vivos Therapeutics is $4.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vivos Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.2, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $31.8 million, earnings will come to $1.7 million, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $4.53, the bearish analyst price target of $4.0 is 13.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.