Last Update 21 Nov 25

Fair value Increased 14%VVOS: Significant Clinical Findings Will Drive Upside in 2024

Analysts have raised their price target for Vivos Therapeutics from $5.10 to $5.83 per share. They cited improved revenue growth projections and modest adjustments to future profitability assumptions.

What's in the News

- Vivos Therapeutics announced a delay in filing their next 10-Q with the SEC, missing the required deadline (Key Developments).

- The company held its annual general meeting, and declared voting results indicate the withdrawal of the investor activism campaign by SP Manager LLC (Key Developments).

- Baker Tilly US, LLP was approved as the new independent registered public accounting firm for the fiscal year ending December 31, 2025, replacing Moss Adams LLP (Key Developments).

- New clinical data shows Vivos' FDA-cleared DNA device provides significant relief for children with ADHD and OSA, offering a non-surgical and non-pharmaceutical alternative for pediatric OSA (Key Developments).

- Peer-reviewed published data confirm the safety and efficacy of the Vivos DNA appliance in treating pediatric OSA, with major reductions in severity and airway improvements reported in a multicenter clinical trial (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has increased from $5.10 to $5.83 per share, reflecting improved expectations.

- Discount Rate has risen slightly, moving from 6.78% to 6.98%.

- Revenue Growth projection has increased significantly, from 39.4% to 56.5%.

- Net Profit Margin is marginally lower, shifting from 5.39% to 5.24%.

- Future P/E ratio has decreased, moving from 26.6x to 22.2x. This suggests improved valuation efficiency.

Key Takeaways

- New regulatory clearance and market preferences are removing adoption barriers, fueling revenue and margin growth through expanded treatment options for sleep apnea.

- Strategic expansion, scalable service models, and a shift to recurring revenue streams are positioning the company for sustainable, high-margin earnings and broader market reach.

- Execution risks, industry pressures, and reliance on costly financing threaten profitability, margin expansion, and the success of shifting from legacy revenues to new patient-centric growth models.

Catalysts

About Vivos Therapeutics- Operates as a medical technology company that develops and commercializes treatment modalities for patients with dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults.

- Recent FDA clearance for Vivos' devices to treat severe OSA, along with increasing patient preference for non-invasive alternatives to CPAP, is rapidly expanding their addressable market and removing previous adoption barriers-likely driving stronger revenue growth and improved margin stability in future quarters.

- The accelerating demand for sleep apnea solutions, driven by growing public awareness and willingness to seek treatment, is outpacing current operational capacity at newly acquired and affiliated centers; as Vivos ramps up SO team deployments and expands physical locations, this capacity expansion should directly increase top-line revenue and operating leverage.

- Early success in integrating The Sleep Center of Nevada (SCN) and the highly replicable, scalable SO team model-supported by positive initial patient volumes-positions Vivos to quickly scale into additional geographies and partnerships, setting up a pathway for sustained revenue growth and improved gross margins as fixed costs are spread over greater volumes.

- Pivoting away from legacy revenue streams to a recurring, services-driven model with diagnostic, treatment, and adjunct offerings (including pediatric programs and collaborations with specialty groups) is expected to drive more predictable, higher-margin earnings and longer-term patient value.

- The company's proactive engagement with payers to expedite credentialing and improve reimbursement, combined with industry movement toward value-based healthcare and outcome-driven therapies, could accelerate insurance adoption and patient uptake, further boosting revenue predictability and margin expansion.

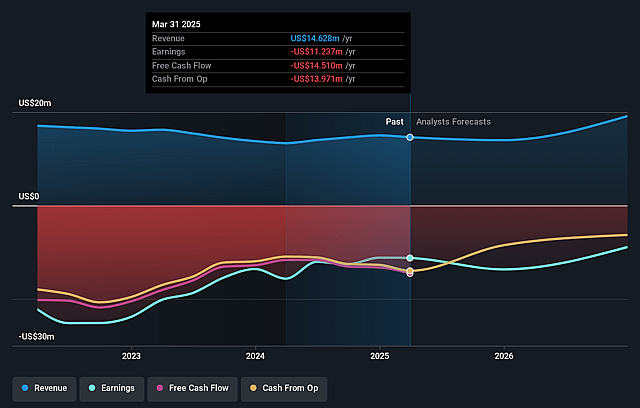

Vivos Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vivos Therapeutics's revenue will grow by 39.4% annually over the next 3 years.

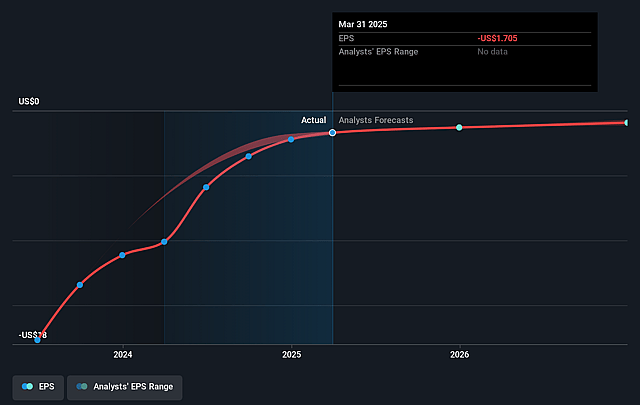

- Analysts are not forecasting that Vivos Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vivos Therapeutics's profit margin will increase from -99.5% to the average US Healthcare industry of 5.4% in 3 years.

- If Vivos Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $2.1 million (and earnings per share of $0.23) by about September 2028, up from $-14.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, up from -2.4x today. This future PE is greater than the current PE for the US Healthcare industry at 20.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vivos Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent operating losses and increased expenses related to acquisitions (such as the $1.8 million in SCN integration costs) combined with only modest revenue growth could lead to extended periods of negative net margins and greater risk of dilutive equity financing or debt, impacting future earnings per share.

- A 9% year-over-year revenue decline in the first half of 2025, primarily due to weaning off legacy VIP enrollment revenue, exposes Vivos to the risk that new patient-centric models may not ramp quickly enough to offset legacy declines, undermining sustainable long-term revenue growth.

- High reliance on the rapid deployment and successful scaling of Sleep Optimization (SO) teams and integration of new acquisitions introduces execution risk-delays, bottlenecks, or failure to quickly reach full operational capacity could suppress forecasted revenue and keep the company from reaching profitability as projected.

- Significant dependence on expensive debt financing to fund current operations and acquisitions, coupled with tightening credit markets and high interest costs, raises the risk of financial strain and limits operational flexibility, with potential negative impacts on net cash flow and shareholder equity.

- Ongoing industry pressures, such as potential proliferation of low-cost/device competitors and shifting insurer reimbursement trends, could increase price competition and reimbursement headwinds, suppressing Vivos' gross margins and future topline growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.1 for Vivos Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.2, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $39.0 million, earnings will come to $2.1 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $4.53, the analyst price target of $5.1 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Vivos Therapeutics?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.