Key Takeaways

- Surging patient demand and rapid operational rollout support potential for significantly higher revenue, margin expansion, and accelerated positive cash flow beyond current expectations.

- Clinically validated solutions, experienced leadership, and streamlined workflows position the company for rapid, scalable growth and sustained, high-margin recurring revenue.

- Persistent operating losses, slow scalability, and financing risks threaten profitability and growth as new models and industry trends challenge Vivos Therapeutics' revenue stability and competitive position.

Catalysts

About Vivos Therapeutics- Operates as a medical technology company that develops and commercializes treatment modalities for patients with dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults.

- While analyst consensus views the rollout of sleep optimization (SO) teams and sleep center acquisitions as driving incremental revenue and margin expansion, current evidence suggests patient demand is running several multiples above expectations, supporting a potentially exponential scaling of SO teams across untapped centers and driving revenue and net income growth well beyond the current forecasts.

- Analysts broadly agree the new profit-sharing/acquisition model increases patient conversions and margin, but this may vastly understate the upside, as the company's early ability to bring SO teams online ahead of budget, combined with multi-week patient backlogs and untapped historical patient bases, could quickly drive the business to positive cash flow and materially accelerate both revenue and operating leverage.

- With global rates of sleep-disordered breathing and associated comorbidities sharply rising, and persistent dissatisfaction with CPAP devices, Vivos is positioned to capture outsized share as a clinically-validated, non-invasive solution, likely expanding long-term top-line growth and enabling premium pricing to enhance profit margins.

- The company's leadership has deep experience in scaling multi-provider organizations, as shown by their prior success in dental roll-ups, which materially lowers execution risk and could support far more rapid expansion nationally and internationally, driving both recurring revenue and predictable earnings growth.

- The establishment of new clinical models and streamlined digital workflows-combined with accelerating payer acceptance for dental-based OSA therapies-can fast-track physician referrals and insurance reimbursement, reduce acquisition costs, and create a sustainable pathway to high-margin, recurring revenue streams and robust cash generation.

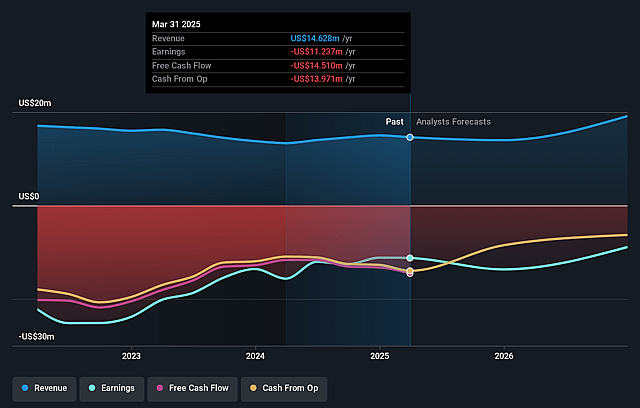

Vivos Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Vivos Therapeutics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Vivos Therapeutics's revenue will grow by 53.8% annually over the next 3 years.

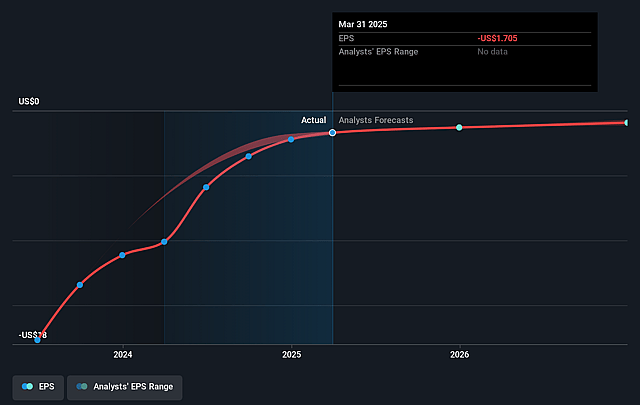

- Even the bullish analysts are not forecasting that Vivos Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vivos Therapeutics's profit margin will increase from -99.5% to the average US Healthcare industry of 5.3% in 3 years.

- If Vivos Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $2.8 million (and earnings per share of $0.31) by about September 2028, up from $-14.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.8x on those 2028 earnings, up from -2.0x today. This future PE is greater than the current PE for the US Healthcare industry at 21.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vivos Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in revenue, down 6 percent for the quarter and 9 percent for the first half of 2025 compared to the previous year, alongside a reduction in higher-margin VIP enrollment revenues, suggests the new model is not yet offsetting legacy business losses, which could compress overall revenues and margins if replacement does not accelerate rapidly.

- The company continues to post widening operating losses, with a $4.9 million operating loss in Q2 2025 and $8.8 million for the first half of the year, even after the acquisition of SCN, pointing to persistent challenges in reaching profitability and cash flow break-even, which threatens long-term earnings stability if operating leverage does not improve.

- The business relies on ongoing and potentially expensive debt and equity financing to fund operations and acquisitions, with $21.5 million in liabilities and only $4.4 million in cash, raising the risk of dilution or higher interest expenses that could erode future net margins and impact financial flexibility.

- The company's integration and expansion strategy hinges on successfully deploying multiple SO teams and executing acquisitions/affiliations nationwide, but constraints in physical facilities, credentialing timelines for payers, and the need to replicate high initial uptake may result in slower than expected scalability, potentially stalling both top line revenue growth and profitability.

- Long-term industry and secular trends-including the rise of less invasive sleep apnea treatments, regulatory scrutiny, potential reimbursement pressures, and digital health alternatives-threaten to reduce clinical adoption and could intensify price pressure, creating risk to future revenues, margin sustainability, and the company's competitive position.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Vivos Therapeutics is $6.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vivos Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.5, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $52.4 million, earnings will come to $2.8 million, and it would be trading on a PE ratio of 25.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $3.86, the bullish analyst price target of $6.5 is 40.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.