Key Takeaways

- Rising regulatory costs, digital health trends, and payer resistance threaten revenue growth and profitability for Vivos' device-based treatments.

- Competitive pressures and innovation in alternative therapies risk making Vivos' offerings obsolete, challenging long-term market relevance and financial sustainability.

- Strategic acquisitions and expanded service offerings position the company for higher recurring revenue, greater market reach, and improved long-term profit stability amidst favorable industry trends.

Catalysts

About Vivos Therapeutics- Operates as a medical technology company that develops and commercializes treatment modalities for patients with dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults.

- Vivos Therapeutics' ability to achieve sustainable revenue growth is at risk due to intensifying regulatory scrutiny and rising compliance costs for healthcare device makers, which could increase overhead and slow the introduction of new products, directly impacting future revenue and profit margins.

- Increased consumer adoption of digital-only health solutions and telemedicine may undermine demand for in-person and device-based dental interventions, such as Vivos' oral appliances, potentially causing a long-term decline in addressable market and contraction of revenue streams.

- Persistent uncertainty around broad payer reimbursement and difficulty demonstrating long-term clinical superiority of Vivos devices threaten ongoing adoption and limit the scalability of top-line revenue, while compression in insurance reimbursement could further erode net margins.

- The company's operational structure remains subscale, heavily reliant on integrating and acquiring individual sleep centers; with rising competition from larger medtech and dental device companies, Vivos risks both margin compression and the need for frequent, dilutive capital raises, pressuring earnings per share and shareholder value.

- Advances in alternative sleep apnea therapies, including minimally invasive surgical techniques and wearable digital health solutions, risk making oral appliance therapies obsolete over time, leading to structural declines in revenue and the company's longer-term market relevance.

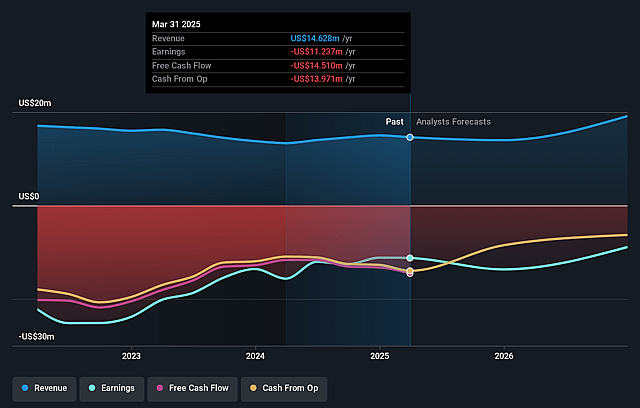

Vivos Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vivos Therapeutics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vivos Therapeutics's revenue will grow by 18.8% annually over the next 3 years.

- The bearish analysts are not forecasting that Vivos Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vivos Therapeutics's profit margin will increase from -76.8% to the average US Healthcare industry of 5.3% in 3 years.

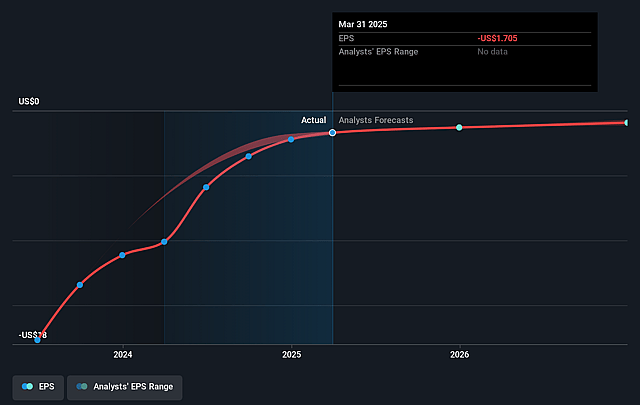

- If Vivos Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $1.3 million (and earnings per share of $0.18) by about August 2028, up from $-11.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, up from -2.3x today. This future PE is lower than the current PE for the US Healthcare industry at 21.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vivos Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of The Sleep Center of Nevada provides direct access to thousands of new patients monthly, with management expecting immediate revenue accretion and a net contribution margin of 50 percent or better, suggesting a strong potential for both top-line growth and improved net margins.

- Vivos has demonstrated a 70 percent or higher conversion rate of sleep study patients choosing its appliance treatments over CPAP in previous alliances, combined with average revenue exceeding four thousand five hundred dollars per case, indicating that expansion into sleep centers could drive sustained high revenue per patient.

- Management's experience in acquiring and integrating professional healthcare practices-including building a prior company to over two hundred fifty million dollars in revenue-supports the likelihood of successful scaling, leading to improved efficiency and potentially stronger operating earnings as more deals are executed.

- The company's strategic pivot to alliances and acquisitions diversifies its revenue streams to include diagnostics and consultative services, not just device sales, which could increase recurring revenue and strengthen profit stability over the long term.

- Favorable secular trends, such as increasing awareness and diagnosis of sleep apnea, plus FDA clearance for broader indications of Vivos appliances, may materially expand the addressable market and accelerate both revenue growth and potential insurance reimbursement, positively impacting overall earnings and valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vivos Therapeutics is $2.25, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vivos Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.2, and the most bearish reporting a price target of just $2.25.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $24.5 million, earnings will come to $1.3 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $4.45, the bearish analyst price target of $2.25 is 97.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.