Key Takeaways

- Pivoting from dentist-led distribution to integrating with sleep medicine providers should boost margins, revenue growth, and capture more value from the sleep apnea market.

- Recent acquisitions and new business model aim for profitability, reduced cash burn, and capitalize on industry consolidation through a scalable expansion strategy.

- High cash burn, reliance on external financing, unproven acquisitions, and revenue declines pose significant risks to growth, profitability, and shareholder value.

Catalysts

About Vivos Therapeutics- Operates as a medical technology company that develops and commercializes treatment modalities for patients with dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults.

- The acquisition of The Sleep Center of Nevada positions Vivos to directly access a large and growing pool of sleep apnea patients at the point of diagnosis, enabling higher rates of patient conversions to Vivos treatments and materially increasing near-term and recurring revenue.

- The strategic shift away from legacy dentist-driven distribution toward integrating with, acquiring, or affiliating with sleep medicine providers should allow Vivos to capture a greater share of the value chain, expand margins, and accelerate top-line growth as consumer interest in non-invasive, patient-friendly therapies rises.

- Management expects higher product sales volume—particularly in pediatric lines—alongside broader service offerings (diagnostics, consults) post-acquisition, leveraging the strong secular demand for early sleep disorder detection and preventative health, all of which should drive sustainable revenue growth and earnings improvement.

- The new business model is anticipated to substantially reduce historic cash burn and push the company into positive cash flow and profitability as early as Q3/Q4 2025, directly impacting net earnings and potentially alleviating concerns over future dilution or insolvency risk.

- Vivos’ active pipeline of additional acquisition or partnership opportunities with sleep centers—supported by management’s track record of successful roll-ups—offers a scalable path to consolidate fragmented market share, realize operating leverage, and benefit from industry consolidation trends, which should have a positive impact on both revenue and margins over time.

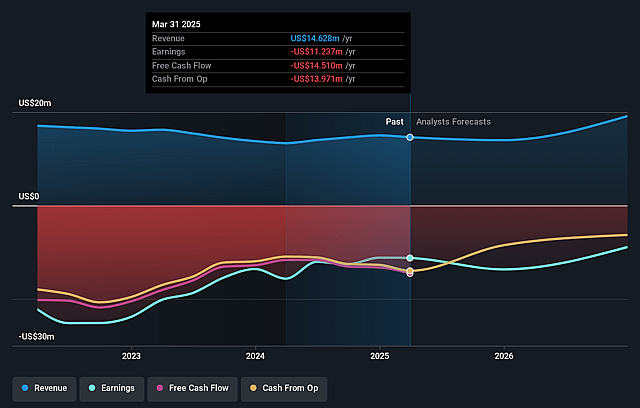

Vivos Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vivos Therapeutics's revenue will grow by 12.5% annually over the next 3 years.

- Analysts are not forecasting that Vivos Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vivos Therapeutics's profit margin will increase from -76.8% to the average US Healthcare industry of 5.4% in 3 years.

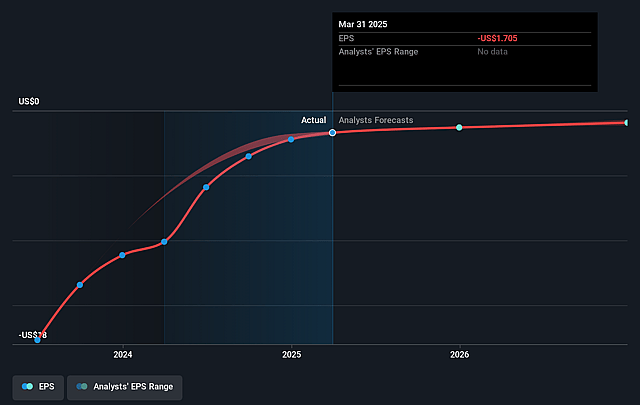

- If Vivos Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $1.1 million (and earnings per share of $0.16) by about August 2028, up from $-11.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.1x on those 2028 earnings, up from -2.4x today. This future PE is greater than the current PE for the US Healthcare industry at 21.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vivos Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing persistent operating losses and high cash burn, with Q1 2025 net loss increasing slightly to $3.9 million and only $2.3 million in cash left as of March 31, 2025, forcing reliance on external financing and risking ongoing shareholder dilution (impacts net margins, cash flows, and shareholder value).

- The shift away from the VIP dentist enrollment model has resulted in a year-over-year revenue decline ($3.0 million in Q1 2025 vs. $3.4 million in Q1 2024), with product sales growth not yet sufficient to offset lost service revenues, threatening sustainable top-line revenue growth.

- Success of new acquisitions like The Sleep Center of Nevada and alliances remains unproven, and prior similar ventures (e.g., Rebis Health) have underperformed expectations due to unpredictable partner

- or integration-specific challenges, indicating execution risk for future business model pivots (impacts revenue realization and gross margin stabilization).

- The company’s growth strategy is heavily dependent on adding new sleep centers and integrating their operations, potentially increasing operational complexity, integration costs, and execution risk, while also leading to a near-term increase in operating expenses before any revenue synergy is realized (negative earnings and profit margin effects).

- The need to secure new loans ($7.5 million) and a required simultaneous equity infusion to close acquisitions further increases financial leverage and potential dilution, and any delays or failures in achieving projected patient conversion rates or revenue improvements may hinder ability to meet debt obligations, directly impacting cash flows and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.225 for Vivos Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.2, and the most bearish reporting a price target of just $2.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $20.8 million, earnings will come to $1.1 million, and it would be trading on a PE ratio of 32.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $4.61, the analyst price target of $4.22 is 9.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.