Key Takeaways

- Successful acquisitions and advanced technology position Vivos for rapid national expansion, improved margins, and significant recurring revenue growth.

- Growing demand for non-invasive sleep apnea treatments and strong insurer support are expected to boost long-term profitability and market share.

- Ongoing losses, dependence on external financing, narrow product focus, regulatory uncertainty, and intensifying competition threaten Vivos' profitability, revenue growth, and long-term financial stability.

Catalysts

About Vivos Therapeutics- Operates as a medical technology company that develops and commercializes treatment modalities for patients with dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults.

- Analyst consensus sees the SCN acquisition as transformational, but with robust pre-booked patient demand, operational readiness, and proven conversion rates above 70 percent from prior alliances, the initial earnings and cash flow contribution could accelerate well ahead of current revenue forecasts, driving an outsized impact on both top-line growth and profitability.

- While analysts broadly acknowledge the model shift toward direct patient capture and higher-margin product sales, they may be underestimating Vivos' ability to rapidly scale this model nationally through a pipeline of advanced-stage acquisitions and affiliations, which could compound recurring revenue and sustain operating margins above 50 percent as more centers come online.

- Vivos is uniquely positioned to benefit from the global surge in sleep apnea cases driven by demographic and lifestyle factors, allowing it to capture unprecedented patient volumes just as demand for at-home, non-invasive therapies undergoes a step-change, with implications for exponential revenue growth over the next decade.

- The company's investment in proprietary technology platforms-including data analytics, remote diagnostics, and telehealth solutions-could enable scalable, low-cost patient acquisition and engagement, delivering material operating leverage and improving net margins as fixed costs are spread over a rapidly expanding user base.

- As major insurers and healthcare systems increasingly prioritize cost-effective, personalized solutions, Vivos' clinical outcomes and FDA-cleared indications are likely to drive accelerated payor adoption, greater reimbursement, and mainstream inclusion in clinical sleep protocols, providing a durable tailwind for earnings, cash flow, and long-term market-share gains.

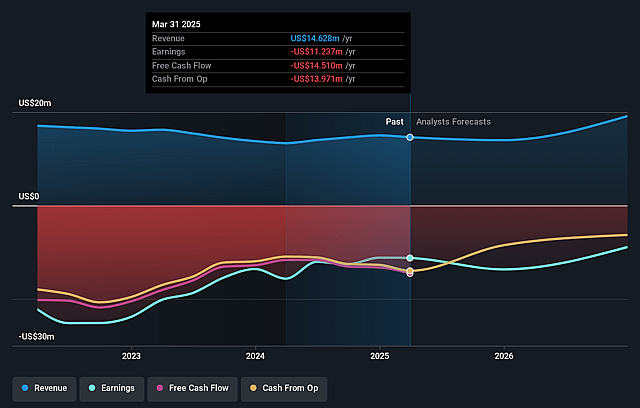

Vivos Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Vivos Therapeutics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Vivos Therapeutics's revenue will grow by 19.1% annually over the next 3 years.

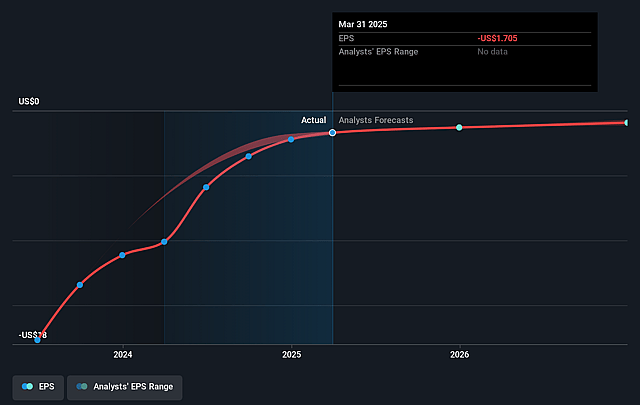

- Even the bullish analysts are not forecasting that Vivos Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vivos Therapeutics's profit margin will increase from -76.8% to the average US Healthcare industry of 5.3% in 3 years.

- If Vivos Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $1.3 million (and earnings per share of $0.19) by about August 2028, up from $-11.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 40.6x on those 2028 earnings, up from -2.2x today. This future PE is greater than the current PE for the US Healthcare industry at 21.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vivos Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Vivos continues to post sizable net losses and negative cash flows quarter after quarter, with $3.9 million in net loss and cash used in operations of $3.8 million in the most recent quarter, calling into question its ability to achieve sustained profitability and increasing the risk of shareholder dilution through necessary future equity raises.

- The company's new acquisition-driven strategy amplifies dependence on access to external financing, as evidenced by the need for both a $7.5 million senior loan and a simultaneous $1.5 million equity infusion to close the SCN deal, which may be harder to secure in a long-term environment of rising interest rates and tighter credit conditions, directly threatening liquidity and growth initiatives.

- Reliance on limited product lines and a single technology platform, combined with healthcare industry trends of consolidation and the emergence of telemedicine or direct-to-consumer alternatives, leaves Vivos vulnerable to competition from larger dental device companies or new digital health entrants, which could erode its revenue base and weaken margins.

- Despite FDA clearance, there remains significant regulatory and reimbursement uncertainty regarding insurance coverage of oral appliance therapy, and company experience with the Rebis alliance showed that "the top of the funnel" of patient referrals did not materialize as expected, indicating unpredictable revenue growth and potential pressure on gross margins if coverage or acceptance fails to scale as anticipated.

- Rising scrutiny from government agencies and payors over the cost-effectiveness and pricing of sleep apnea therapies may bring further downward pressure on reimbursement rates and margins, while heightened data privacy regulation could increase compliance costs and create additional hurdles to market expansion, threatening long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Vivos Therapeutics is $6.2, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vivos Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.2, and the most bearish reporting a price target of just $2.25.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $24.7 million, earnings will come to $1.3 million, and it would be trading on a PE ratio of 40.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $4.11, the bullish analyst price target of $6.2 is 33.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.