Key Takeaways

- Increased demand for dialysis solutions and successful long-term contracts drive stable growth and revenue visibility, especially as the company enters new and underserved markets.

- Operational improvements and a strong reputation enhance margins and market share, with expanded access and customer acquisitions supporting further revenue gains.

- Customer retention risks, ongoing losses, weak diversification, and industry consolidation threaten margins and long-term growth amid shrinking demand for core hemodialysis products.

Catalysts

About Rockwell Medical- Develops, manufactures, commercializes, and distributes various hemodialysis products for dialysis providers worldwide.

- Long-term, the expanding prevalence of chronic kidney disease and end-stage renal disease tied to an aging global population is expected to increase the addressable patient base and demand for dialysis solutions, positioning Rockwell Medical to drive revenue growth as it wins new long-term supply contracts and expands into underserved geographies like the Western U.S.

- Recent customer wins and a shift to long-term, minimum-purchase agreements with over 80% of the customer base have greatly improved revenue visibility and predictability, supporting future top-line stability and reducing historical risks from customer concentration.

- Ongoing investment in manufacturing automation and operational efficiency-funded by positive cash flow from operations-is set to enhance gross and net margins over time as cost per unit decreases and scalability improves.

- Rockwell Medical's strong reputation for quality, reliability, and a resilient supply chain-highlighted by increased demand following a competitor recall-has solidified its status as a preferred supplier amid industry consolidation, strengthening market share and earnings potential.

- The company is also positioned to benefit from global healthcare spending increases and access expansion in international and rural markets, setting the stage for incremental revenue as new customer acquisition and market entry initiatives begin to deliver results.

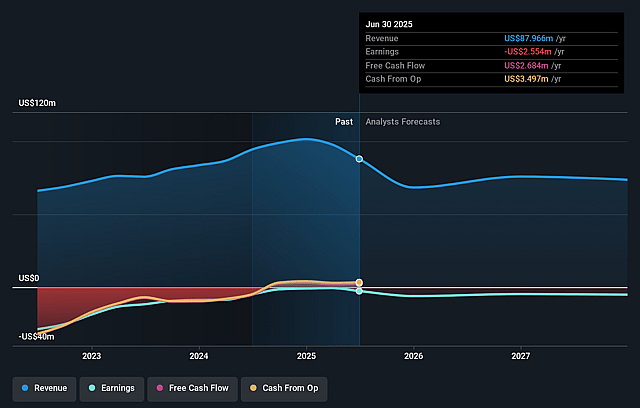

Rockwell Medical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rockwell Medical's revenue will decrease by 6.8% annually over the next 3 years.

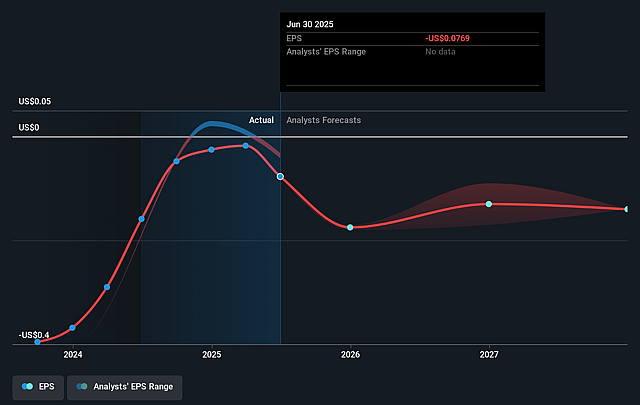

- Analysts are not forecasting that Rockwell Medical will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Rockwell Medical's profit margin will increase from -2.9% to the average US Medical Equipment industry of 12.5% in 3 years.

- If Rockwell Medical's profit margin were to converge on the industry average, you could expect earnings to reach $8.9 million (and earnings per share of $0.22) by about September 2028, up from $-2.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.2x on those 2028 earnings, up from -23.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 6.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Rockwell Medical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated shift of major providers like DaVita away from Rockwell Medical, as evidenced by the largest customer transition in 2025 resulting in a 38% drop in Q2 revenues and ongoing uncertainty around securing a new long-term contract, highlights customer retention risk and persistent revenue volatility.

- The company's ongoing net losses (e.g., $1.5 million net loss in Q2 2025 vs. $300,000 net income in Q2 2024) and negative adjusted EBITDA despite operational right-sizing indicate an inability to generate sustainable profitability, raising concerns about long-term earnings and margin pressure.

- Industry consolidation among major dialysis providers (e.g., DaVita, Fresenius, IRC), with increased preference for scale and pricing power, poses significant risk to Rockwell's negotiating leverage and may result in tighter contracts, further compressing margins and revenues.

- The ongoing secular trend toward home-based and alternative CKD management models could structurally reduce demand for in-clinic hemodialysis concentrates-a core Rockwell product line-potentially shrinking the company's addressable market and impacting long-term top-line growth.

- Continued dependence on a limited product suite (mainly hemodialysis concentrates and liquid bicarbonate) and the lack of evidence for successful broad diversification into other renal therapies constrains recurring revenue streams, leaving the business highly exposed to market and regulatory disruptions that could restrict revenue and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.0 for Rockwell Medical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $71.1 million, earnings will come to $8.9 million, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 8.0%.

- Given the current share price of $1.73, the analyst price target of $4.0 is 56.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Rockwell Medical?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.