Key Takeaways

- Strong customer diversification, expanding industry contracts, and competitive gains are poised to drive above-expected revenue growth and significant margin expansion.

- Leading market position and scalable logistics infrastructure position Rockwell to benefit from industry shifts and unlock recurring, higher-margin future revenue streams.

- Heavy reliance on a shrinking core market, persistent operating losses, and limited product innovation expose Rockwell Medical to sustained revenue pressure and long-term profitability risks.

Catalysts

About Rockwell Medical- Develops, manufactures, commercializes, and distributes various hemodialysis products for dialysis providers worldwide.

- Analyst consensus recognizes Rockwell's customer diversification, but the current valuation does not fully appreciate the scale of new long-term contracts and large account negotiations underway; the potential to re-sign its largest customer or secure supply agreements with major industry leaders like DaVita and Fresenius could produce an outsized rebound in revenues and drive above-consensus growth as early as late 2025.

- While analysts expect manufacturing automation and expense reductions to stabilize margins, the operational improvements are already yielding margin expansion and could drive a step-function increase to net margins and EBITDA, as increased automation and volume flow-through further accelerate profitability beyond what consensus expects.

- The recent product recall and quality issues affecting a key competitor have positioned Rockwell as a superior, trusted supplier, likely accelerating share gains in a consolidating market and translating to significant revenue and margin tailwinds as providers prioritize reliability and patient safety.

- With a leading position in U.S. bicarbonate hemodialysis concentrates and a highly scalable supply chain, Rockwell is poised to capture a disproportionate share of the growing global dialysis market driven by the aging population and expanding healthcare access, supporting multi-year recurring revenue growth.

- As home dialysis and novel modalities proliferate, Rockwell's existing product base, ongoing innovation, and unmatched logistics infrastructure make it a likely beneficiary of industry shifts toward decentralized renal care, opening new, higher-margin revenue channels and cementing long-term earnings growth.

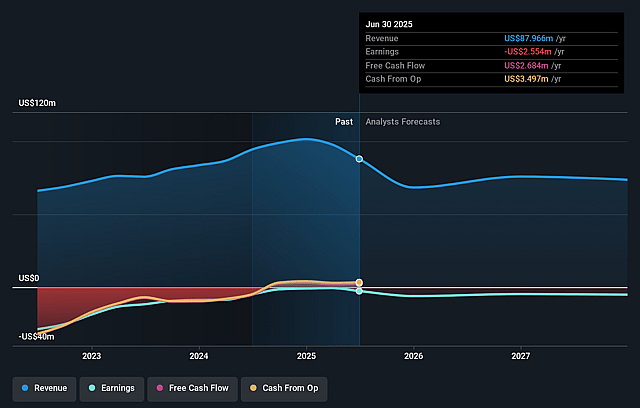

Rockwell Medical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Rockwell Medical compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Rockwell Medical's revenue will decrease by 6.8% annually over the next 3 years.

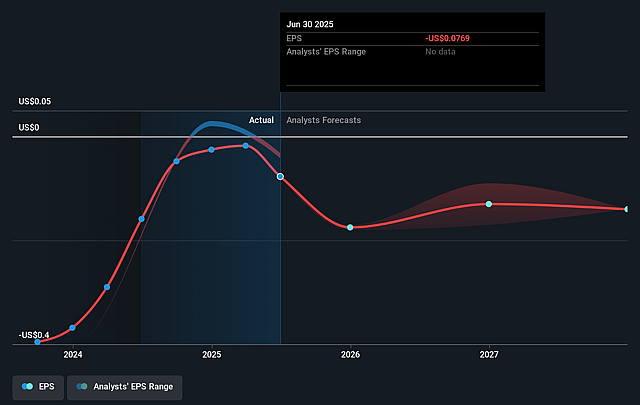

- Even the bullish analysts are not forecasting that Rockwell Medical will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Rockwell Medical's profit margin will increase from -2.9% to the average US Medical Equipment industry of 12.3% in 3 years.

- If Rockwell Medical's profit margin were to converge on the industry average, you could expect earnings to reach $8.8 million (and earnings per share of $0.21) by about September 2028, up from $-2.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.3x on those 2028 earnings, up from -24.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to grow by 6.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

Rockwell Medical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant decline in Rockwell Medical's revenue and gross profit-driven by the loss of its largest customer and an overall 38% drop in quarterly net sales year over year-highlights both ongoing customer concentration risk and the challenge of backfilling lost business, which could pressure long-term revenue and earnings.

- Operating losses have persisted, with net loss reaching $3 million for the first half of 2025 compared to $1.4 million a year earlier, and adjusted EBITDA turning negative, raising concerns about the company's ability to generate sustained profitability and positive net margins, especially as cost pressures in healthcare intensify.

- Despite new contract wins, the company's core business remains heavily based on supplying traditional hemodialysis concentrates, which is at risk of shrinking as home dialysis adoption and alternative renal therapies gain traction in the industry, threatening both future revenue opportunities and topline growth.

- While customer concentration has improved somewhat, the business is still susceptible to contract renewal risks and ongoing pricing pressures due to industry consolidation among dialysis providers and more powerful group purchasing organizations, likely resulting in compressed net margins and potential revenue volatility.

- The absence of significant new product innovation or diversification beyond hemodialysis concentrates leaves Rockwell Medical exposed to technological obsolescence, and if competitors introduce cost-saving or superior therapies, this could further erode market share, suppressing revenue growth and profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Rockwell Medical is $5.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Rockwell Medical's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $71.3 million, earnings will come to $8.8 million, and it would be trading on a PE ratio of 29.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of $1.8, the bullish analyst price target of $5.0 is 64.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.