Key Takeaways

- Lifeward is positioned for significant growth from increased global demand, product innovation, and operational scaling, potentially outpacing current analyst expectations on both revenue and margins.

- Strategic advantages in AI integration, patient-focused leadership, and proven international expansion provide unique access to high-value market segments and sustainable long-term profitability.

- Heavy reliance on a narrow product range and uncertain reimbursement limits growth, while regulatory hurdles and financial pressures threaten long-term profitability and market expansion.

Catalysts

About Lifeward- A medical device company, designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

- Analyst consensus expects accelerating commercial adoption from expanded payer coverage and new product innovation, but this still understates the magnitude of demand driven by aging populations and global reimbursement expansion-penetration rates could materially exceed expectations and rapidly drive quarterly revenue growth to historic highs.

- While analysts broadly agree that operational improvements and an expanding streamline of leads will modestly improve margins, these initiatives, combined with leadership's proven history of commercializing transformative medical technologies, could result in gross and net margin gains at a pace and scale not yet reflected in current guidance, substantially increasing earnings power.

- Lifeward's portfolio diversification and next-gen AI/robotics integration uniquely position the company to benefit from global shifts toward home-based and outpatient care, opening previously untapped market segments and supporting recurring high-margin revenue beyond current product lines.

- The Germany operation's proven profitable, high-velocity business model serves as a blueprint for rapid international scaling; deploying these practices in the U.S. and other major markets could compress sales cycles and improve cash conversion well ahead of consensus expectations.

- Management's deep personal connection to the patient experience, combined with strategic discipline and rigorous cost controls, is likely to enable Lifeward to out-execute competitors on both innovation and commercial scale, delivering operational leverage and sustainable long-term profitability as healthcare systems increasingly prioritize quality of life and mobility solutions.

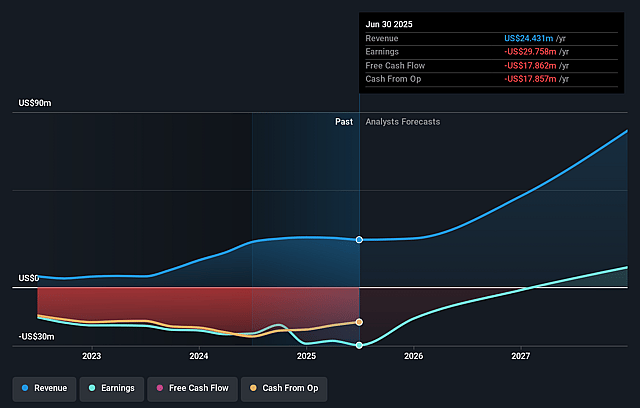

Lifeward Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lifeward compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lifeward's revenue will grow by 72.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -121.8% today to 22.7% in 3 years time.

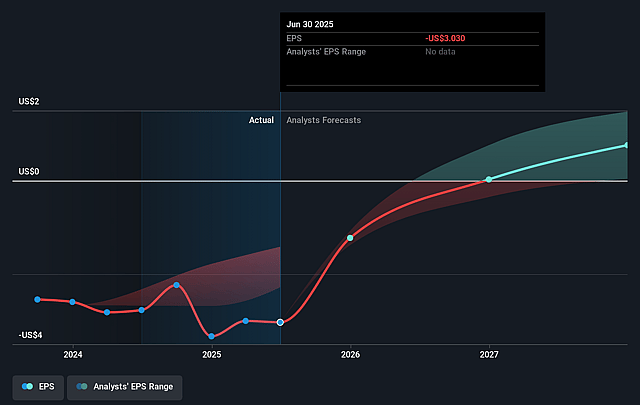

- The bullish analysts expect earnings to reach $28.3 million (and earnings per share of $2.14) by about September 2028, up from $-29.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from -0.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.34%, as per the Simply Wall St company report.

Lifeward Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lifeward's revenues have declined year-over-year from $6.7 million in Q2 2024 to $5.7 million in Q2 2025, largely due to the loss of one-time Medicare-related revenue, and ongoing uncertainty in the timing and consistency of payer approvals raises doubts about the predictability of future revenue growth.

- The company remains heavily reliant on a limited portfolio of mobility solutions like the ReWalk exoskeleton, making it vulnerable to competitive disruption, technological obsolescence, and secular trends toward commoditization in the medical device industry, which could reduce both revenue potential and market share.

- Increasing regulatory scrutiny-particularly the slow pace and challenges related to gaining and maintaining approvals like CE clearance in Europe and evolving reimbursement policies-could lengthen development cycles, raise compliance costs, and restrict Lifeward's ability to scale internationally, limiting top-line revenue growth.

- Lifeward's ongoing net losses, negative cash flow, and the need to seek additional financing via debt or equity underscore challenges in reaching sustainable profitability, especially as R&D and regulatory costs rise amid global pressure to contain healthcare spending, which could compress future earnings and margins.

- The extended and unpredictable nature of the reimbursement and payer approval process for expensive advanced medical devices, compounded by increasing global health care cost-control measures and potential government rationing for high-cost treatments, may limit Lifeward's addressable market and curtail long-term revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lifeward is $13.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lifeward's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $124.9 million, earnings will come to $28.3 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 9.3%.

- Given the current share price of $0.56, the bullish analyst price target of $13.0 is 95.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Lifeward?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.