Last Update 16 Aug 25

Fair value Decreased 7.69%Expanding International Healthcare Access And Efficiencies Will Unlock Value

The consensus price target for Lifeward has been revised down to $8.00, primarily reflecting a sharp decrease in its future P/E multiple, while profitability remains stable.

What's in the News

- Lifeward reset full-year 2025 earnings guidance under new management, targeting revenue of $24–$26 million.

- Reported $2.78 million in impairment charges for Q2 2025.

- Almog Adar appointed CFO, succeeding Michael Lawless, who resigned for personal reasons; Adar previously served as VP of Finance and Chief Accounting Officer.

- Received Nasdaq deficiency notice for failing to maintain $1.00 minimum bid price; has 180 days to regain compliance or risk delisting.

- Expanded distribution agreement with SportsMed Products Ltd., extending AlterG product distribution to the UAE and entire GCC region.

Valuation Changes

Summary of Valuation Changes for Lifeward

- The Consensus Analyst Price Target has fallen from $8.67 to $8.00.

- The Future P/E for Lifeward has significantly fallen from 14.95x to 9.40x.

- The Net Profit Margin for Lifeward remained effectively unchanged, moving only marginally from 14.75% to 14.82%.

Key Takeaways

- Demographic shifts and expanded healthcare access drive sustained, multi-year demand for mobility and rehabilitation solutions, supporting higher growth and a larger addressable market.

- Increased operational efficiency, portfolio diversification, and payer engagement aid revenue growth, improve margins, and strengthen overall financial performance.

- Slower commercial adoption, reimbursement delays, market skepticism, capital constraints, and costly product transitions threaten Lifeward's revenue predictability, cash position, and future profitability.

Catalysts

About Lifeward- A medical device company, designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

- Lifeward is positioned to benefit from expanding healthcare access in international and U.S. markets, as evidenced by pipeline growth in both Germany and the United States, and expectations of higher deliveries in the second half-these factors could drive accelerated revenue growth as payer approvals and adoption improve.

- The demographic shift toward an aging population and increasing prevalence of chronic diseases is fueling sustained demand for Lifeward's mobility and rehabilitation solutions, supporting a larger, long-term addressable market and underpinning robust multi-year growth in revenues.

- Bringing manufacturing in-house and consolidating facilities are expected to enhance operational efficiencies, reduce costs, and lift gross margins over time, especially as higher volumes leverage fixed costs.

- The company's focus on portfolio diversification-including launches of next-generation products (ReWalk 7, MyoCycle, AlterG) and integration of digital/software features-broadens customer reach and should support higher revenue growth and margin improvement through both new market penetration and improved pricing power.

- Operational initiatives to expand payer coverage, accelerate reimbursement cycles, and refine revenue cycle management are likely to shorten cash conversion periods and improve working capital, which should translate into improved net margin and earnings as sales scale.

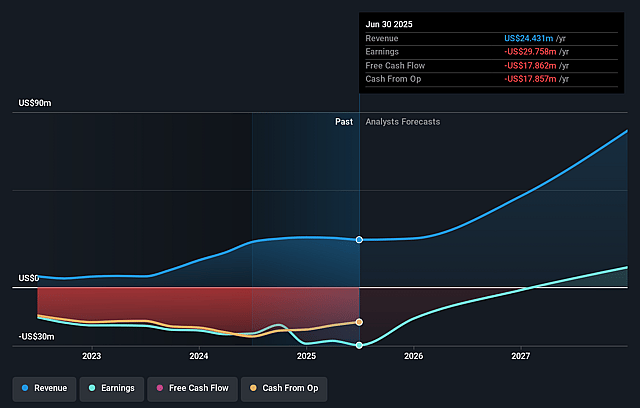

Lifeward Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lifeward's revenue will grow by 58.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -121.8% today to 14.8% in 3 years time.

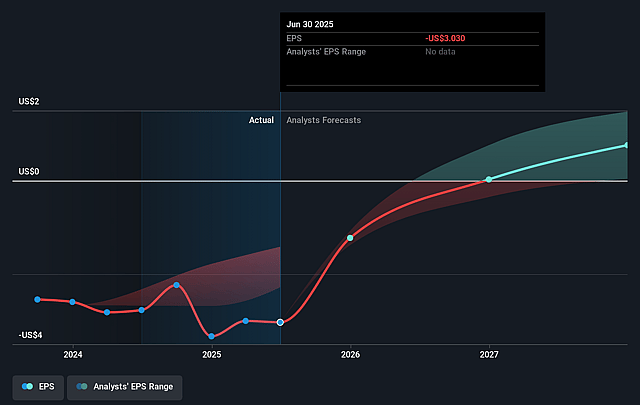

- Analysts expect earnings to reach $14.5 million (and earnings per share of $1.05) by about September 2028, up from $-29.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $19.8 million in earnings, and the most bearish expecting $673.0 thousand.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from -0.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.43%, as per the Simply Wall St company report.

Lifeward Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lifeward's year-over-year revenue declined by 15% in Q2 2025 (from $6.7M to $5.7M), and management lowered full-year revenue guidance citing slower-than-expected commercial adoption cycles and uncertainties in payer approvals, indicating that near-term and possibly long-term revenue growth may be less predictable and more gradual than anticipated.

- The company has acknowledged persistent delays and irregularities in Medicare collections and reimbursement cycles, with payment processing not yet occurring on a regular schedule-this exposes Lifeward to ongoing working capital pressures and could limit both revenue conversion and net margin improvement if not resolved.

- Lifeward reported a significant goodwill impairment charge triggered by a notable decline in share price, suggesting that the market currently values the company's growth prospects conservatively and that Lifeward is exposed to ongoing risk of further market reassessment impacting shareholder value.

- Despite investments in operational efficiencies and manufacturing consolidation, Lifeward remains a going concern with cash sufficient only into Q4 2025, and will require additional capital-raising debt or equity could dilute existing shareholders or constrain future earnings, particularly in capital-constrained markets.

- The ongoing dual support for legacy and new product lines (ReWalk 6 in Germany and ReWalk 7 in the US) has led to increased inventory and higher short-term costs; if CE approval in Europe for ReWalk 7 is delayed or new product adoption lags, this could further pressure gross margin and erode profitability in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.0 for Lifeward based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $97.8 million, earnings will come to $14.5 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 9.4%.

- Given the current share price of $0.57, the analyst price target of $8.0 is 92.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.